Bitcoin CME OI’s 6-month high could suggest bearish reversal or another high

It has been a very lively week for Bitcoin from the point of view of price and market interest.

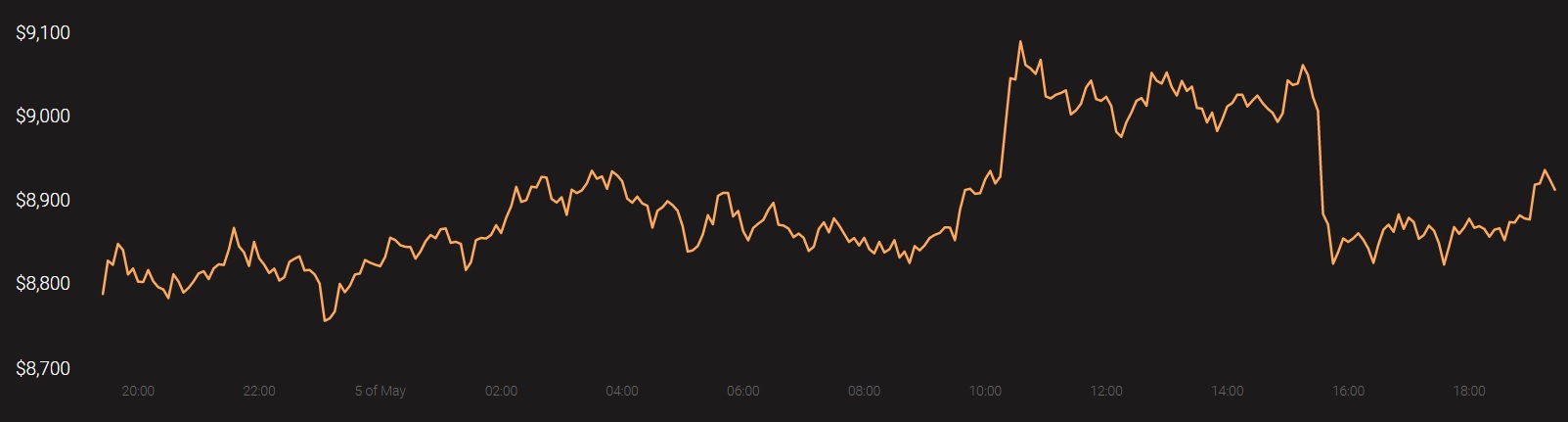

Bitcoin, at the time of writing, was consolidating between the range of $8500 and $9000 on the charts, movement that triggered improved fundamentals all across Bitcoin’s ecosystem.

Source: BTC/USD on Trading View

If you analyze Bitcoin’s 4-hour chart, it is clearly evident that the coin’s rise was particularly staggering for a 24-hour window between 29th-30th April. Since then, BTC has undergone strong sideways movement between $8550 and $9050. Now, collective improvement of BTC fundamentals a day or two after the rise is justifiable, but a particularly improving metric has caught the eye of some over the past couple of days.

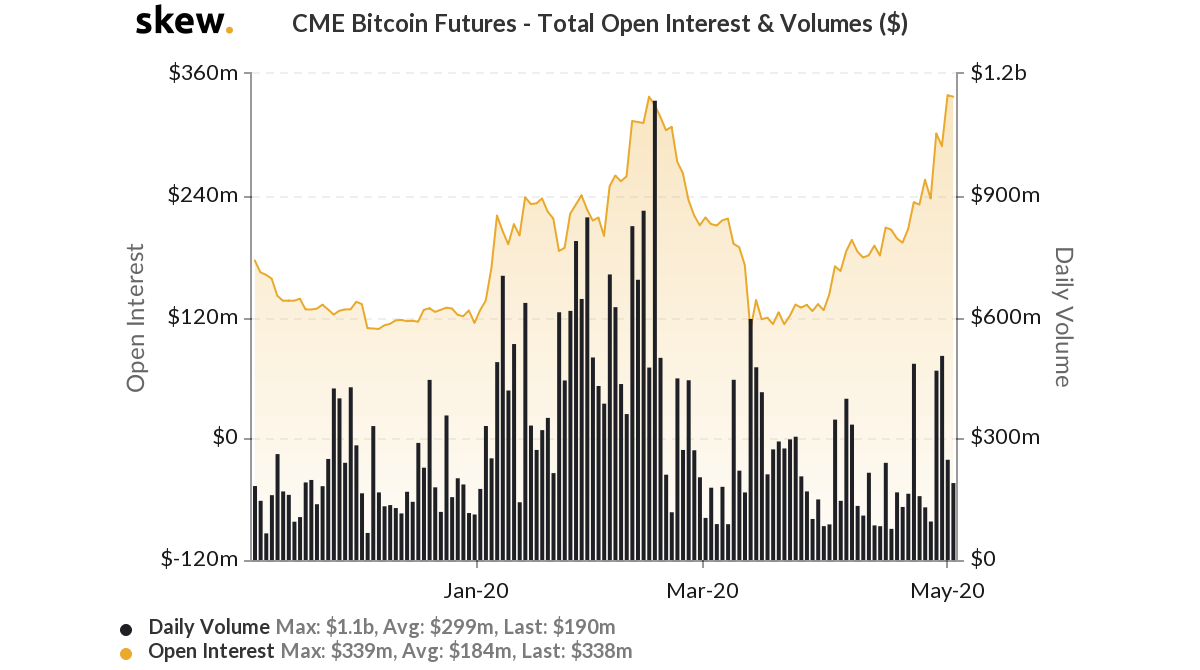

Source: Skew

As previously reported, Bitcoin Futures on CME registered a major hike over the past week. On observing the attached Skew markets chart, it was observed that Open Interest on CME’s Bitcoin futures chart was at a 6-month high. If the metric is reviewed superficially, it will appear to be a positive development, but there is a significant question mark behind the 6-month ATH milestone.

The OI was noted to be $289 million towards the end of the recent rally. However, over the aforementioned period of consolidation, it spiked all the way to $339 million.

Now, historically, when the OI rises alongside the price, it is a bullish signal, indicating that more BTC Futures investors are entering the market and are involved in additional buying, with any purchases being generally aggressive in nature.

The high OI, at the moment, suggests high activity, but the price hasn’t risen much over the past few days. Hence, the rise in OI is a little unusual during this phase of the bull market.

According to OI analysis, an unusually high Open Interest in a bull market is a dangerous signal. When a rising trend of Open Interest begins to reverse, expect a bear trend to get underway.

Additionally, it is also known that a price breakout is much stronger if the OI continues to rise during price consolidation because more often than not, investors are caught between and on the wrong side of the market when the breakout takes place.

In short, Bitcoin’s price is currently at a tricky place, something that could trigger a couple of scenarios before the halving.

Case 1: Accredited Investors are bracing for a bearish reversal

It can be speculated that if the OI reverses and starts plummeting, it might trigger a bearish trend, and investors could be preparing themselves for such a situation before the halving. $9400 could be the top before the event and the price may attain new lows going forward.

Case 2: Price follows OI over the next few days, another high price rally

However, if Bitcoin is able to go over $9000 over the next 48-hours and the OI continues to rise, it will be a clear indication of another bullish rally, one that will be backed by the Futures market and investors.

The next seven days before the halving are setting up the stage for Bitcoin and the immediate trend is likely to facilitate major implications for Bitcoin’s price post-halving as well.

At the time of writing, Bitcoin was trading at $8,914 with a 24-hour trading volume of $24 billion.

Source: Coinstats