Bitcoin Options’ Put/Call ratio settles slightly above 1 as optimism rises

Bitcoin’s pullback from $7,000 to $6,700 prompted a negative impact on the derivatives front. The Put-Call ratio on Bitcoin Options contracts climbed to a three-week high of 1.53 on 5 April, with the figure rising by more than 139% in a matter of just three days.

According to Deribit Insight, a large percentage of Put accumulation over the last few weeks was “likely protection against long BTC holdings”. The platform further added,

“Post 3rd Apr options expiry 1000x ATM calls changed hands. Yesterday at the 7.1k low, 500BTC+ notional bought via ATM calls (24/4 7k-8k) + puts sold (17+24/4 6.5-7k). Using BTC puts to protect long underlying BTC, or using long BTC calls to increase upside exposure, both show how being long options can be used to achieve upside with a limited downside in uncertain times.”

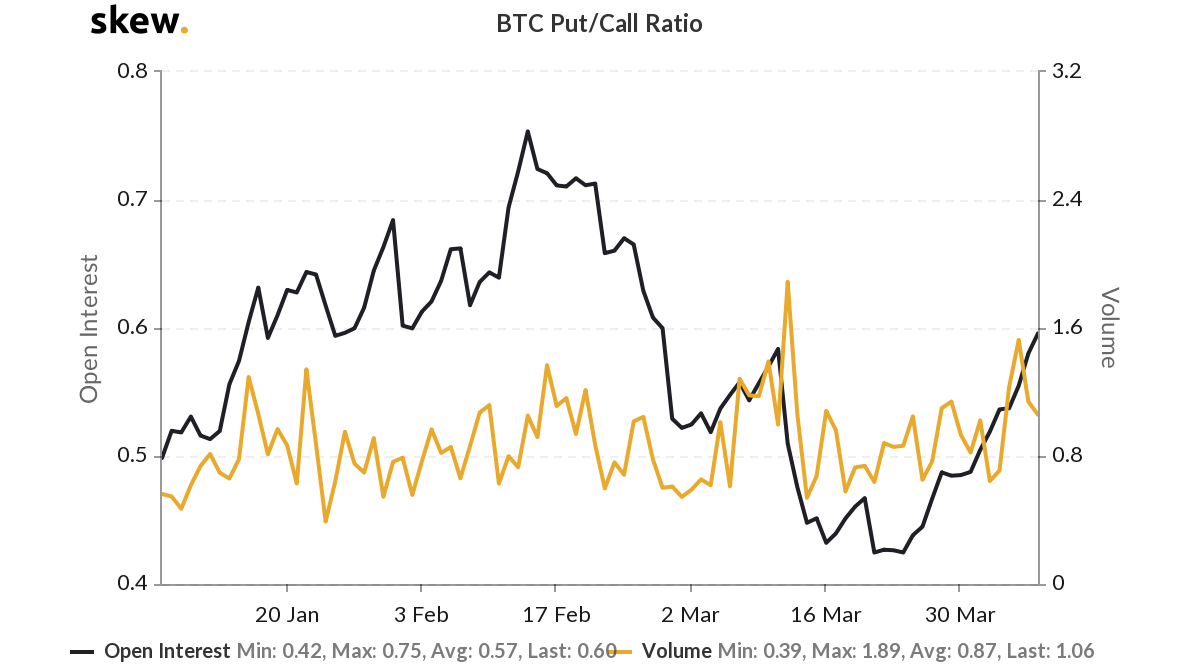

While the Put/Call ratio on BTC Options continued to be more than 1, depicting a bearish picture, the latest chart suggested that traders were poised for a price reversal as the figures quickly came down. This development coincided with the spot price as Bitcoin strengthened its foothold above the $7,000-mark. According to the latest chart by crypto-analytics firm Skew, the Put/Call ratio figure stood at 1.06, at the time of writing.

Source: Skew

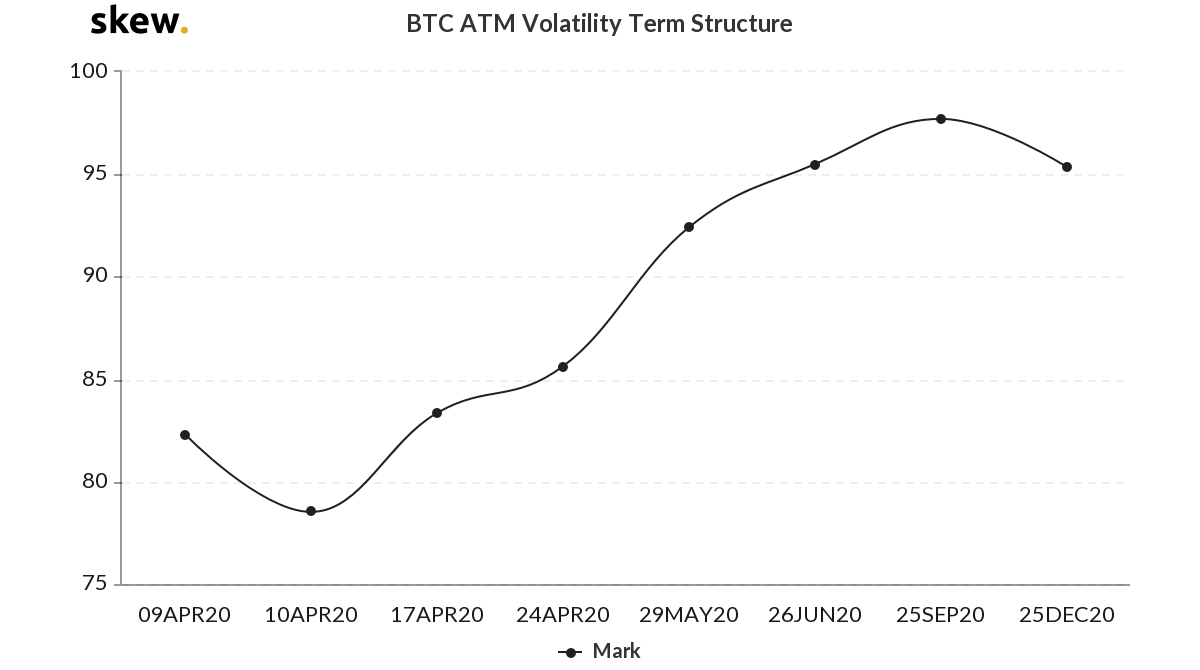

Source: Skew

The underlying market sentiment over this week has been largely positive, with no major downside market corrections being observed. Besides, BTC’s at-the-money [ATM] Volatility Term Structure for Options contracts up to September 2020 was increasing. This could potentially mean that traders are anticipating a highly volatile period induced by the scheduled halving event.

However, the ATM Volatility Term Structure chart recorded a decline for the December Options contract. This essentially implied that the traders are expecting Bitcoin’s price to become less volatile subsequently. The movement of Implied Volatility [IV] v. Realized Volatility [RV] also aligned with this sentiment as the gauge between the two has been expanding gradually since the third week of March.