Is Ethereum’s DApp dominance under threat with Optimistic Rollups gaining traction?

When it comes to smart contracts being deployed, Ethereum is the prime candidate. Over the course of the last few years, the Ethereum network has evolved into a fairly robust platform, one that can facilitate the ever-evolving worlds of tech and finance. The ecosystem’s focus on decentralization has further resulted in innovative offerings like DApps and DeFi on its platform.

Kevin Ho of Optimism, a firm dedicated to scaling Ethereum, was the guest on the latest episode of the Blockcrunch podcast, with Ho highlighting the effect of Optimistic Rollups on the DApp ecosystem and its impact on the Ethereum Network. He stressed,

“Because you are able to get instant transactions on Optimistic Rollup and because there is nothing that, can’t be deployed on Optimistic Rollup that that can be deployed on layer one, Ethereum. It really won’t make sense to be deploying contracts on main chain, Ethereum. Instant transactions, incredibly cheap transaction fees, and, you still get the cross contract interactions that you would get on Ethereum layer one.”

Ho went on to add that a shift is inevitable, with him noting, “We’ll really see a shift from all contracts being on layer one, to being on Optimistic Rollup and they still maintain that sort of DeFi type coupling that we’re seeing emerge today.”

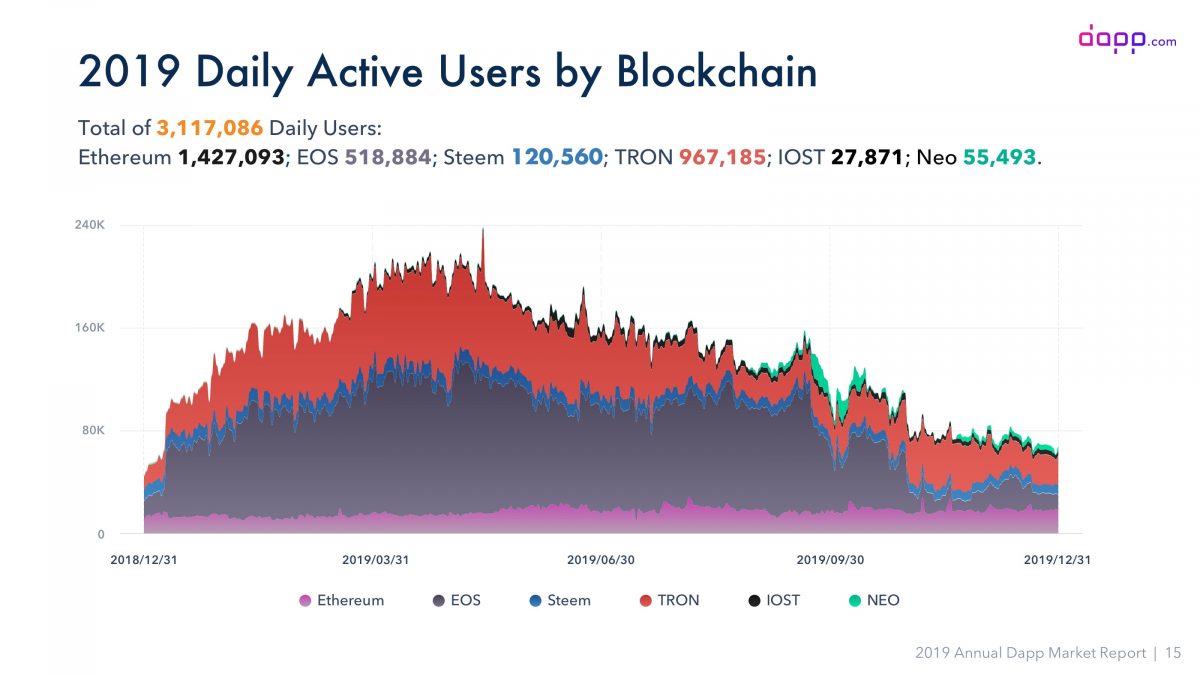

Source: DApps.com

The Ethereum network’s presence and dominance within the DApp ecosystem have been cemented over the course of the past few years. In fact, the DApp report for 2019 highlighted,

“Nearly half of active Ethereum DApp users have used DeFi DApps in 2019. 70% of the volume generated by the native ETH token was the use of decentralized exchanges and financial services, such as lending and etc.”

Finally, Ho also spoke about the difference between Optimistic Rollups and ZK-Rollups, stating that while the former uses validity proofs to prove that transactions are valid, solutions like Optimistic Rollups use fraud proofs. However, the Optimism exec pointed out that,

“Zero knowledge validity proofs are a more secure solution but there are definitely some tradeoffs, one of which is that these validity proofs can’t verify arbitrary EVM computation.So you can’t do general solidity smart contracts on ZK-Rollups. It’s very much for transactions and for specific use cases like decentralized exchanges today.”