CME Bitcoin Futures COT report implies 28-41% surge in April

Bitcoin’s worst sell-off seems to be a thing of the past, in light of the new weekly candle which is up by 18.83%. With hours remaining for this weekly close, the future of Bitcoin, at least in the short to medium term, seems to be optimistic, with the same favoring the bulls.

Source: BTC1! on TradingView

The CME Bitcoin Futures are indicating a gap above the price at press time, [$6,345] and it ranges from $8,200 to $9,100. This would mean a surge of 28% to reach the gap and 41% surge to close the gap. This would a good opportunity to go long.

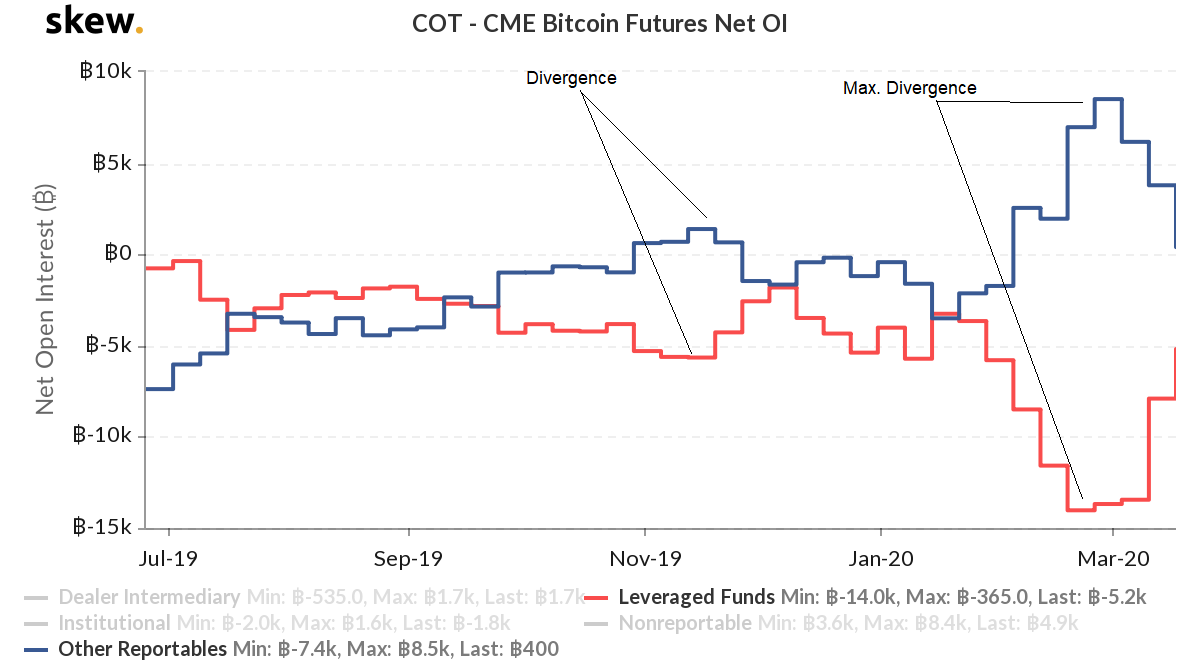

CME COT Report

The CME COT report presents a convergence of leveraged funds and other reportables after a historic divergence. Leveraged funds typically include hedge funds and various types of money managers, including registered commodity trading advisors (CTAs), registered commodity pool operators (CPOs) or unregistered funds identified by CFTC. However, reportables also include clearing members, Futures commission merchants, and foreign brokers.

Source: Skew

The divergence between the leveraged and other reportables reached a peak point on 25 February. Total leveraged positions of -2806 and 1703 reportable positions were observed during the peak divergence.

Since then, the divergence has been on a decline. A convergence between these two investment types was observed on 10 December, when both the leveraged and other reportables’ positions converged to a point. This signified the bottom for the price at that time. After this point, the price started rallying and hit a peak on 13 February 2020.

At press time, the total leveraged positions had come down to -1038 and other reportables amounted to 80. This convergence, in a way, suggested that the bottom is in and it is time for the rally.

Source: Skew

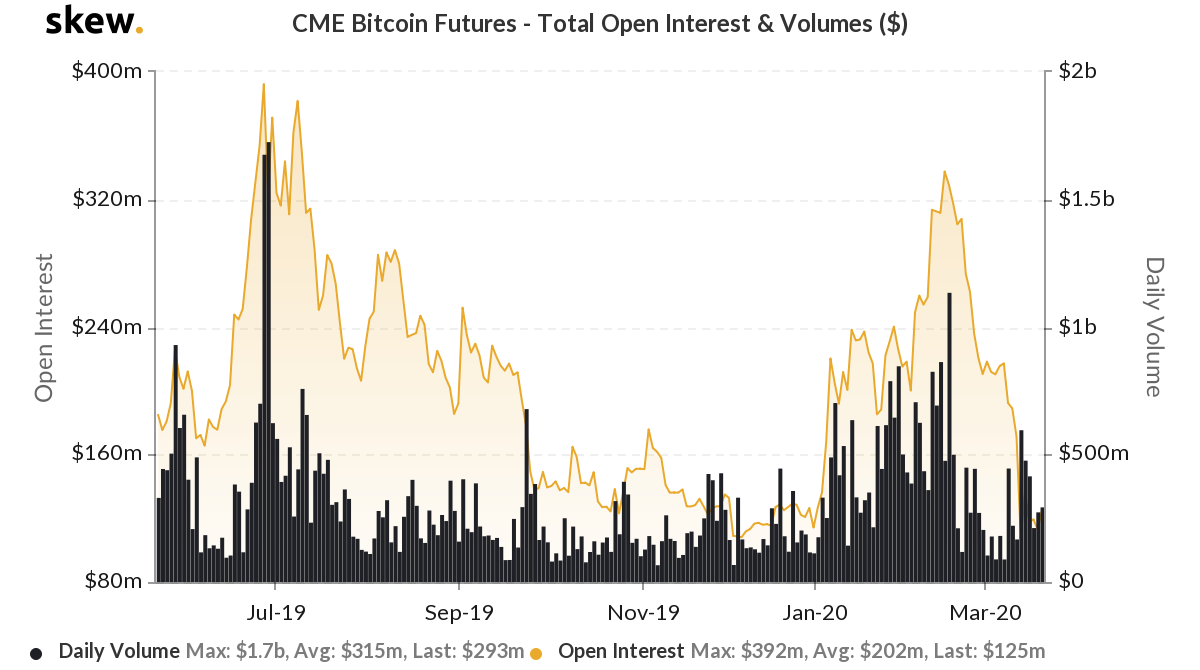

With Open Interest hitting a low, last seen in January 2019, the CME gap and the convergence have brewed a perfect storm for the next rally. The icing on this anticipated cake aka the rally is the end of the first quarter for Bitcoin, a period that has a history of being in the red. Hence, the start of April will considerably improve the price of Bitcoin.