Are Bitcoin’s alleged risks worth the worry anymore?

“The wagering of money or something of values on an event with an uncertain outcome, with the primary intent of winning money or acquiring asset profitability.”

That is the definition of gambling, according to Wikipedia. Although the meaning of it is pretty unnerving, here is another interesting statistic. In 2019, the total gambling gross yield worldwide was estimated to be upwards of a whopping $450 billion. Now, that is a lot of money going into a game of chance.

However, that’s what it is. Gambling has an innate risk factor to it, one that intrigues and attracts the human mind. The psychological titillation of being unassured of the outcome, while having a chance at gaining profits is a form of fixation, verified by the above revenue figure.

Ironically, cryptos initially brought in a similar set of traits. People didn’t know what to expect, there was no proven history of benefits, but there was a slim chance that you might quadruple the value of your net assets. And people rushed in, 2017 being the prime example.

That being said, today, while crypto is still risky and highly volatile, it is changing the perspective of the global financial system. And yet, it is still associated with its own set of risks, all of which are flung in from every direction to discredit the credibility of this new asset class.

Although certain risks are fairly justified, some of them have been proven wrong over the course of the last decade. In this article, we will try to identify which of these famous crypto-risks should still be kept in mind, and which ones are downright ignorant.

“People lose all their money in crypto”

Yes! Let’s start the proceedings with a crowd favorite, or should I say critic-favorite.

It is so common to hear people complain about the volatility in crypto and to be frank, it probably has strong arguments, but it is not 2017 anymore! The amount of credibility and respect digital assets have received over the past couple of years has been accounted for, and even though people have lost capital in digital assets, smart investors probably haven’t. Hence, the present validity of the above risk is very questionable because investing in any asset without doing your research will lead to losses, irrespective of whether they are stocks or cryptos.

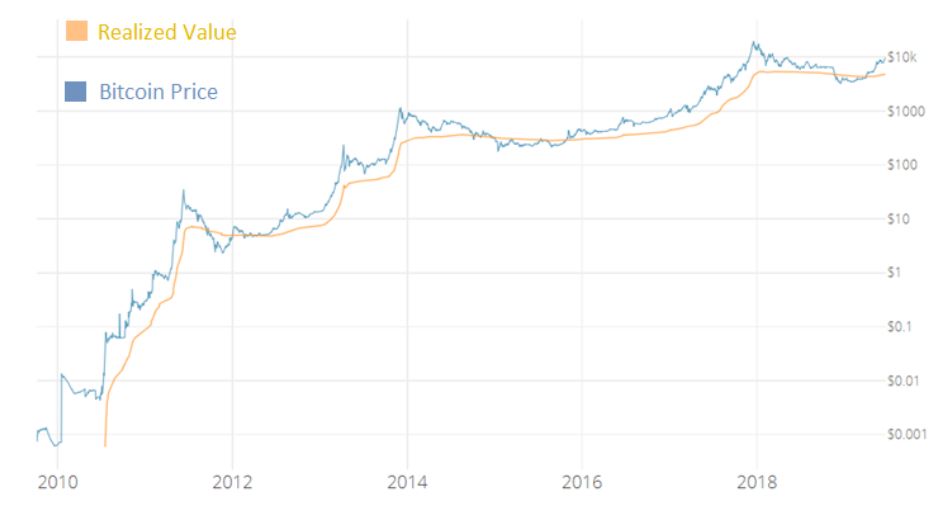

Source: Willy Woo

However, coming back to crypto, the fact that digital asset investors have been profitable for 98.2 percent of the days since Bitcoin’s inception might hold more weight. Now, don’t shout at the messenger, but that is a fact. According to a study, between 3830 days from January 4th, 2009 to June 30th, 2019, it was profitable to buy Bitcoin for 3671 days, break-even for 90 days, and unprofitable for a brief period of 69 days, a time period which included most days of December 2017. I leave this right here now.

“Centralized assets will replace decentralized cryptos”

Hmm, a debatable concern indeed.

Now, the tussle between centralization and decentralization is a legitimate concern, but one always discussed in a misleading way. To a certain extent, centralization has been eyed to bring more value to crypto. From the beginning of time, institutions have performed and fared well in a system of hierarchy.

I admit that major digital assets are not really institutions, but centralized crypto does make a better impression on professional investors. David Waslen, CEO and Co-Founder of HedgeTrade Blockchain, told AMBCrypto,

“The centralization of crypto has a calming effect on institutional investors and those not so trusting of community-led protocols and self-executing algorithms.”

However, props to Mr.Walsen as he also identified the affinity of the global community with decentralized crypto. He added,

“One of the central aspects and driving forces of decentralization is the community. The level of decentralization a company imbues into their ecosystem is often a measure of their appeal to the global crypto community.”

So, as a conclusion, it is not exactly a risk that centralized crypto will take over decentralized assets such as Bitcoin in the future, but it cannot be taken lightly as well. With the entry of Big Finance in the digital asset industry, we may possibly move towards centralization of crypto, but it’s fair to say that it won’t be an easy path forward for them.

“Crypto is filled with Manipulation and Liquidity Issues”

Alright, now we are getting into the thick of things.

So, if you are new to the crypto-space and you have heard about incidents of crypto-manipulations, chances are high that those reports were true.

Right now, manipulation continues to be a major predicament in the industry. This includes the wash trading of funds, where a false perception is created to picture more market activity than in actuality, and pump and dump traits, where an organized group would create a serious surge and decline in a matter of hours.

In fact, a recent study has also suggested that Binance, outrightly the most popular exchange in the world, is surprisingly also a hotbed for such manipulation activities. So, the risks and concerns associated with such activities are definitely legitimate.

However, the liquidity risk is technically a grey area.

Previously, it was a significantly major concern (to be honest, it still is), but institutional capital is coming in now and the cryptocurrency industry has a stronger claim as a financial asset.

“Regulations will defeat the purpose of crypto”

These risks involving the government, I tell you, are the WORST.

Without a doubt, the regulation aspect of cryptocurrencies has been a significant part of the discussion for years now. The fact that Bitcoin is not clear on whether it is a currency or store-of-value raises a lot of rudimentary doubts in the mind of the traditional market.

Talking about the risk, the proper phrasing would be ‘Improper regulation will defeat the purpose of crypto.’ That is obviously a serious concern because if someday, digital assets become completely authorized in the hands of a few, there will be no difference between fiat and cryptos. However, there is a solution.

Regulation of crypto in an indirect manner would solve the accountability problem of these assets while safe-keeping their decentralized nature. Hossein Nabilou’s How to regulate Bitcoin is a brilliant explanation of the entire case for indirect regulations.

Through indirect regulations, Bitcoin would be adhering to a set of standards, rather than following a set of rigid rules. There is a difference.

Under the indirect regulations approach, central authorities and other banking payments are more likely to regulate entities or intermediaries, rather than the asset themselves. Hence, the interface and interaction between digital assets and fiat currency remain within a bi-directional flow.

Now, pardon me if that explanation dragged on, but it is necessary for you to understand the nooks and cracks of this risk. I mean, that’s why this article was written in the first place.

Honorable Mentions and a subtle exit

Although new risks pop up every day on a casual Reddit scrolling, it is important to note that humans errors are also a major risk as well. Just read upon Quadriga CX’s story, you’ll know what I am talking about.

Now, I agree that cryptocurrencies are indeed risk-riddled assets, but I am taking my chances with it because there is a bit of trust here as well. Unlike gambling, I am not leaving it all to chance; but hoping for a future with these assets, with all the risks associated with it, is perhaps a chance, a risk worth taken.