Bitcoin dumps 9% overnight, longs worth $140+ million face liquidation: Here’s how the market will cope

BitMEX traders might have had the worst when it comes to yesterday’s Bitcoin collapse. The price of Bitcoin fell from $10,200 to $9,500 in one fell swoop. However, just as the BitMEX traders thought the nightmare was over, it got worse as the price collapsed by another 4% and is now, finally consolidating as the bears and the bulls hash it out.

How Longs Got Rekt

Source: TradingView

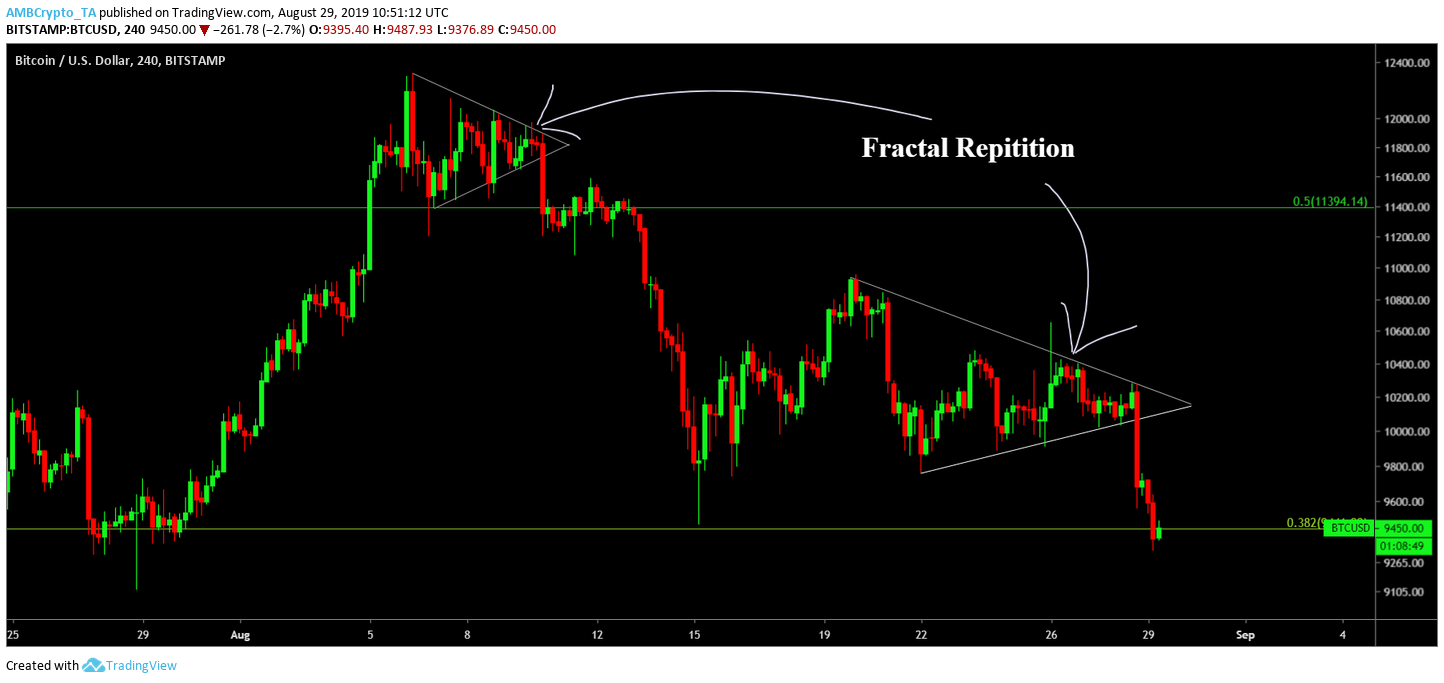

As seen above, the break out of the triangle was very evident as it was similar to a pattern that was formed in the first and second week of August. Put vaguely, it was a fractal. Although evident, the collapse of Bitcoin was not expected by many BitMEX trades as a total of ~$150 million longs were liquidated due to this particular move.

$150 million worth of Longs just got Liquidated at BitMEX#bitcoin pic.twitter.com/RweaP9KoS3

— Boxmining (@boxmining) August 28, 2019

Further, there was a buy wall of a whopping $130 million on BitMEX, causing a lot of panic among traders who were quick to note that it was a spoof order to fool the noobs, beginners, or the plebs, as crypto-twitter calls them. Spoof trade or not, it worked like a charm.

What Now?

Source: TradingView

As mentioned previously, the price is stuck in consolidation and is trying to close above the 0.382 fib-level seen in the chart above. On a slightly lower time frame of H4, there is a green candle that still is yet to close. Even if it does close above the 0.382 level, the succeeding candle would give an accurate representation of how the trend would proceed. There are however, chances of the price hugging the 0.382 level closely and moving sideways for a quite a while, before another big move.

The prospect for Bitcoin, at least in the medium term, looks bearish and that it is not out of the dog house yet. The reason for this is mean reversion. Bitcoin’s rise from April 1 and 2, 2019 was nothing short of a parabolic rise. When this happens, the price usually overshoots the actual price. Eventually, the price will have to return to the mean, which is what’s happening with Bitcoin as of now. Further, the price has also broken the 100-day moving average, after respecting it for over 180 days.

Targets

Medium to Long-term Time Frame

Source: TradingView

Judging by the resistance setups, one can deduce that Bitcoin might even hit anywhere between $9,100 to $8,100, in the next few months.

The first stop i.e, $9,100, doesn’t look like a tough one and it is completely possible if the bears keep mauling the longs. However, this will only be possible after a short-term rise in Bitcoin’s price after the recent downfall. Adding credibility to the above is the MACD indicator which is giving bearish signals.

Short-term Time Frame

The prices will move sideways until mean reversion takes place, following which there will be a slight pump, probably up to $9,800 and $10,100. Rejection at any of these levels is obvious. On an off chance that the bulls do have enough juice, they might pump Bitcoin to $11,400, which is unlikely. There is definitely a bullish recovery phase that Bitcoin will go through. However, if bears keep mauling the bulls, we might even see $9,100 to $9,000.

Conclusion

Short Term

- A pullback to $9,800.

- IF the bulls are lucky, a pullback to $10,100.

- IF the destruction continues, price might even hit $9,100

Medium to Long Term

- Mean reversion to $9,100 and as low as $8,100.

- In an EXTREMELY bearish scenario, the price might hit $5,800. This is as low as Bitcoin will ever go if something huge does happen in the ecosystem. [Disclaimer: Highly unlikely]