Can Bitcoin offer relief in emerging markets plagued by devaluing currencies?

As the word’s reserve currency the US dollar has seen increased demand during times of crisis. The liquidity crisis in the past few months saw the price of digital assets like Bitcoin plummet in a matter of hours. For many parts of Latin America, with extremely dollarized economies like that of Venezuela, Bitcoin is finding new use cases.

Matt Ahlborg, Founder of UsefulTulips.org in a recent interaction on the Tales from the Crypt podcast highlighted the role Bitcoin can play in economies with devaluing currencies and how it can help people gain access to otherwise inaccessible investment markets. Ahlborg noted that in such environments one of the most important value propositions Bitcoin can offer is by using Bitcoin products to make access to the US dollar a lot easier. He added for most users, Bitcoin is a way to increase one’s spending capacity via a reliable and stable currency and not necessarily a form of investment, he said,

“Oftentimes people want US dollars or they want something stable, but they also want something which they can spend and so if you gave them a dollar derivative, for example, they can’t take that dollar derivative to Netflix to buy a month subscription. They can’t take that dollar derivative to buy goods online…”

Ahlborg elaborated on the immense potential for Bitcoin in emerging markets and said that its value as a means of exchange is quite high in many parts of Latin America owing to the highly unstable fiat currencies present. He noted,

“These Bitcoin companies in the space, they need to acknowledge that is the challenge that they have in front of them, and they have to make it not only hold the value but also be spendable for accepted in commerce.”

Source: BitPremier

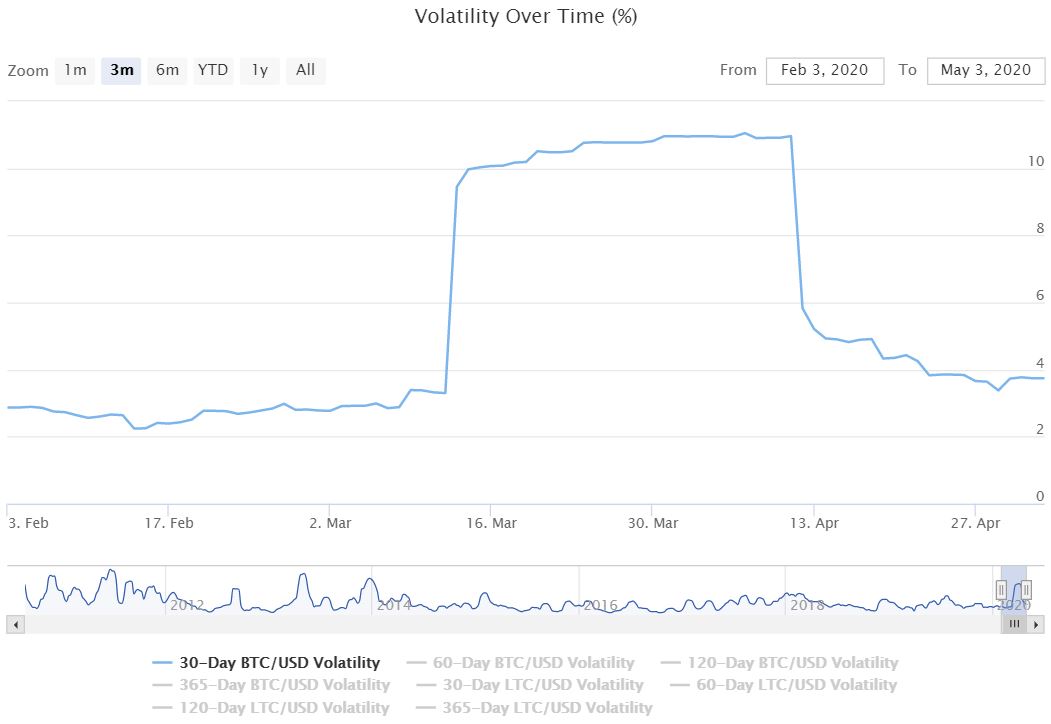

In such scenarios Bitcoin’s volatility if it were to increase may hinder progress. At present according to data from BitPremier, BTC’s volatility over time has seen a dramatic reduction in comparison to the previous two months.

While most discussion surrounding Bitcoin adoption Latin America is limited to its significance in Venezuela, Argentina is also positioned to become another hub in which many users are forced to rely on cryptos like Bitcoin for similar reasons. Capital controls within the country are on the rise and the country has a history of freezing dollar accounts leading to a lot of losses. In a recent blog post, Ahlborg noted,

“Argentina has long had economic, monetary, and political circumstances which many say are favorable to Bitcoin adoption. However, its overall footprint, at least from the perspective of LocalBitcoins, is still relatively muted in comparison to other countries.”

Source: UsefulTulips

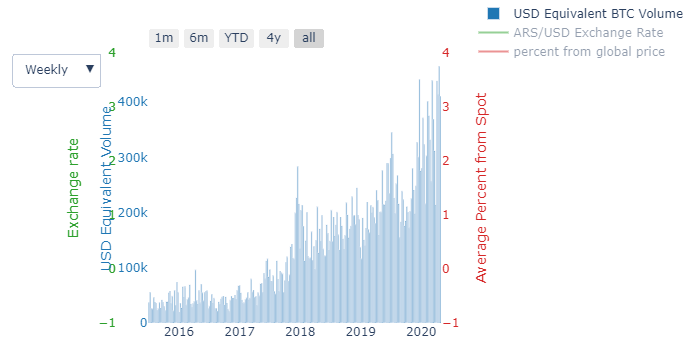

However, according to data on Local Bitcoins Argentine peso (ARS) Volume has also seen a drastic increase in volume on the platform in recent years. Ahlborg also pointed out that in such economies the opportunity is immense owing to the current financial infrastructure. He said,

“If Bitcoin companies can offer accounts that bear interest that would be great. In most emerging markets they have currencies that devalue by 4- 7% a year on average. And in the worst case, it’s over 50%. So just think about if you could have an interest-bearing account that would gain 3% a year instead of losing 5% just by holding your own currency, that would be massive.”