Bitcoin hodling among institutional investors on the rise

The previous year saw institutional investors arrive on the Bitcoin scene, and recent indications suggest that 2020 is when they will make their mark. With the growth of regulated investment avenues, institutions have a lot more options, to not just trade, but also hodl Bitcoin.

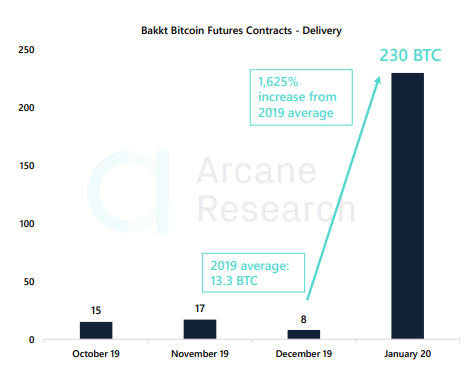

According to a recent report by Arcane Research, Bakkt, the digital assets’ platform of the Intercontinental Exchange [ICE] has seen a 1,625 percent increase in Bitcoin delivery for January 2020. On January 17 230 Bitcoin Futures contract went to delivery, notching over $2 million in notional value, read the report.

Source: Bakkt Bitcoin delivery, Arcane Research

To put that figure in perspective, the total Bitcoin Futures contracts delivered in the final quarter of 2019 was a paltry 40. October November and December saw 15, 17 and 8 contracts delivered on the platform backed by Microsoft, and Starbucks. Moreover, for the entirety of 2019, the monthly delivery average was 13.3 Bitcoins, which the January mark exceeded by over 1700 percent.

Bakkt, in the crypto-institutional investment world, is significant, regardless of its poor numbers, for its physical delivery caveat. The platform is the only regulated exchange to offer this service. Hence, the report noted that the increase in delivery of actual Bitcoin, over trading metrics like open interest and volume is significant,

“This rapid increase of physical delivery could indicate growing demand for holding bitcoin among institutional investors instead of only trading.”

Institutional investors on CME are also bullish on Bitcoin. CME’s Bitcoin Futures contracts are trading at a premium of almost 5 percent, for the contracts expiring in June 2020. The report pegged Bitcoin’s price at just under $9,000 on CME, while the spot price stood at $8,400.

While this indicates that institutional investors are bullish on the long term, in the short term, price expectation is subdued. The January contracts set to expire in a week are trading at a 0.46 premium, while the March contracts are trading at 2.04 percent premium.

The differing premium in the long and short term could be due to the halving. In May 2020, Bitcoin will undergo its third halving, dropping the block rewards to 6.25 BTC per block, which is set to have a significant impact on the price.