Bitcoin: Will there be any more entry points?

Since the start of October, Bitcoin’s price has been on an impressive bull run, with the same noting an increase of close to 90 percent. While 2020 as a year was significant for Bitcoin, as it unfolded and the effects of the global pandemic were felt strongly across markets, staying above $12k would have been sufficient and impressive for Bitcoin. However, the fact that Bitcoin climbed to a new ATH was quite clearly the icing on the cake.

But, is it too late to enter the Bitcoin market for retail investors since the price has spiked considerably over the past few months? In other words, is it too expensive now to buy in? Interestingly, data seemed to show the contrary, while also hinting at effective entry points for new investors in the Bitcoin market.

Network data provided by Glassnode pointed to an interesting phenomenon taking place within the Bitcoin market. Rafael Schultze-Kraft, CTO at Glassnode, pointed out that the network data was showing a very clear buy signal, adding that given Bitcoin’s rather optimistic and strong fundamentals, a strong entry point for investors seemed to be appearing.

As per the data that takes into account hash rate and price action, when the hash rate recovers along with the 30d Moving Average (MA) going above the 60d MA and positive price momentum, one can argue that given past precedents, the king coin is well suited for a price rally. This was seen in the past too since as per Glassnode’s Bitcoin Hash Ribbon chart, there were four previous instances when this happened, following which, a massive surge in Bitcoin’s valuation took place.

However, what adds value to such a ‘prediction’ is not just the past price movement of Bitcoin but also the fact that the previous month has seen strong organic demand. In fact, a recent LongHash report had noted that there is substantial proof that the rally to $19,484 was driven by organic demand. For example, there have been significant inflows of USDT all throughout Bitcoin’s November rally. The report noted,

“USDT inflow is an indicator that can be used to gauge overall investor confidence because lots of sidelined capital within the cryptocurrency market are stored in stablecoins.”

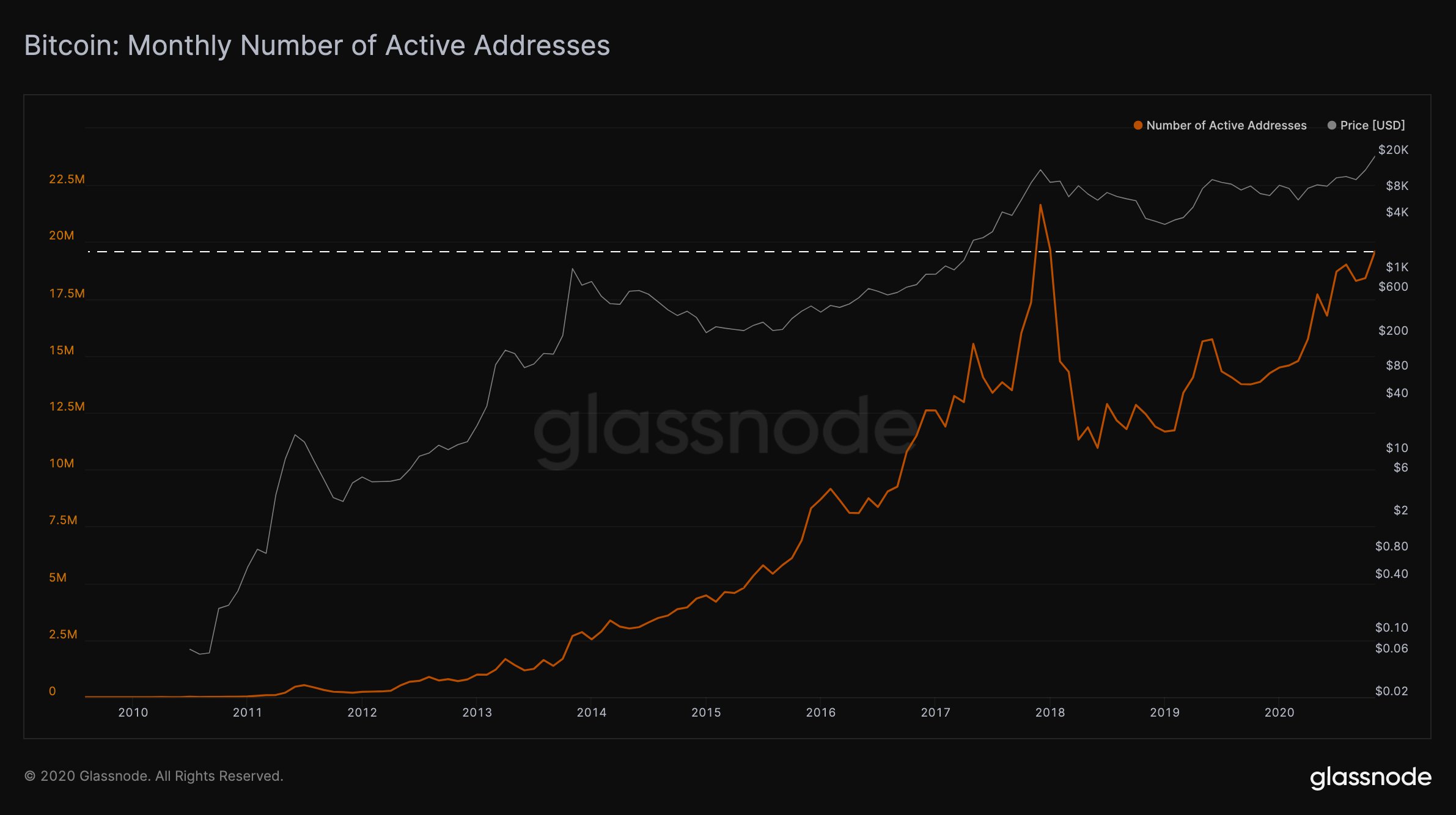

Source: Glassnode

Additionally, there has been robust network activity around Bitcoin over the past month. According to network data, there were almost 19.6 million active Bitcoin addresses sending/receiving the coin, a figure that happens to be the third-highest peak when it comes to active network addresses, only behind December 2017 and January 2018.

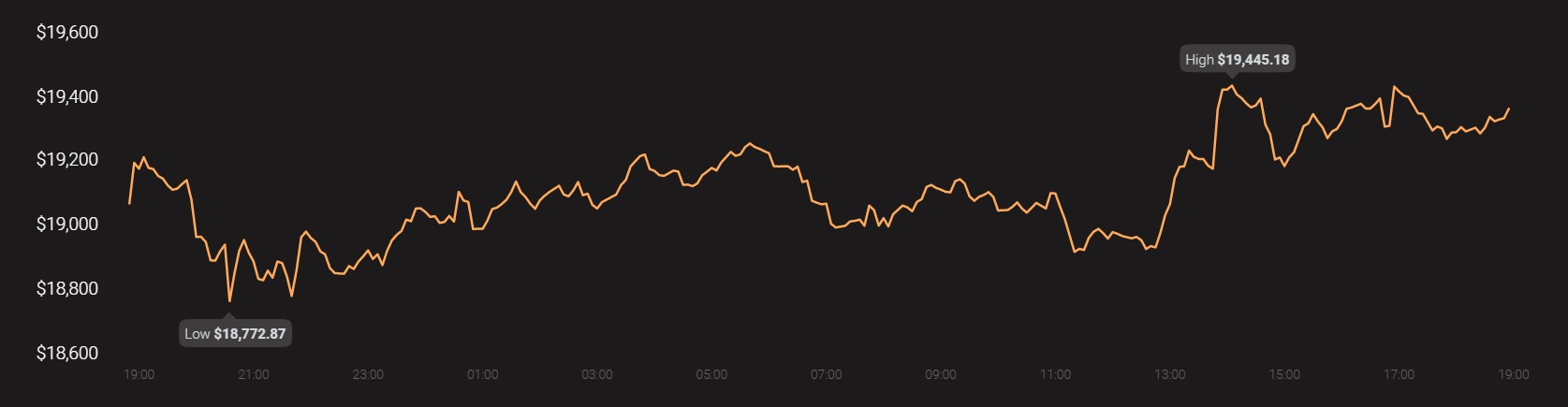

Right now, it’s quite clear that the $20k resistance breach is a matter of when and not if and given such a scenario’s likelihood, Bitcoin around $19k may not be as expensive as it seems.

Source: Coinstats