This is why Bitcoin should break out of its echo chamber

Public perception is key to radically new ideas and innovations gaining traction in mainstream society. Such is the case for the world’s largest cryptocurrency – Bitcoin. While Bitcoin has come a long way over the past decade, Bitcoin doesn’t really rely on a centralized and well-oiled branding and marketing machinery. If adoption has increased and public perception of crypto has become less hostile, it has primarily been a product of its intrinsic value.

During a recent episode of the What Bitcoin Did podcast, Dan Held, Director of Business Development at Kraken, spoke about how the initial public perception of Bitcoin was formed and the present marketing processes in place for Bitcoin that are spreading awareness, and to a certain extent, trying to demystify crypto for the average user. Held noted,

“With Bitcoin, we are a part of this decentralized marketing team where each one of us crafts our own narrative to how to pitch Bitcoin.”

For many investors, Bitcoin’s most promising use-case has been its characteristics as a store of value, which is why it is often linked to gold; simply put, it’s often seen as a robust long-term investment vehicle. Most of these narratives have gained traction recently and if one were to look at Bitcoin’s transformation chronologically, from payments to store value, it is evident that a certain healthy degree of trial and error has existed in the ecosystem. Held commented,

“We talk about Bitcoin in terms of gold 2.0, some people talking about it from a payments perspective and part of that, you know, we have to think about how do I land that narrative and you can kind of think about it as it’s inception – trying to incept the idea of Bitcoin into someone’s head.”

However, while cryptocurrencies like Bitcoin do have a plethora of use cases, they vary across various demographics, with millennials seeming to be the only demographic that has made vocal their distrust in traditional forms of banking and finance. This is also due to Bitcoin’s technical nature and the fact that the ecosystem surrounding Bitcoin on most digital media platforms tends to act as an echo chamber of users who speak a common vocabulary.

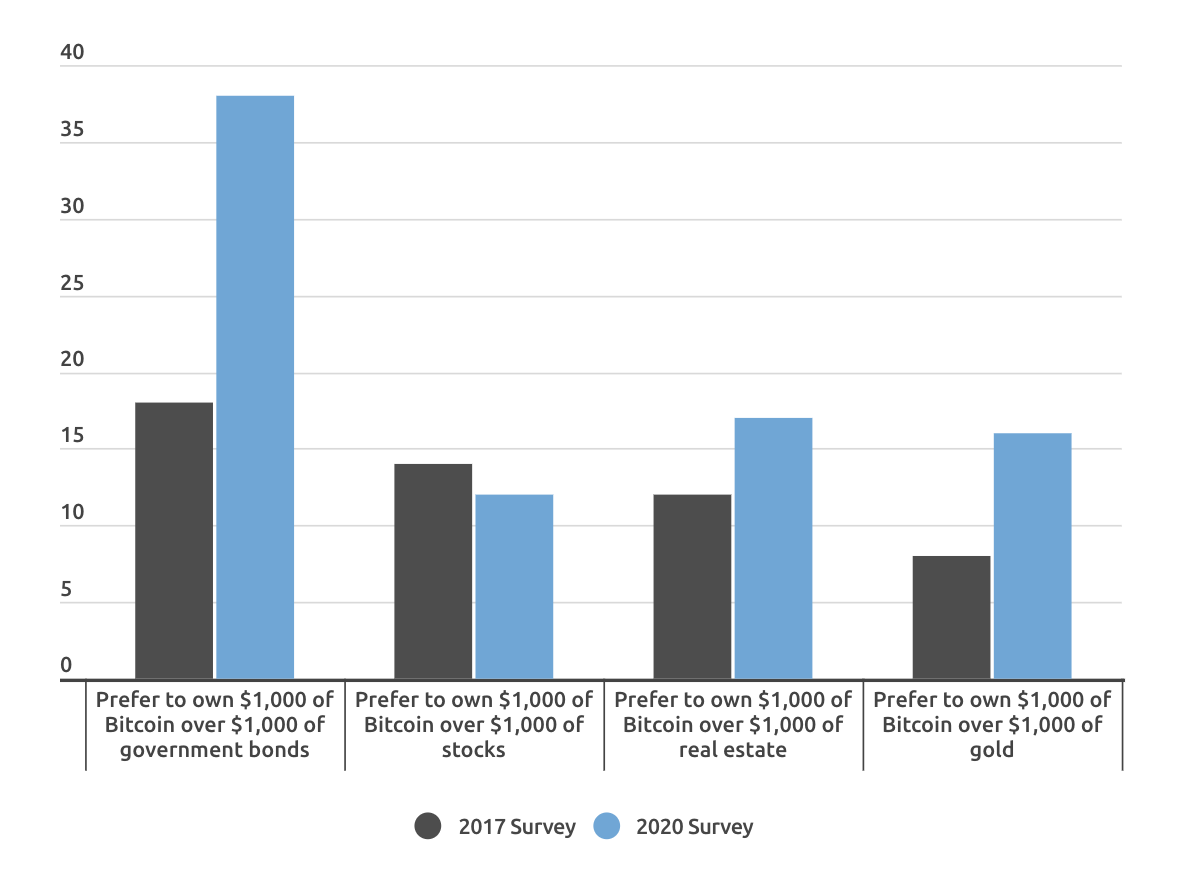

Source: The Tokenist

Interestingly, a recent survey conducted by The Tokenist had highlighted how trust in Bitcoin had increased across generations since 2017. Despite Bitcoin’s lack of traditional forms of branding and marketing, such gains are significant. The report had noted,

“Over 45% of respondents would prefer to own Bitcoin over stocks, real estate and gold, an increase of 13% over the 2017 baseline. Although confidence in BTC dropped marginally in the 65+ age group, among millennials confidence has increased dramatically against three asset classes: government bonds, real estate, and gold.”

Talking about how Bitcoin-related content needs to find a varied audience across various platforms, Held went on to highlight,

“It’s not okay for us to just pat ourselves on the back and be like, cool I got a thousand favorites on my tweet today, which happens to me every day cause I’m primarily talking to Bitcoiners…this is what we should be thinking about, is how do we get the message of Bitcoin everywhere we can.”