Bitcoin Futures platform Bakkt notes renewed volume entering market

Bitcoin’s price was been depreciating by the hour, triggering liquidations worth $500 million and causing the coin to fall further. As Bitcoin collapsed, the rest of the cryptocurrency market also turned red, contributing to the chaos. Despite the turmoil in the spot market, the Futures market reflected an interesting turn of events with volumes climbing along with Open Interest [OI] in the market.

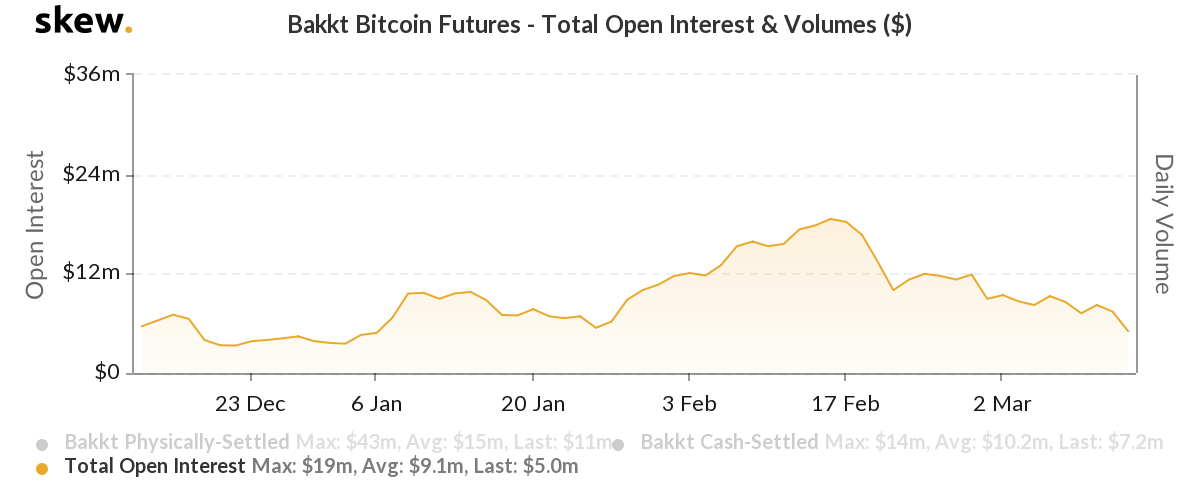

According to data provided by skew markets, BTC Futures volume on the platform had been low since the start of 2020. However, the Open Interest had been building. The impact of BTC’s price began to take shape late in February and since then, the interest was sinking along with the volume.

On 14 February, Bakkt’s OI peaked this year at $19 million, but the simultaneous fall in BTC’s price caused the Interest to fall to $10 million. At press time, it was around a low range of $5 million. The drastic dip in OI registered a 74% decrease.

Source: Skew

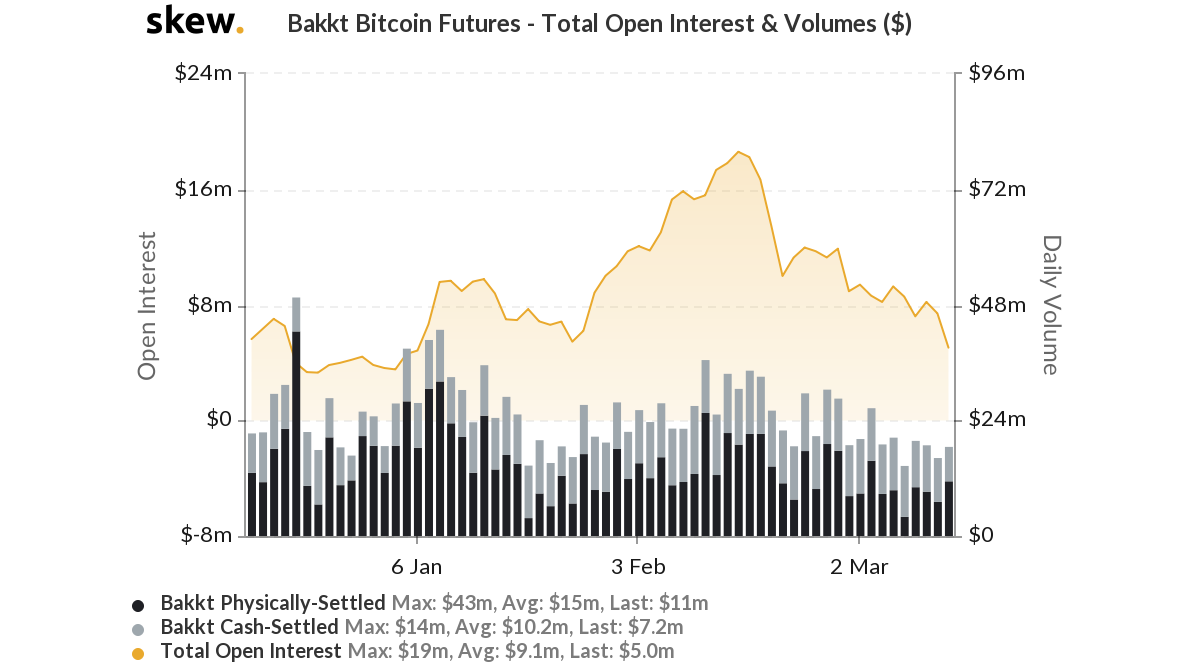

Despite the fall in OI, the volume on the platform saw a significant increase in recent days. At press time, the volume of BTC Futures on Bakkt was about $18.2 million.

Source: Skew

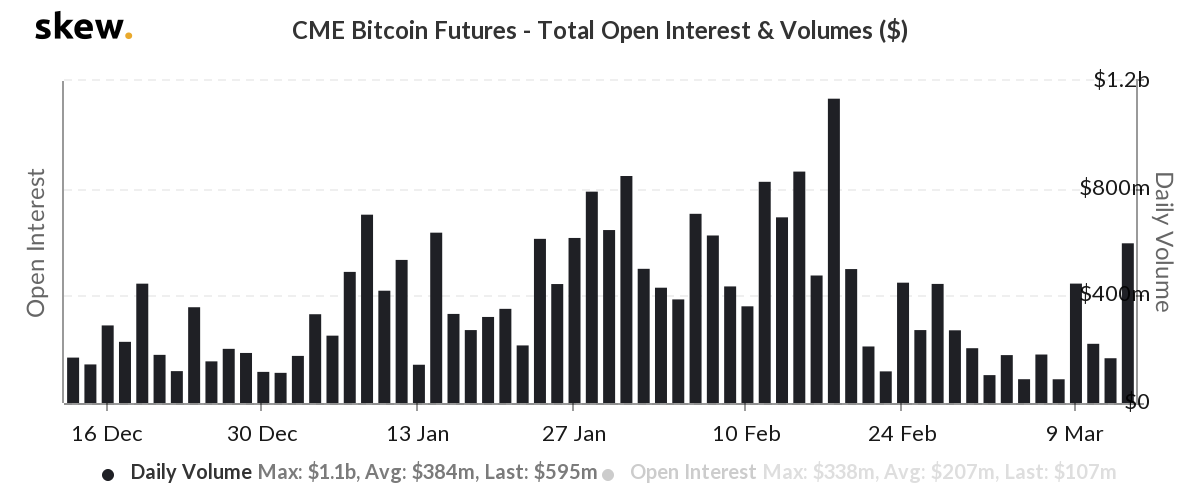

The increase in volume could be because of the falling price of the digital asset, creating buying opportunities for traders and giving them a chance to short BTC. A similar trend was also observed on CME, wherein the volume shot up to $595 million from $88 million just last week. However, this switch in volume was not much in comparison to CME’s 2020 peak of $1.1 billion on 18 February.

Compared to the 18 February data, the volume had fallen by 68.34%.

Source: Skew

The CME OI marked its 2020 peak at $338 million, but observed a steady decline till 11 March. However, the reducing interest escalated on 12 March as the OI fell to $107 million.