Bitcoin Cash sees high miner attrition post-halving – hash rate drops 74%

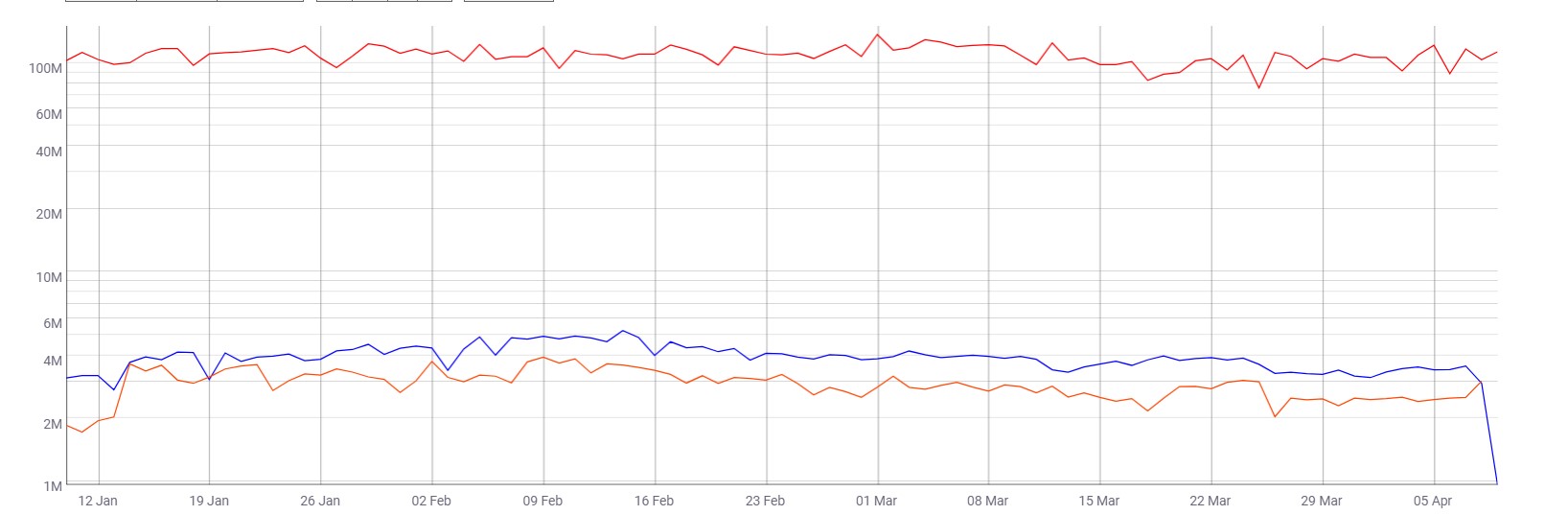

Bitcoin Cash, the fork of Bitcoin and Bitcoin SV, the fork of Bitcoin Cash have both undergone halving recently. Bitcoin Cash seems to have had a hard time after the halving as it is facing dire circumstances. Bitcoin Cash’s hash rate has witnessed a ~74% decline since April 07 to date and this has a wide range of implications.

Half of Bitcoin Cash

On April 8, at block height 630,000, 12:20 UTC, the Bitcoin Cash underwent its first halving. By definition, this caused a 50% reduction in its block rewards from 12.5 BCH to 6.25 BCH. Typically, for Bitcoin and Litecoin, the pre-halving period is observed with a rise in price and post-halving is seen with miners adjusting to the new rewards system.

However, what happened with Bitcoin cash was drastically different. The hash rate of Bitcoin Cash went from 3.6 million TH/s to 960,000 TH/s, a whopping 74% decline.

Source: Coinmetrics

The miners would be better off mining Bitcoin or Bitcoin SV due to higher mining rewards as compared to BCH. Further, the usage of the SHA-256 algorithm for all three blockchains would make it easier for the miners to switch sides. However, at the same time, the hash rate for BSV is on the rise.

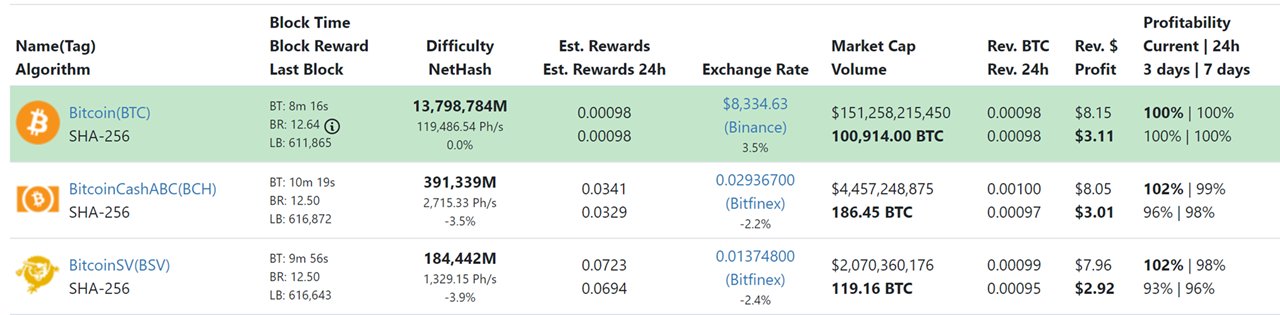

This was the mining reward for Bitcoin Cash, Bitcoin SV, and Bitcoin, before the halving. This shows a small spread among the coins, which explains how things were balanced before the halving.

Source: WhatToMine

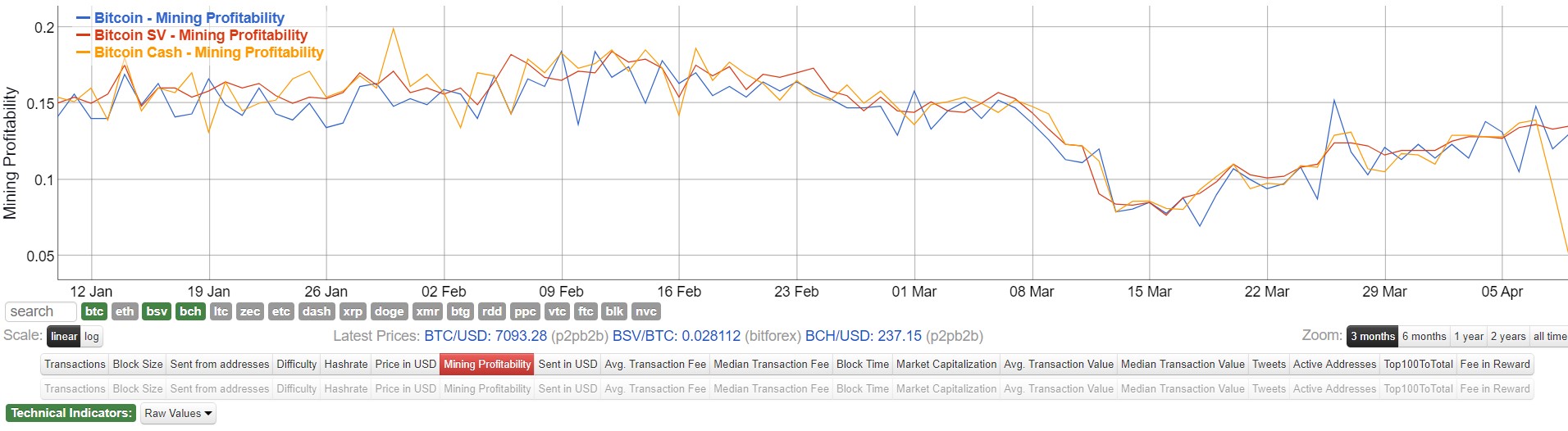

But after the halving, the mining revenue for Bitcoin Cash [Yellow] has started to decline rapidly. At the time of writing, the BCH mining profitability was $0.00488 per day per TH per second. Whereas, for BSV and BTC, it was at 0.13 per day per TH per second.

Source: Bitinfocharts

If the hash rate continues to decline rapidly for Bitcoin Cash, this could create a mass exodus of miners from BCH to BTC and BSV. This could decrease the security of the blockchain and allow a 51% attack. From its very short history, BCH has already come under such attacks, hence, this could prove to be very expensive for the fifth-largest cryptocurrency in the world. Although speculative in nature and unlikely, the coin could also undergo a death spiral, which could lead to the hash rate of BCH heading towards near zero.