Bitcoin Options trading spikes to new high after dreadful crash

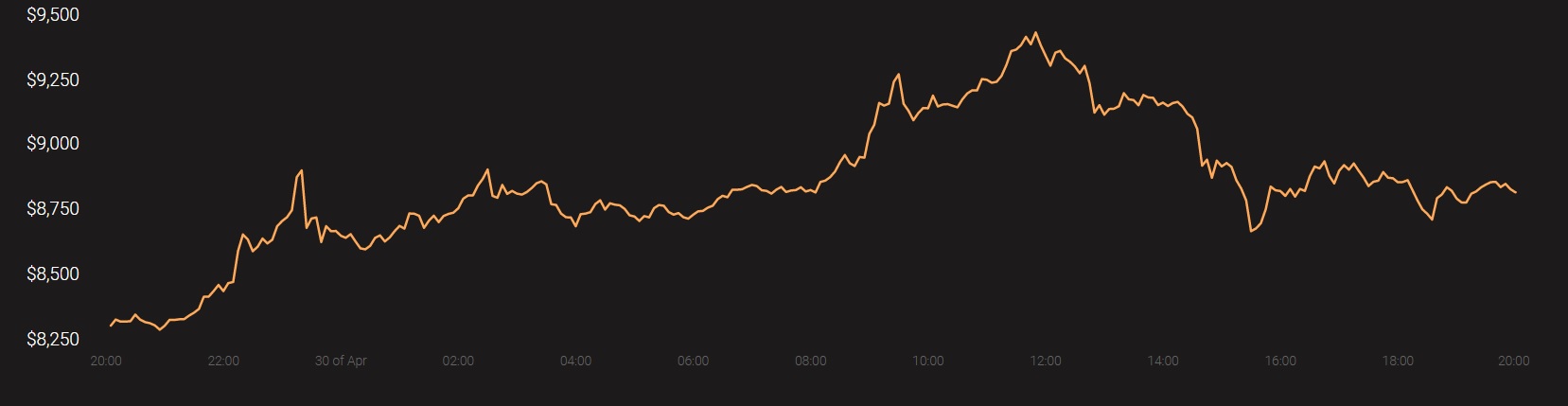

Bitcoin’s price, after a period of consolidation, broke out of the $7k range to shoot directly to $9k. This tremendous spike in BTC’s price transpired over the course of 29 April and continued onto early-30 April. After a brief correction, however, the price of the coin was close to $8,830, at press time.

Source: Coinstats

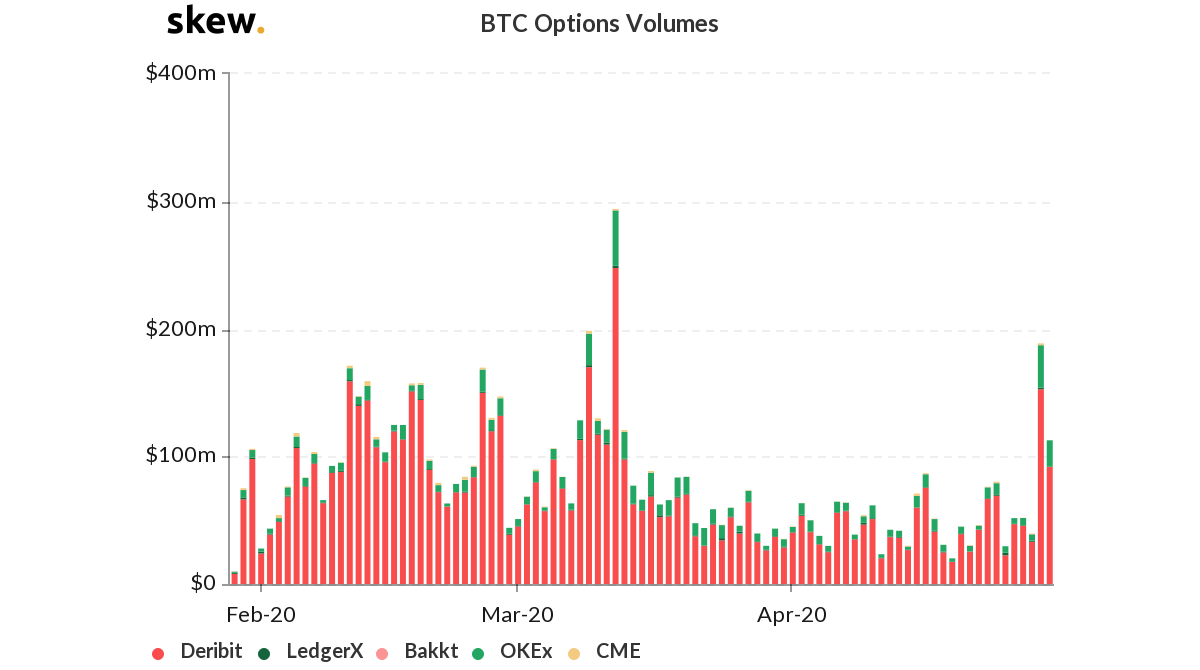

As the spot market was surging, the BTC Options market recorded the highest volume since the fall in March, on 29 April. In fact, according to data provider Skew, Deribit contributed the highest volume of $153 million, followed by OKEx with $33 million. LedgerX and CME volume were restricted to $1.2 Million and $1.5 million, respectively, whereas Bakkt did not show any significant volume.

Source: Skew

Apart from the sudden market crash taking place on 12 March, the BTC Options volume was close to $150 million; however, the present volume had managed to surpass that with $188.7 million. On 30 April, the volume was continuing to rise, with the same, at press time, recorded to be $142 million.

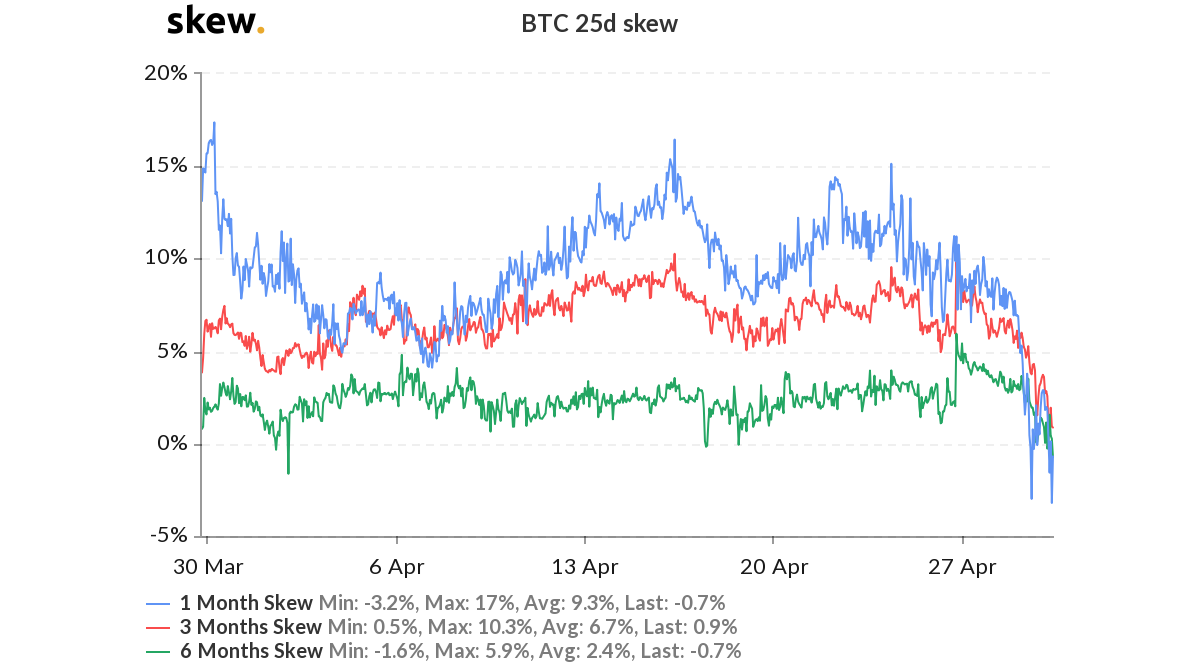

The short-term BTC skew was also impacted in the market frenzy. The skew was positive across all time frames a couple of days back. However, data suggested that the short-term skew, or 1-month skew, took a dip into the negative zone on 29 April. This indicated that the price of puts relative to calls fell at meaningful trading volumes, noting a shift in investor sentiment across the market. It may also mean that the demand for Bitcoin options might be retracting in the short-term.

Source: Skew

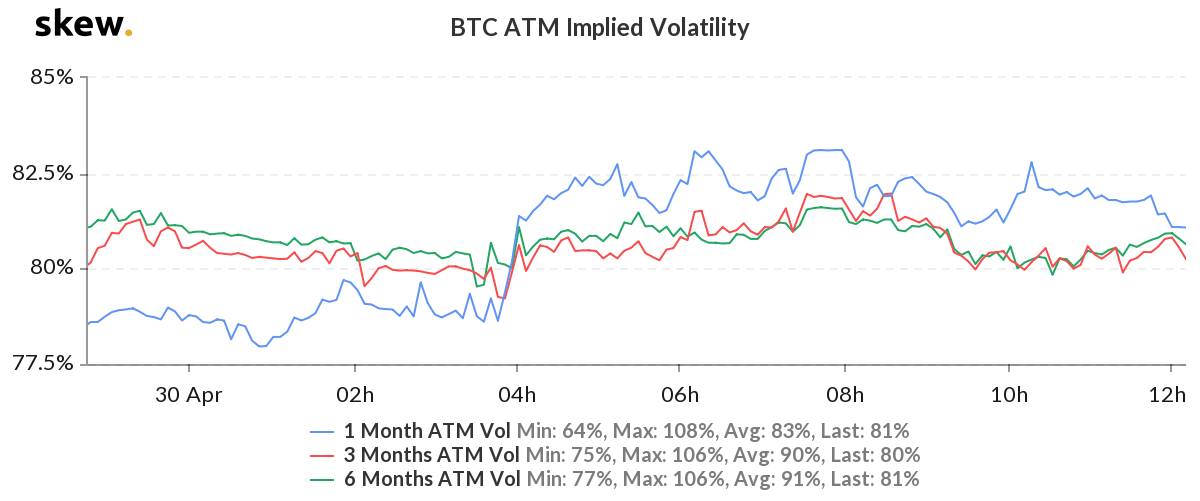

Similarly, the 1-month implied volatility has also been spiking up since 29 April; it has continued to rise on 30 April.

Source: Skew

The 1-month ATM Implied Volatility surpassed the 3-month and 6-month ATM volatility and was recorded to be 81%, while the other longer-term volatility was not far away. The 3-month volatility was at 80%, while the 6-month was observed to be 81%.