What are Bitcoin market’s institutional participants up to now?

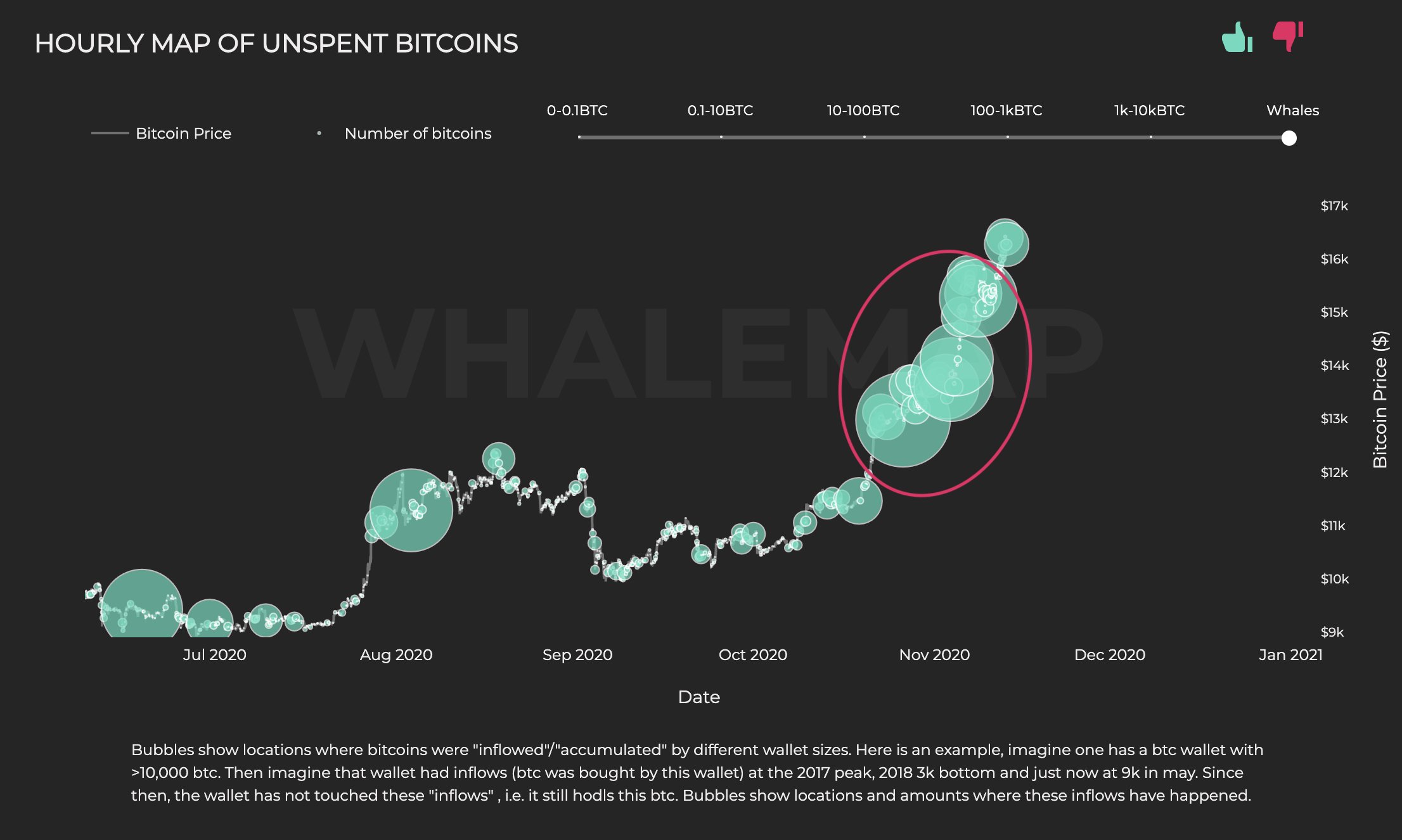

As Bitcoin’s price crossed $16,000 on spot exchanges, one expected that institutions would unload their bags and book profits. However, based on the Map of unspent Bitcoins from Whalemaps, inflows to whale wallets above $12,000 remain unspent. In fact, institutions seem to be buying and HODLing at the same time.

The chart attached herein highlights inflows to whale wallets (exchange and institutional wallets with >10,000 BTC balance). As can be observed, the accumulation between $12k to $16k is massive.

Map of unspent Bitcoins || Source: Whalemaps

The bubbles on the chart represent the prices at which the unspent BTC or accumulated BTC is being HODLed. Despite being profitable, institutions are choosing to HODL on rather than book unrealized profits, even at the current price levels, and this may be a signal to retail investors and traders. Unless these bubbles start disappearing, BTC on spot exchanges may not record massive price drops on the charts.

Considering the fact that inflows to exchanges have not amped up yet, this looks very much like institutional FOMO. What started with MicroStrategy’s purchase of $500M worth of Bitcoin straight off their balance books has turned into an institutional-level FOMO.

As institutions buy and HODL, it may be the right time to capitalize on the volatility on spot exchanges. However, once institutions start selling we may possibly see a free fall in Bitcoin’s price until the volume is exhausted.

Recent comments from institutions and influencers that are acquiring BTC since September 2020 like Michael Saylor have inspired many more into action. With the institutional wall of money only just setting in, only 2.5M Bitcoin are left to be mined. As the shortage gets real, more institutions are getting interested. This has contributed to the price rise, while also presenting a great opportunity to retail traders to empty some bags and book profits before the trend reversal.

We are closing in on the end of the current phase of Bitcoin’s market cycle, with the end of 2020 less than 55 days away. Enter 2021, many more factors may drive the institutional BTC narrative – like the launch of the Digital Yuan, the possible approval of a BTC ETF, or regulatory approvals in top economies like the European Union or the USA.