Bitcoin Futures liquidity drops as spot prices tumble

With Bitcoin trading sideways for the better part of the previous week, something’s got to give and give it did. On 7 March, the price dropped by over almost 5 percent in less than 9 hours, pushing liquidity in the Futures market down.

The rapid price drop, coupled with the immense trading volume that unregulated derivatives exchanges run, the spread across the park broadened. Major exchanges offering Bitcoin Futures products, both to deep-pocketed institutional investors as well as the retail crowd, saw lowered liquidity.

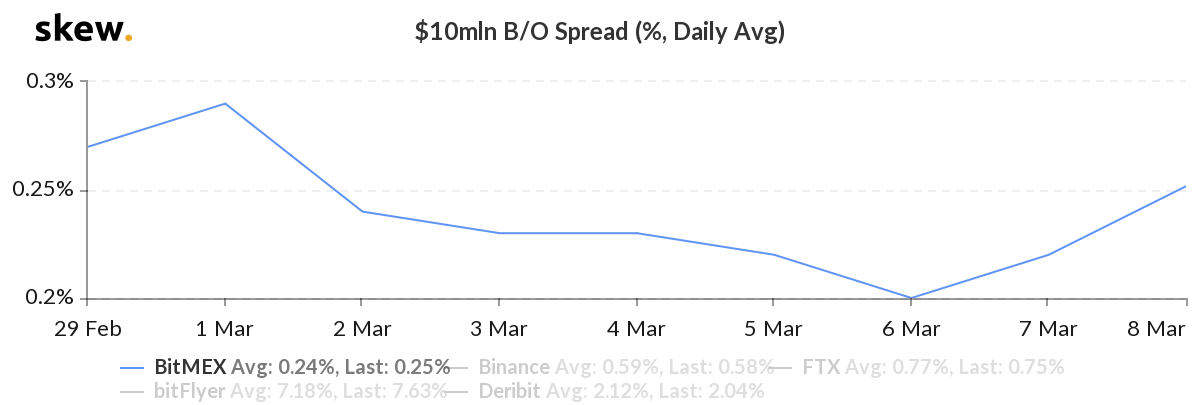

According to data from skew markets, the $10 million Bid-Offer spread saw a substantial increase. On 6 March, the spread for Seychelles-based exchange BitMEX was 0.2 percent, with an average of 0.24 percent for the past few months. The price drop saw the same increase by over 60 basis points to over 0.26 percent.

BitMEX $10 million B/O Spread | Source: skew

Similar trends were seen in other derivatives exchanges. Binance which attracts more retail-centric traders saw its spread increase from 0.49 percent to 0.58 percent but is still below its average of 0.6 percent. Japan-based bitFlyer which has the highest spread average of 7.18 percent, saw its B/O spread increase from 6.53 percent to 7.63 percent amid the price drop, a massive increase of 110 basis points.

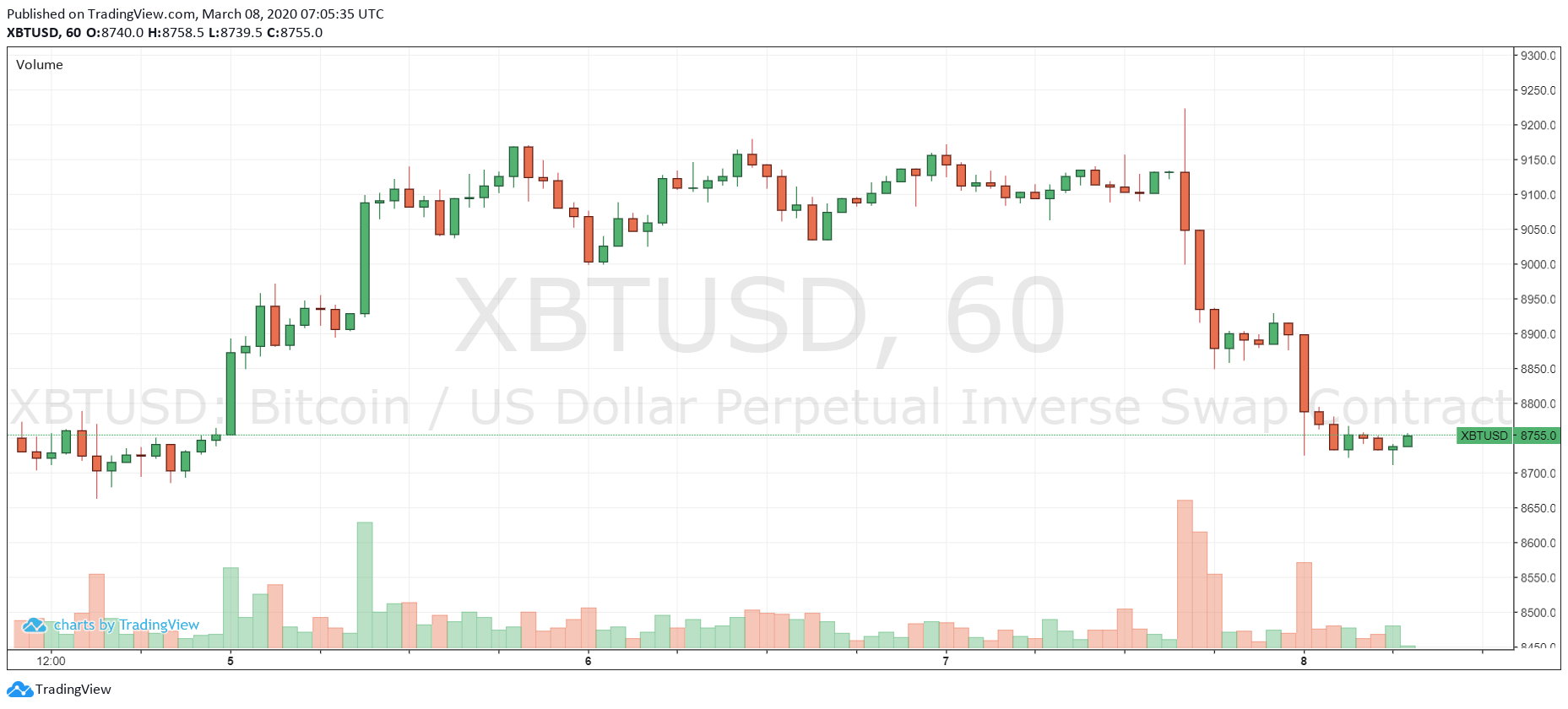

During the price drop, which was concentrated between 1600 UTC to 1900 UTC on 7 March, BitMEX had an hourly volume of $446 million, $350 million and $223 million, respectively. The second drop which took the price to $8,700 was traded at $257 million between 0000 to 0100 UTC on the following day.

XBTUSD Price | Source: BitMEX

The rapid price drop, leading to $1.27 billion traded on BitMEX in a haste, pushed the liquidity down as indicated by the increase in the B/O spread.

Similar trends were seen in both OKEx and Huobi, the other hotly traded BTC Futures exchanges. The 24-hour volume of the two exchanges stood at $2.88 billion and $1.85 billion respectively. From the previous day, the volume has seen a marginal increase of $660 million for OKEx and $560 million for Huobi, concentrated in the hourly price movement, showing signs of lower liquidity.