Bakkt in the game: Bitcoin Futures moving away from CME?

Even though it’s been less than two months since its launch, Bakkt was the forgotten golden child of the Bitcoin market. Slated to be the prime catalyst that would take the king coin back to its all-time high, the Intercontinental Exchange’s digital assets program underwhelmed, and ‘Moon’ had to wait.

Buy the Rumour – Sell the News

In the months prior to its official launch, ICE reinforced that Bakkt was not dead and rumor-mill kept building. After reaching its YTD high in June at $13,800, Bitcoin dropped to $10,000, but kept abreast with the five-figure mark, holding on till the launch of Bakkt’s Bitcoin Futures contracts, which were primed to push the king coin’s price over its yearly high.

The momentum behind Bakkt was significant because of three reasons – the heavyweight backing of NYSE’s parent company ICE, complete with supporters like Starbucks and Microsoft, the regulatory approval of the U.S Securities and Exchange Commission [SEC], and the first-of-its-kind physically delivered contracts, unlike its cash-settled equivalent at the Chicago Mercantile Exchange [CME]. Blockchain.com’s Garrick Hileman described the platform as “an important development in the maturation and legitimization of crypto-asset markets.”

The reality was a classic case of ‘buy the rumor, sell the news,’ as the 23 September launch marked the worst day for Bitcoin in 2019. Bakkt and its hotly-anticipated Bitcoin Futures were seen as the forbidden fruits that would convert Wall Streets’ naysayers into all-out Cypherpunks. Alas, they fell short. The total volume that Bakkt amassed in its first day was less than 71 Bitcoins worth, and with it, the spot market repelled.

Boom and Bust

Bitcoin shaved over 18 percent of its value on the days post the launch of Bakkt. Trading in a descending triangle was a hard task to begin with, and the burden of an institutional luring investment vehicle was too big for Bitcoin to bear, and it sunk.

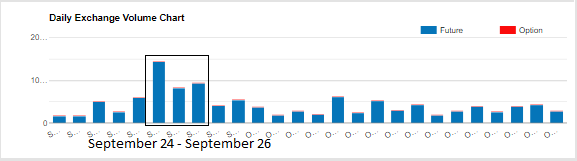

Meanwhile, Bakkt’s massive breakdown resulted in CME’s massive breakout. The regulated Chicago-based exchange saw its Bitcoin Futures trading off the charts as it was made clear what kind of contracts Wall Street preferred. On 24 September, the CME group saw over 14,000 contracts traded, with Bitcoin averaging $9,000 and the volume posting $630 million.

Source: Bitcoin Futures Volume, The CME Group

A “total failure” is what Mati Greenspan, Senior Markets Analyst at eToro, called Bakkt’s launch, opining that the movement from physically-delivered to the cash-settled CME contracts is another indication of Wall Street’s inability to understand Bitcoin. He added that the CME volume spike, shown above, was due to “speculation surrounding Bakkt.”

Forgotten Child

The cryptocurrency industry is fickle, and if something as monumental as Bakkt doesn’t ensure “moon,” then it is cast aside. Bakkt’s massive letdown resulted in it being thrown into the ash-heaps of crypto-history, albeit temporarily.

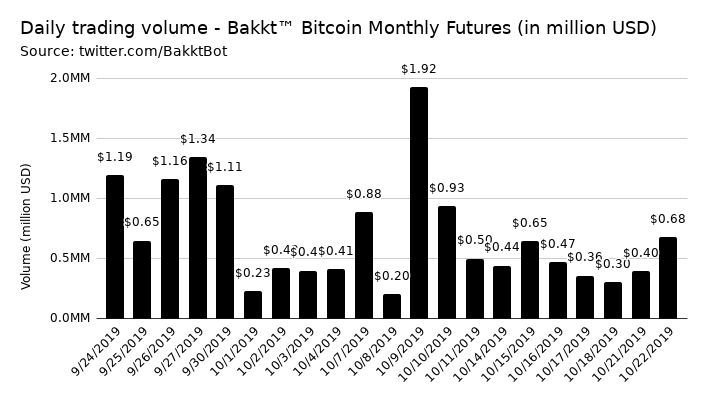

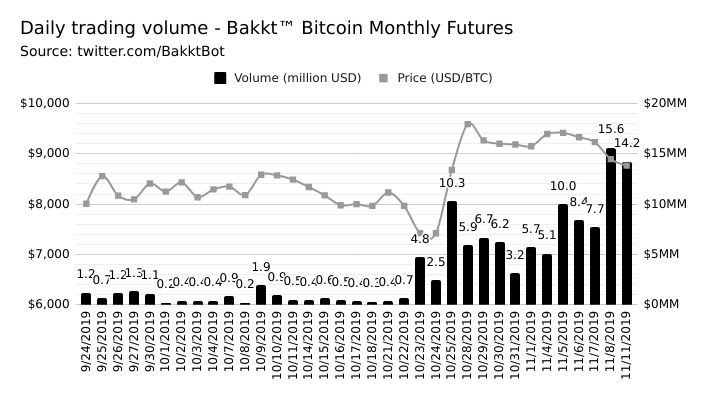

For almost a month, from 24 September to 22 October, the average volume on ICE’s brainchild platform was under $700,000, with the highest volume being $1.9 million on 9 October. During this period, the platform was forgotten from the larger cryptocurrency space, as the focus shifted to more organic crypto-derivative products.

Source: Bakkt Volume Bot, Twitter

Bakkt’s Revival

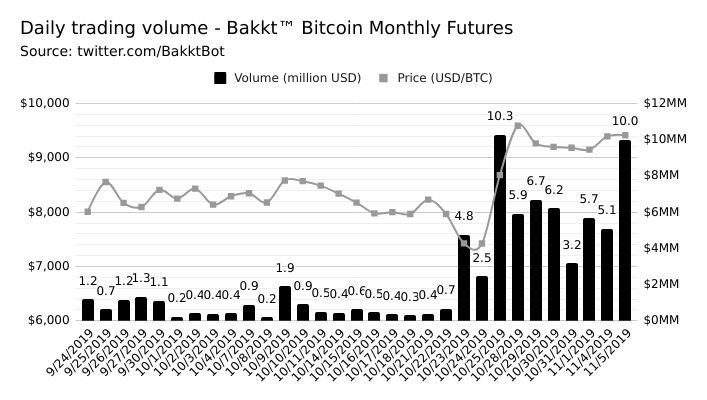

While the initial few weeks saw a massive let-down in both the volume and the sentiment surrounding Bakkt, CME Futures saw a positive spillover. However, both were short-lived. On 23 October, Bakkt saw a massive 640 contracts traded, with the price of BTC down to below $7,400, putting the volume at a new ATH of $4.8 million, more than double the previous high of $1.9 million.

Thus, with every price decline, institutional investors began hoarding Bitcoin with the hopes of cashing-out during the price reversal. One thing to remember here is that Bakkt, despite operating under ICE, is still trading Bitcoin Futures, and hence, the same rules apply as on other cryptocurrency exchanges. Yes, Bakkt is dwarfed in volume compared to the billions being transacted by heavyweight exchanges, but market participants like market makers still inhabit this regulated market.

Speaking to AMBCrypto, Charles Phan, CTO of cryptocurrency exchange Interdax, stated that Bakkt could be “picking up volume from other places.” He added,

“As volume continues to increase in the bitcoin market from the October lows, one consequence is that arbitrageurs might be trading more using Bakkt’s contracts.”

Following the massive drop in BTC’s price prior to the $4.8 million high on Bakkt, Bitcoin, despite entering the ‘Death Cross,’ crossed over into bullish territory thanks to Xi Jinping’s comments on blockchain. Bitcoin recorded its highest daily gain of 2019 and Bakkt shattered its ATH for the second time in the week, recording $10.3 million in volume.

The week that followed saw Bitcoin steady at $9,000 and Bakkt notching daily volumes of over $5 million [barring 31 October]. On 5 November, $10 million was seen with 1,061 contracts traded, proving that the previous feat was no fluke.

Source: Bakkt Volume Bot, Twitter

Futures Flip

During the launch and failure of Bakkt, it was thought that institutional investors were only interested in trading the contractual Bitcoin, showing little interest in actually hodling. CME contracts skyrocketed while Bakkt plummeted, something which looked like a sign of things to come, until it wasn’t.

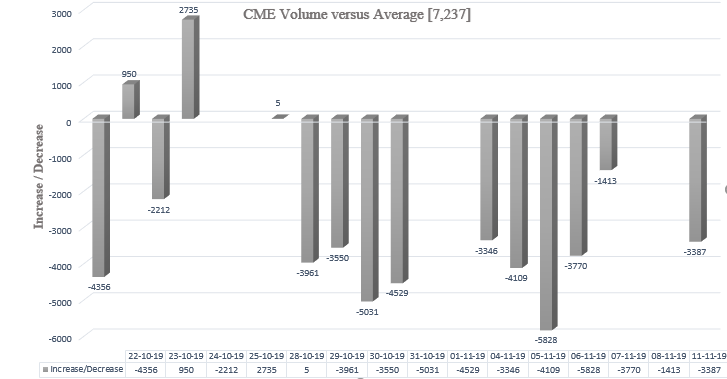

The recent volatility in Bitcoin’s price and the performance of the two Futures markets showed a change in sentiments. Firstly, the CME contracts declined over the past few months, relative to their performance for the complete year. In August, Tim Court, Managing Director of the CME Group, had stated that YTD, the Chicago-based exchange averaged 7,237 contracts traded per day.

On the basis of this average, the performance since 22 October has been dismal. Barring three occasions [October 23, 25 and 28], daily volume has been below the average. Especially during the start of November, the CME performance took a dip, ranging volume that was 3000 – 5000 contracts below 7,237, as indicated by the above chart.

Bakkt, on the other hand, saw two massive peaks within the same period; the first at $10.3 million and the next at $10 million. Following which, it once again broke its ATH on 9 November, seeing volume worth $15.6 million traded on the platform, with the next trading day recording $14.2 million in volume.

Source: Bakkt Volume Bot, Twitter

While Bakkt’s relative increase is strong, it’s meager in comparison to what most people thought could be amassed. Not to mention the hype that Bakkt saw prior to its launch, the burst of liquidity is but a drop in the ocean. Fabio Canesin, Co-founder of NASH, a blockchain FinTech company, told AMBCrypto that Bakkt can be trusted on the liquidity front, because of its vast funding. However, he said that this volume push cannot be a tell-all. He added,

“While their growth is encouraging, I wouldn’t call the volume high, given the size of their operations. They are probably far below their profitability threshold. So I expect their push to continue for the foreseeable future.

Even from a market-influence point of view, Bakkt has a long way to go before it can dictate the price of Bitcoin, despite the growing liquidity, added Phan.

Homecoming

While it is enticing to say that institutional investors are returning from the ‘Bitcoin only in name’ world of cash-settled CME Futures to the physically-settled world of Bakkt, the reality is far from it. Bitcoin volatility within this short period has indicated that institutional investors are weighing both the platforms, not just siding with the U.S dollar or cryptocurrency.

Bakkt’s rise off-late, coupled with the drop in volume in the CME’s books, is noticeable, but it is a longshot to say that institutions prefer physically-delivered products. Moreover, the current Bakkt rise, despite being significant when looking at its performance since its initiation, is minuscule compared to the BTC liquidity on crypto-exchanges, the CME volume, and the potential volume expected from Bakkt.

Another conclusion could be both CME and Bakkt are seeing institutional interest; it’s just that this interest is growing with Bitcoin gaining more notoriety. With financial giants diving head-first into the crypto-world, an air of legitimacy has come in, and it could be pulling in more institutions to trust investments in the decentralized currency.

With Bakkt still in its infancy and CME volumes still significant to the Bitcoin market as a whole, it’s still too early to say whether Bakkt is back in the game. Canesin concluded,

“It’s too soon to say. Their [Bakkt’s] volume is still insufficient to guess whether they are cannibalizing other platforms or expanding the market.