Bitcoin enjoys ‘negative to neutral’ correlation with traditional asset classes

Whenever there have been times of economic uncertainty and geopolitical risk, many in the community have time and again collectively sprung up to echo the “used and abused” narrative of Bitcoin being a safe haven asset.

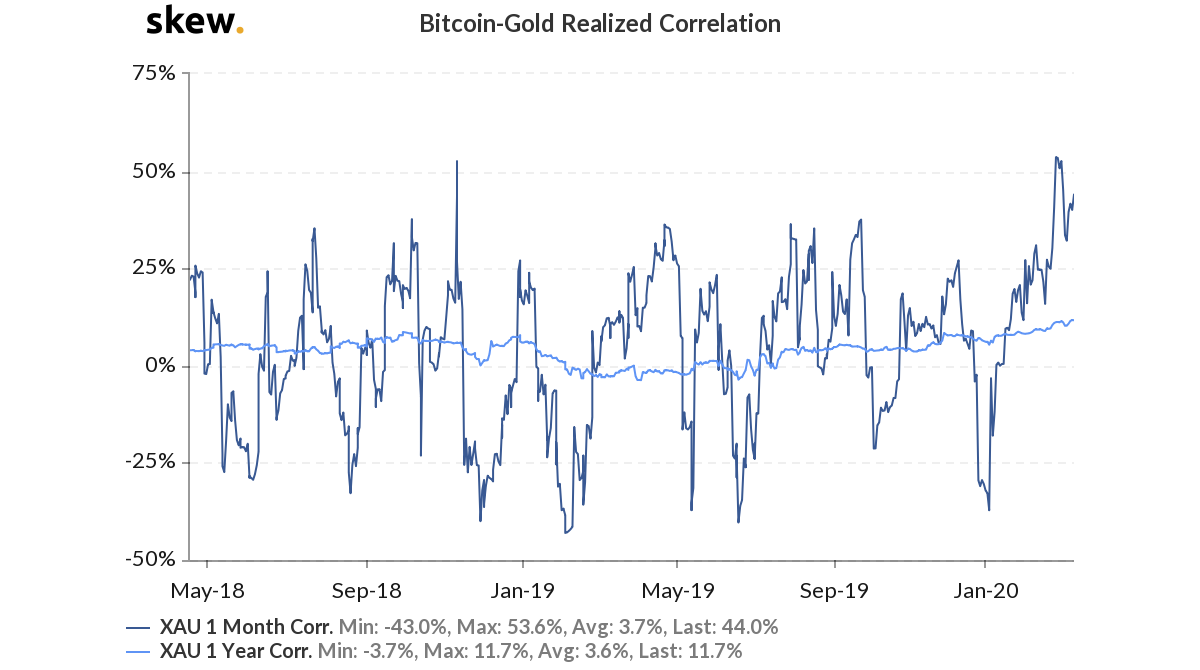

As Bitcoin, and by extension, the entire cryptocurrency industry evolved, it has recorded both retail, as well as institutional capital inflow. Then there’s the question of how correlated the crypto-asset really is. For instance, the realized correlation for the two assets, Bitcoin and Gold, has been positive for a significant part of 2019, with some arguing that for certain periods, Bitcoin appeared to follow Gold’s pattern.

More recently, the US-Iran conflict also managed to catapult BTC-XAU realized correlation. However, as the one-month realized correlation of the two assets continued to trail on the positive side, speculations surrounding the Coronavirus pandemic’s impact on Bitcoin started doing the rounds.

Source: Skew

Speculating on the same, Yassine Elmandjra, who is a crypto-analyst at Ark Invest, in a recent podcast, said,

“In the context of Coronavirus, if Bitcoin were to increase the way that gold has, then Bitcoin is not an uncorrelated asset. What that would suggest is that Bitcoin is a negatively correlated asset to short-term geopolitical risk and market volatility and uncertainty.”

Taking a closer look at the price charts for both Bitcoin and Gold, it can be seen that the price movements have been very different lately. While Gold has maintained an upward streak, the same cannot be said about Bitcoin as the crypto-asset has sustained multiple market corrections this year.

In fact, just today, Bitcoin’s price crashed by 24% over an hour, with the king coin’s valuation falling well below $6k from a price point that was just under $7.5k.

Source: XAU/USD on TradingView

Source: Coinstats

The analyst went on to say that Bitcoin is beyond just “digital gold” as there is no other asset that presents the wide range of characteristics that the king coin presents. Weighing in on the speculations with respect to Bitcoin, Elmandjra added,

“The reason why people are asking this question because in the past there have been some interesting short term indications that Bitcoin acts in a negatively correlated fashion to geopolitical risks and uncertainty.”

According to him,

“I think it’s time for everyone to realize that Bitcoin is still in its infancy stages. Most activities are highly speculative, most activities are via trading. So when you combine the easy access to exposure to Bitcoin and the relative ease at which its price can change day over day, massively volatility that it presents, I wouldn’t necessarily discount Bitcoin not being an uncorrelated asset.”

Elmandjra also admitted to analyzing traditional correlation tables, claiming that he found that Bitcoin provides a “negative to neutral” correlation to traditional asset classes at the extremes.