Bitcoin short-term Price Analysis: 16 July

Disclaimer: The findings of the following analysis underline the instability of movement in the Bitcoin market, with the same likely to steady itself over the next 24-hours

The phrase ‘any publicity is good publicity’ is often subjected to a lot of debate in the digital asset industry, with market sentiment often very quick to flip towards or away from any major crypto-asset. The same can be said about Bitcoin after the world’s largest cryptocurrency found itself in the news for all the wrong reasons recently, with the community, for once, forgetting to worry about its price valuation.

However, this may soon change, especially since at the time of writing, BTC had shaved off 2.07 percent of its price over the last few hours. At press time, Bitcoin was valued at $9050 with a market cap of $165 billion.

Bitcoin 1-hour chart

Source: BTC/USD on TradingView

As can be observed from its short-term chart, Bitcoin’s latest fall came on the back of a descending triangle formation which led to the disruption of support at $9149 and $9089 within a period of 3 hours. The support at $9089 was rather weak, well before the depreciation started to take place from the pattern breakout.

At the time of writing, a significant recovery was already underway on the charts, however, a development that would come as a relief for many BTC holders since the valuation appeared to stabilize just above the support at $9089. Further, the VPVR implied that the present price position might just be a temporary range for the world’s largest crypto-asset since trading volume at the press time value hasn’t been entirely strong over the past 2 weeks.

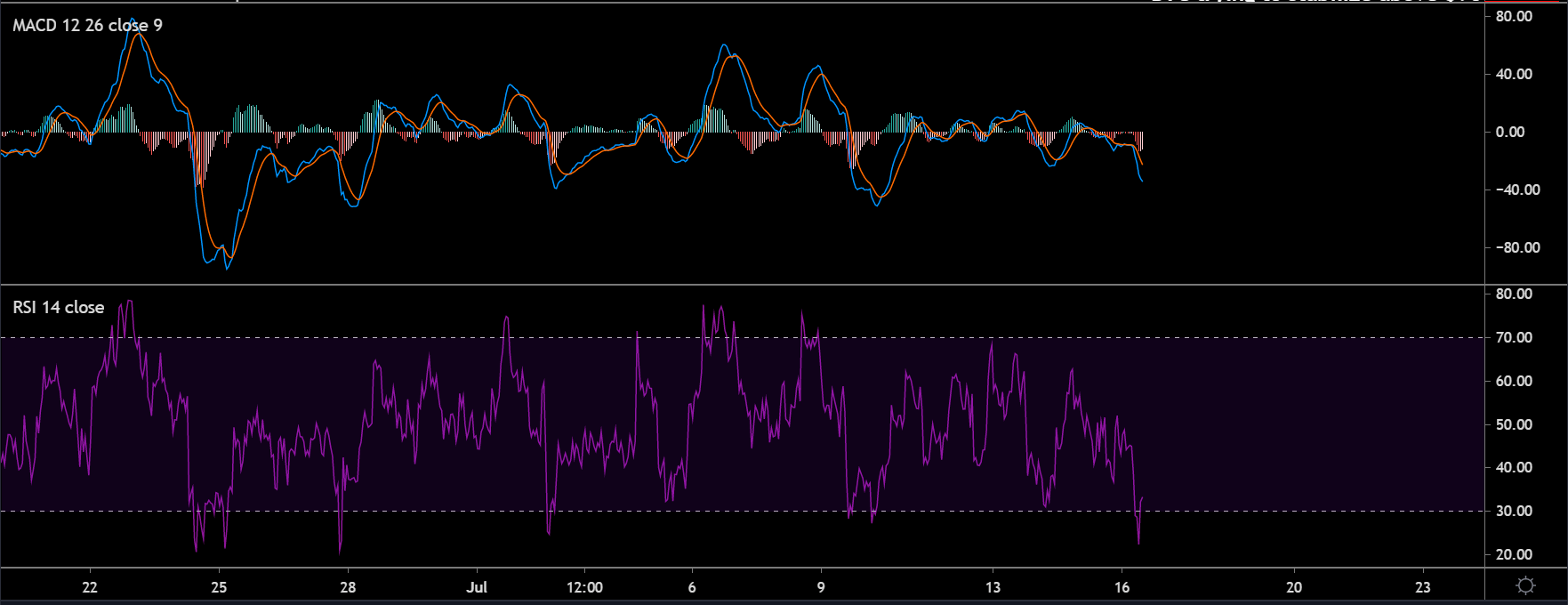

BTC’s market indicators were significantly impacted by the price decline as well. The Relative Strength Index or RSI suggested that BTC had entered the oversold market for the fourth time this month, something that is clearly not a healthy sign in the short-term.

On the contrary, the MACD suggested that the Bitcoin crash was not entirely dependent on the negative publicity as a continued bearish trend had been evident over the past 12 hours on the chart.

Impact of Bitcoin hack might have caused unnecessary sell-off

It is incredibly difficult to dispute that the negative press attached to Bitcoin following the Twitter hacking episode, an episode that targeted the likes of Elon Musk, Warren Buffet, Binance’s CZ, and Coinbase, etc., did not have an impact on the value of the world’s largest cryptocurrency.

Bitcoin was trending for a solid 12 hours across the world, and many would-be investors would have taken a negative shine towards Bitcoin owing to its involvement in the hack.

Alas, such speculations are only assumptions based on the latest price drop. We would have been suggesting the opposite if the price had instead gone up.

Conclusion

Bottom line – Bitcoin’s valuation should stabilize over the next 24-hours, without another period of a setback on the charts.