Bitcoin Cash’s long-term surge could face resistance at $226

It has been a torrid time for the digital asset ecosystem lately and Bitcoin Cash has been a part of it as well.

Since the cryptocurrency market’s fall on 12 March, Bitcoin Cash has lost over 34.16 percent of its valuation over the past week, with its price recorded to be $178, at press time. Its market cap remained around $3.27 billion and it had a trading volume of $3.75 billion over the past 24-hours.

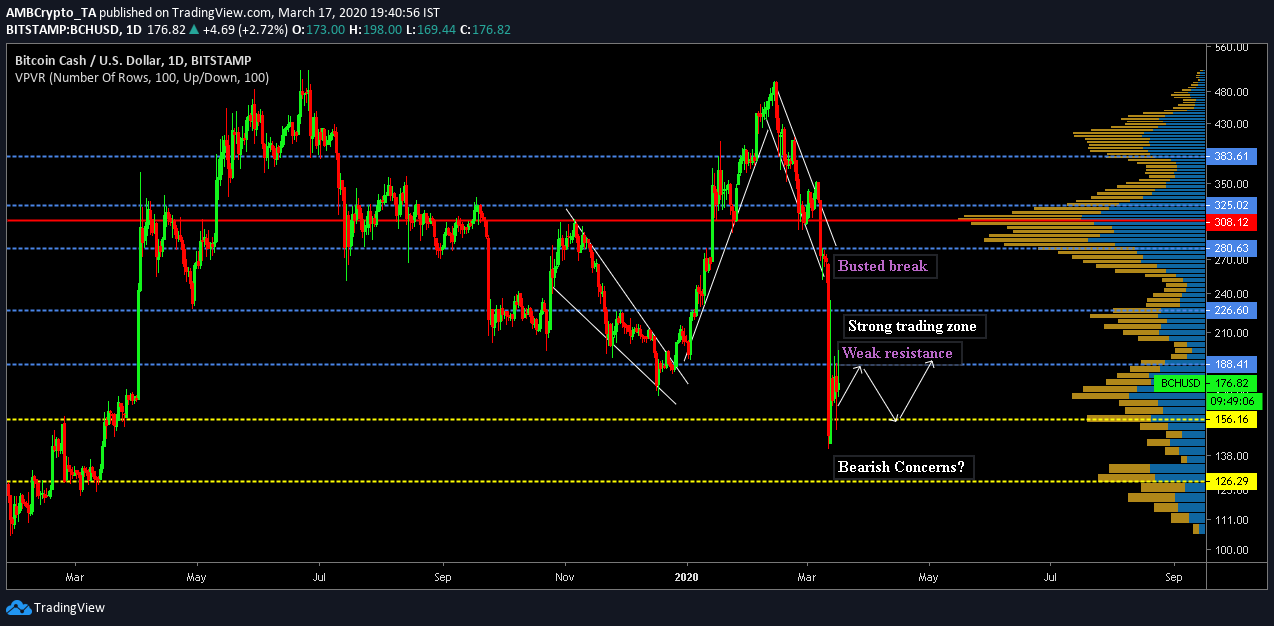

Bitcoin Cash 1-day chart

Source: BCH/USD on Trading View

On observing Bitcoin Cash’s 1-day chart, it can be observed that the token’s upswing happened after the crypto-asset pictured a falling wedge towards the end of 2019. The pattern was followed by a bullish break by the token which came to a halt on 14 February.

Over the past 3 weeks, Bitcoin Cash’s price mediated between the trendlines of a descending channel, but the price ended up exhibiting a busted pattern and the eventual drop was experienced on 12 March. The crypto-asset breached key support levels at $226, $188 and briefly consolidated under $156 as well.

At press time, the crypto-asset had managed to breach above $156. The resistance at $188 is a weak one for the token and there was the possibility of BCH breaching past it pretty easily. However, it is important to understand and consider the current market sentiment as well.

The bears had a strong grip on the market as the entire financial industry remains cautious over a period of what could be the recession.

However, the VPVR indicator also suggested that trading volume between $188 and $156 was substantial, despite the fact that $188 was a weak resistance.

Source: BCH/USD on Trading View

The indicators remained divided as the MACD continued to suggest a largely bearish nature, but the RSI suggested that a trend reversal could be on the charts for the crypto-asset. However, it is fair to say that other factors will play a major role in Bitcoin Cash’s future and the current collapse of the traditional financial class may have irreversible implications for the digital asset industry.

Conclusion

Considering the fact that for the time being, the fall is behind the crypto-industry, Bitcoin Cash should manage to scale above $188. However, consolidating above the $226 range looks like a difficult task.