Bitcoin, Gold uncorrelated while major U.S assets collapse amidst global chaos

Bitcoin has long been touted as an uncorrelated asset and surely enough, it has measured up to that narrative. The same can be said of gold. As major assets across the world feel the heat of chaos, Bitcoin and gold remain unaffected.

Since the start of 2020, there has been a continuous stream of events that have affected global harmony. The jinx flowed from 2019’s Amazon forest fire into the COVID pandemic of 2020, with many in between.

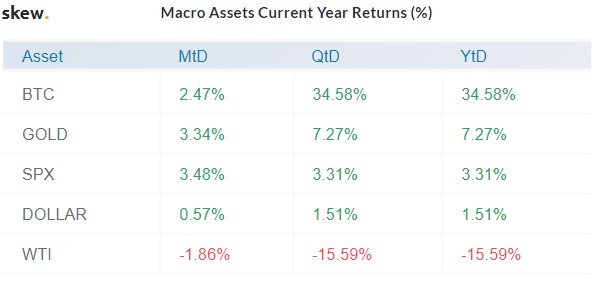

Trending in the low $6,800 regions, Bitcoin has climbed up to $10,500 since the start of 2020. Its year-to-date RoI is just above 34% as it currently hovers around the $9,700 level. Gold has surprisingly reached a high last seen 7 years ago with a YTD growth of 11.51%.

Unlike Bitcoin and gold, the same cannot be said of other assets like the S&P 500, DJI, US 10Y Rates, etc., as they fall short when compared to Bitcoin or gold.

Source: Skew

Bitcoin v. Other assets

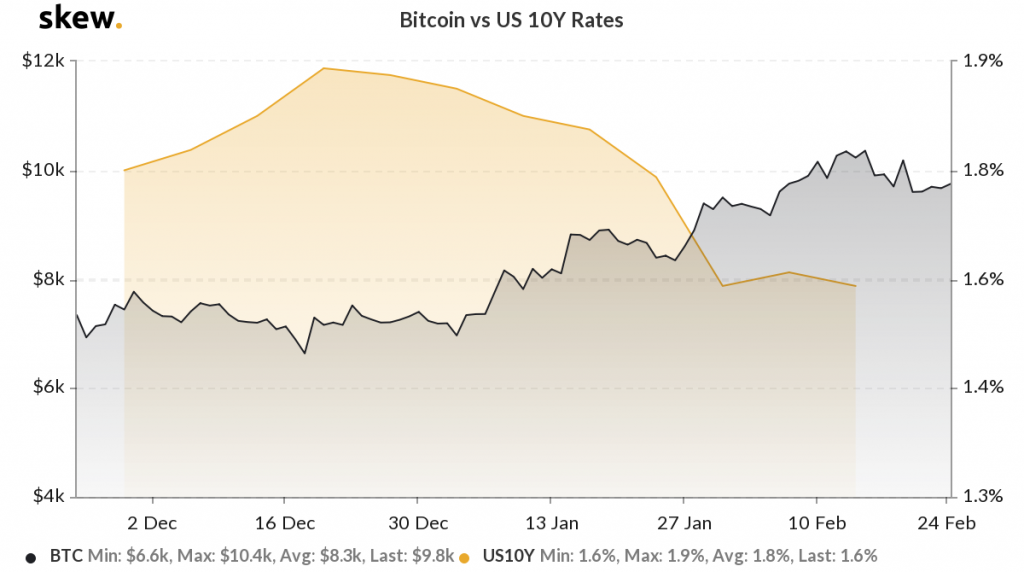

Source: Skew

There is a clear divergence between BTC and S&P 500 price, something that developed over the last week. As Bitcoin’s price rises slowly, the S&P’s collapses.

Source: Skew

For US 10Y rates, the same divergence started in December 2019. However, since the start of 2020, the US 10Y rates have collapsed from 1.9% to 1.6%. Bitcoin, over the same time duration, has increased by 34%. Even Dow Jones Industrial aka DJI’s YTD RoI is at 1.18%, struggling to stay afloat.

Uncorrelated Asset

Bitcoin is uncorrelated to many assets mainly due to its recent introduction, despite the fact that it has a lifespan of about a decade and it has grown exponentially since. Even with its popularity blast, Bitcoin has not been adopted widely as a currency due to its inherent drawbacks. However, as an instrument for store of value [SoV], it is being widely used.

This also explains why, even with the global pandemic scare hanging over the head, Bitcoin has managed to remain unaffected. According to Matthew Graham, CEO of Sino Global Capital,

“We are not convinced the opening of the Chinese market will have any substantial or direct impact (on Bitcoin or cryptocurrencies)… However, in our view, the increasing maturity of the sector will inevitably lead to increased correlation with exogenous events.”

Hence, as Bitcoin ages, its correlation with other assets will increase due to people moving in and out of Bitcoin from traditional world assets. As of now, the price of Bitcoin and gold, for most events, remains unaffected and it continues to grow strong.