Bitcoin: Deribit dwarfs CME, Bakkt options trading volume

The cryptocurrencies derivatives marketplace is expanding. While BTC options have seen increasing popularity among the institutional investors, this space is largely dominated by unregulated players as opposed to the likes of CME and Bakkt.

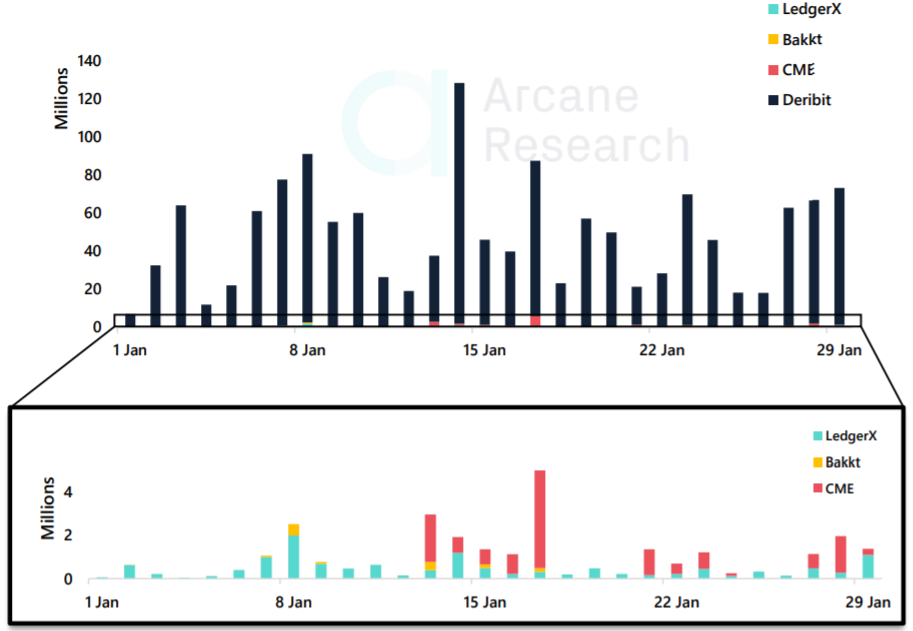

Institutional-focused analytics platform, Arcane Research, stated that crypto derivative exchange Deribit dwarfed the volumes of both CME and Bakkt in terms of BTC options trading.

The research stated,

“..the volumes on these regulated markets [CME and Bakkt] are far from the levels we see on the unregulated retail markets. Deribit’s trading volume makes both Bakkt and CME look non-existing.”

Interestingly, Deribit recently announced that it will be launching Bitcoin daily options on 3rd February with a BTC contract set to expire every day of the year.

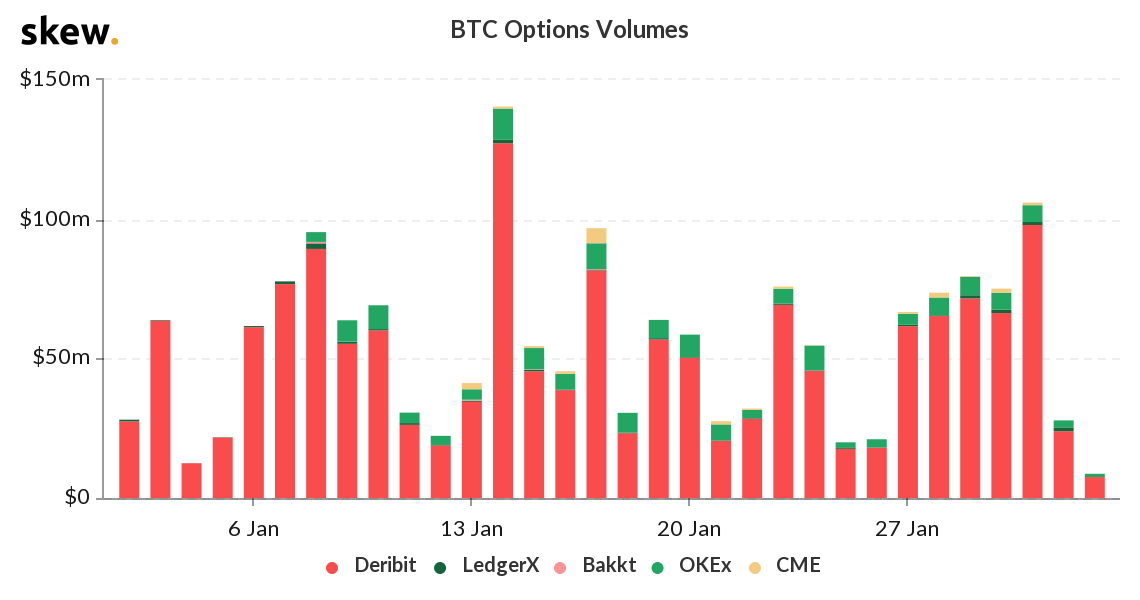

Source: Skew

However, things are not well for the Intercontinental Exchange [ICE]-owned Bakkt. According to the crypto data provider, Skew, Bakkt witnessed zero trading volume for its options for 10 days.

Along the same line, Arcane Research stated,

“Bakkt hasn’t seen an option trade in over a week now and while CME’s new options are doing a lot better than Bakkt, they still have a long way to go.”

NY-based Bakkt launched its options trading on 9th December 2019. So far, BTC options uptake on Bakkt has been weak while its rival CME has seen strong interest on the same. Launched on 13th January 2020, the options trading figures on CME exploded just after a week of going live.

While the unregulated platforms have continued to rally in terms of BTC options trade volume, the Chairman of the Commodities and Futures Trading Commission [CFTC], Heath Tarbert in a recent conversation with Cheddar, said that the regulated derivatives will generate market confidence in crypto. He added,

“By allowing [cryptocurrencies] to come into the world of the CFTC, it’s helping to legitimize [crypto], in my view, and add liquidity to these markets”