Cardano long-term Price Analysis: 11 October

Cardano noted a surge of over 12% in the last 48 hours, with ADA’s price chart picturing $0.0089 as its temporary bottom. At press time, however, the market was still deciding if this pump was an impulse wave or a fake pump. Should it turn out to be the latter, then we can expect the price to retrace its surge. However, if it’s the latter, we can expect a small correction on the charts.

Either way, one needs to keep an eye out for Bitcoin as the correlation of alts with BTC is strong enough to sway altcoin price movements. The following article takes a look at the long-term scenario for ADA and what to expect.

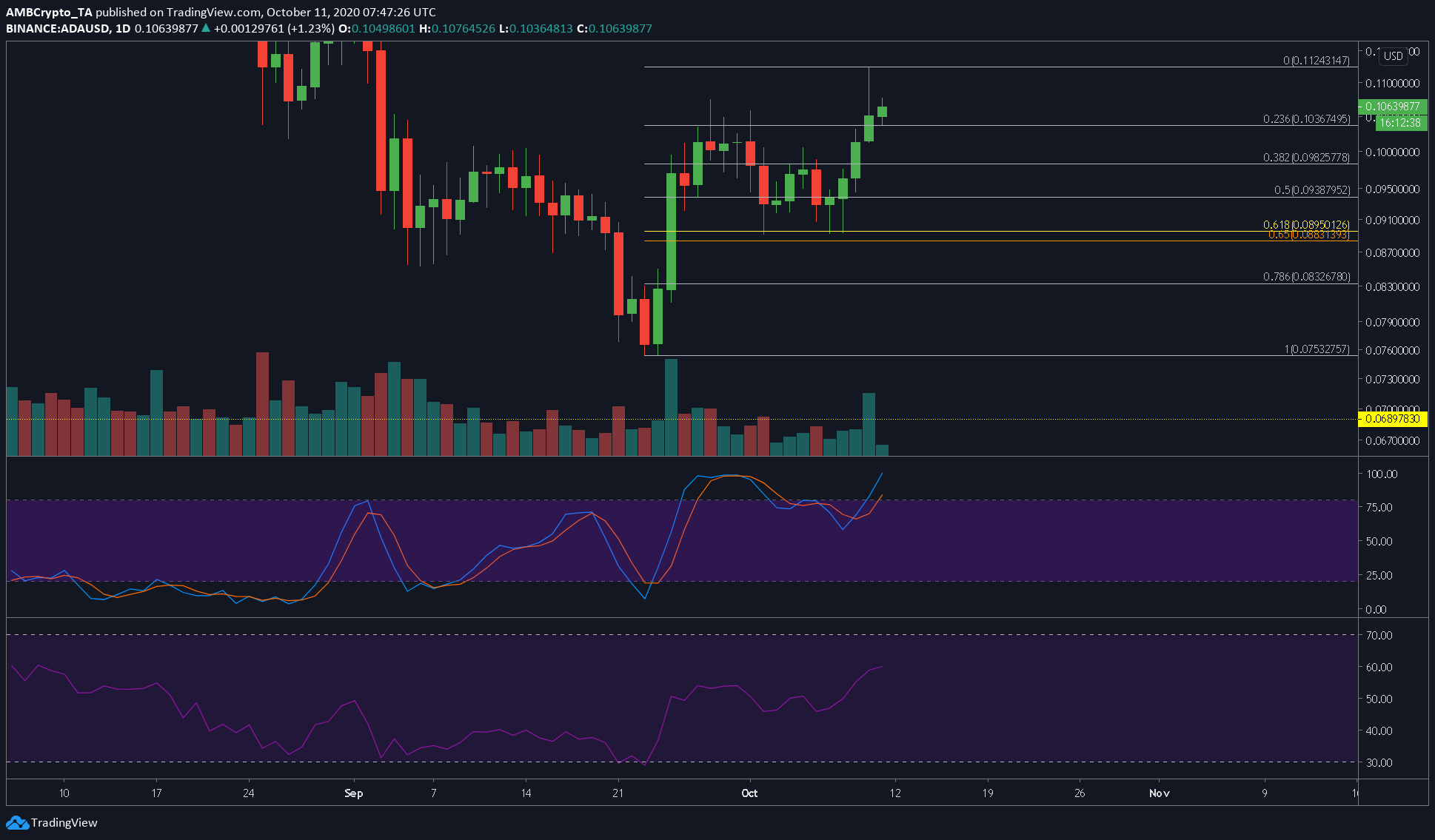

Cardano 1-day chart

Source: ADAUSD on TradingView

From the attached chart, we can see that the first pump pushed ADA to the 0.236-Fibonacci level. The interesting thing here was the retracement, which found support in the golden pocket [between 0.618 to 0.65 Fib levels]. This bounce pushed ADA by 25%, however, the price, at the time of writing, was on a path towards correction.

We can expect the price to move down to the 0.382-Fibonacci level aka $.0.09825 and in dire circumstances, to the 0.5-Fibonacci level or $0.09387. A bounce from either of these levels should push the price up to $0.1123 and beyond.

While the Stochastic RSI was deep in the overbought zone, the RSI still had to catch up. Hence, we can expect a small downtrend to $0.1036 or $0.0938 [2.5% to 7.8% drop], one that would help reset the Stochastic RSI back to the oversold zone or near it. Alternatively, we can expect the Stochastic RSI to remain overbought.

The altcoins’ fate depends on Bitcoin. If Bitcoin moves with strong volumes, altcoins follow. Bitcoin’s latest movement after CashApp’s announcement kickstarted this pump. Bitcoin has since hit $11,500 and was in a correction wave, much like ADA, at press time.

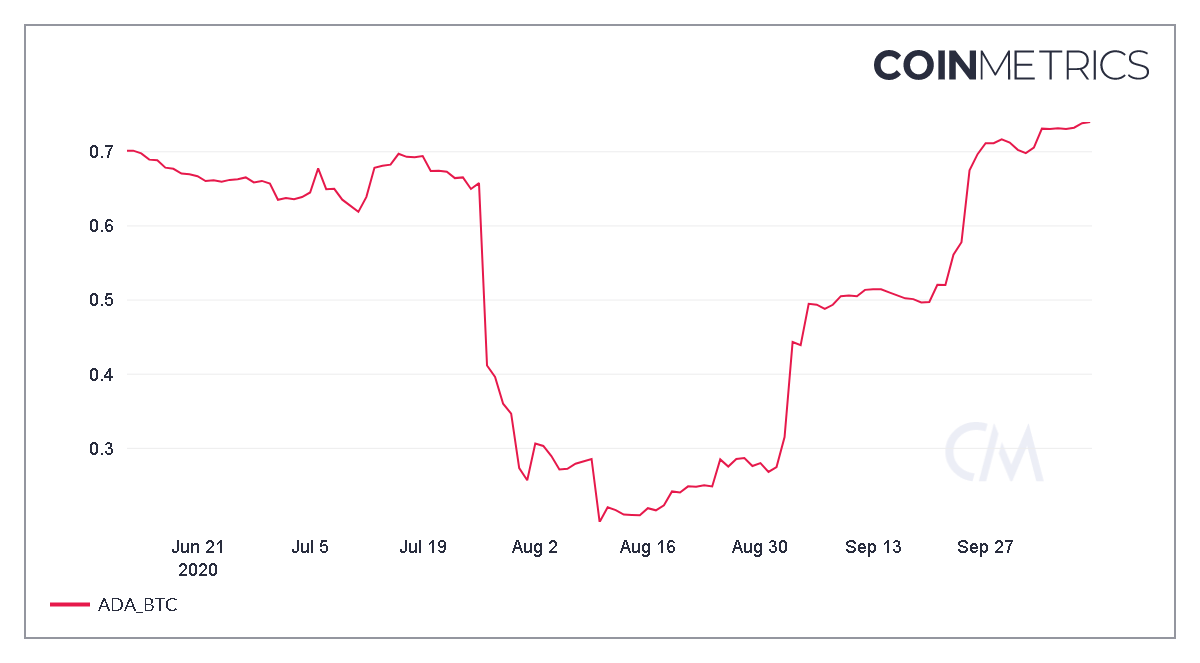

Source: Coinmetrics

Finally, the correlation chart showed that ADA and BTC’s 3-month Spearman correlation had reached a new high of 0.7406. Hence, we can expect ADA to promptly follow the path set by Bitcoin, the world’s largest cryptocurrency.