Bitcoin might soon lose its ‘most volatile’ tag to the S&P500

Bitcoin [BTC], known for its volatility, has been experiencing a lot of ups and downs lately, price-wise. Amid the recent coronavirus outbreak, along with other assets like S&P500, Gold, and Dow Jones, the king coin also experienced a significant price drop. This resulted in a lot of people raising questions about the coin actually being the ‘safe-haven’ asset it claims to be.

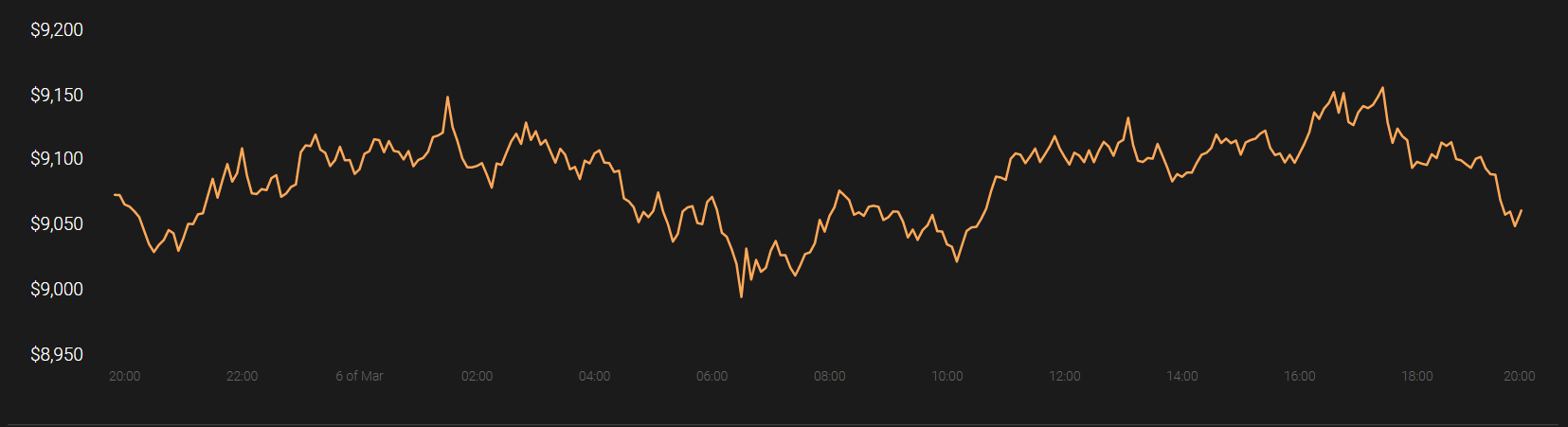

Bitcoin’s price dropped from $10,498 on 12 February 2020 to $9527.77 on 17 February 2020. The price rose again to $10,192 on 19 February, only to fall back to $9626.5 on 20 February. The cryptocurrency has not been able to breach the $10,000 level since then. At press time, Bitcoin was trading at $9058.92.

Source: Coinstats

That said, the S&P500 has also been volatile lately. The price fell from $3,260 on 24 February to $2867.56 on 28 February. However, it soon recovered and rose back to $3,100.06 on 3 March, and has been trading at around the same price for some time now. At press time, SPX was trading at $3,024.09

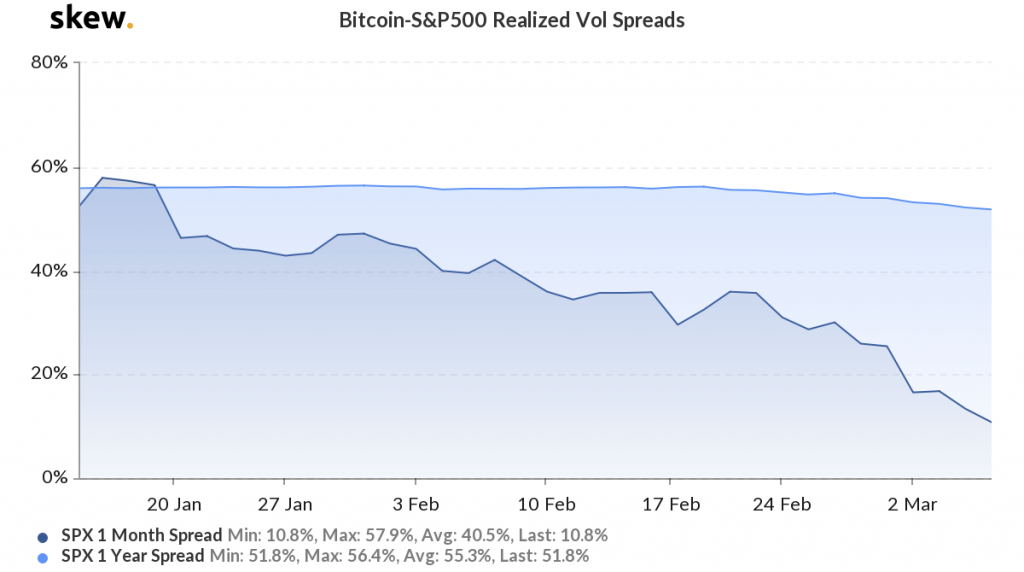

Source: Bitcoin-S&P500 Realized Vol Spreads, skew

When compared to BTC, SPX has seen an increase in its volatility. The realized volatility of BTC has been dropping since 5 January 2020. With several bumps on the way, the realized volatility of Bitcoin with regard to SPX has been falling over the month.

However, Bitcoin’s price has been seeing an upward trend over the past few days. While the cryptocurrency has been consistently consolidating below the $10k mark, the equity index only recovered marginal gains after its nearly 15 percent meltdown. The SPX had a big fall over the entirety of last week while Bitcoin was then locked in the range of $8,500 – $8,800.

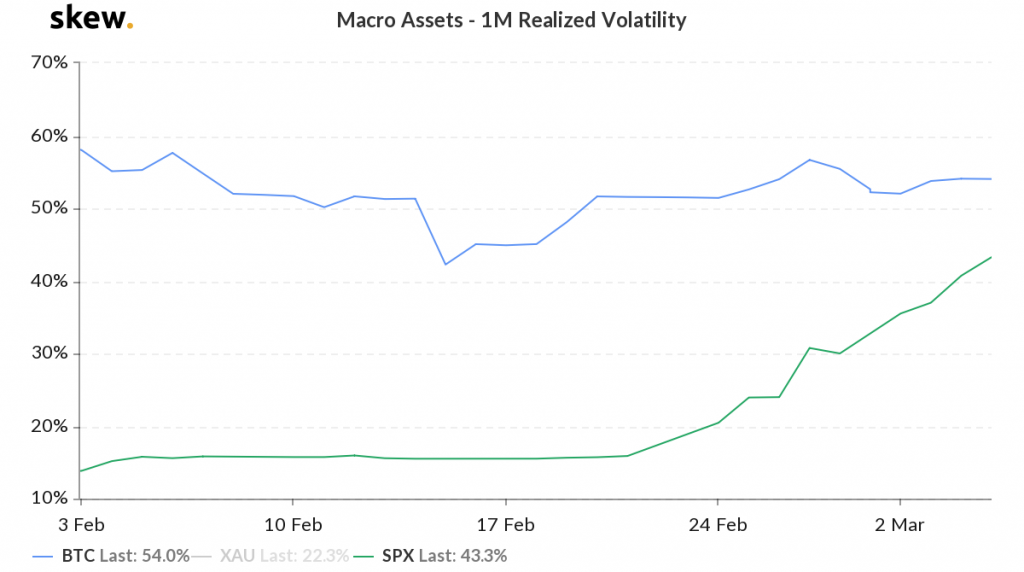

Source: Macro Assets- 1m Realized Volatility, skew

To sum up, while not being conclusive, the volatility of SPX is more likely to increase over the next few days, leaving behind Bitcoin and becoming the most volatile macroeconomic asset relative to Bitcoin, gold, and oil.