Zuckerberg reminds Congress that Libra has not forgotten the US Dollar

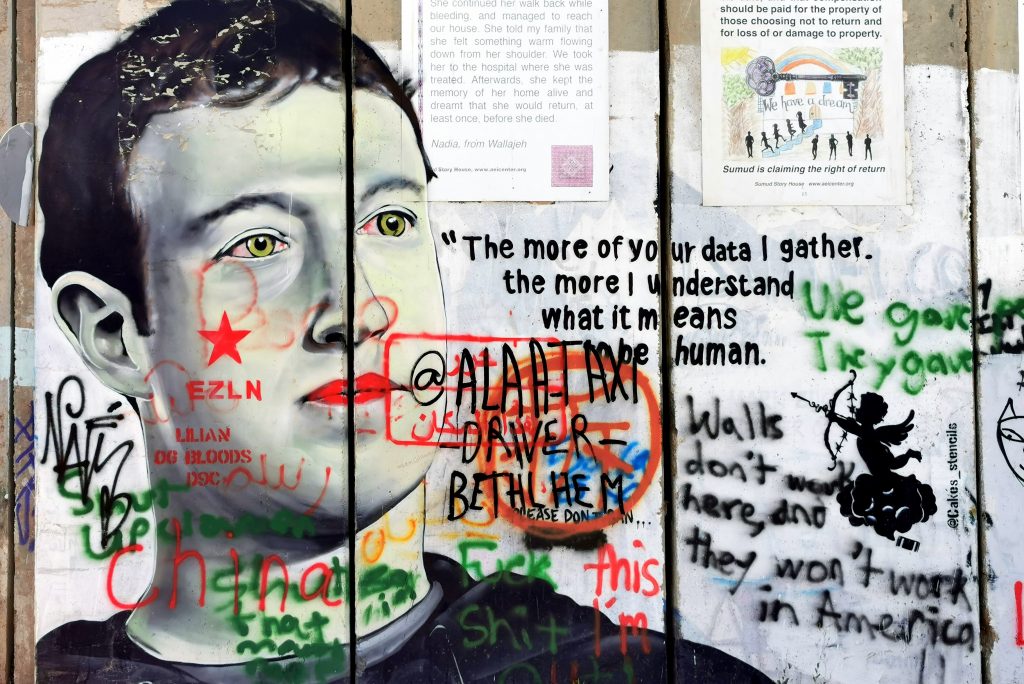

Finally, after four months of Facebook unveiling its payments move to disrupt the world economy as we know it, CEO Mark Zuckerberg stepped into the ring. Libra was the centre of attention in Washington D.C. during Zuckerberg’s October 23 testimony before the U.S House Financial Services Committee. However, members of Congress didn’t miss any opportunity to take a shot at Facebook.

The testimony, in fairness, seemed more like a government-sanctioned roasting of the pale-faced Menlo Park resident, than a means to gather information on Facebook’s digital currency project. Despite the focus being Libra and its effect on privacy, monetary policy, and financial regulations, the representatives veered towards election meddling, civil rights, sex trafficking and a host of other issues.

Facebook, it would seem, stole Libra’s limelight once again.

In the clutter of Facebook’s past grievances, some members of the U.S Congress focused on the issue at hand – Libra. One of them was Blaine Luetkemeyer, a Republican congressman from the state of Missouri. Focusing his allotted five minutes on one of three pillars of the Libra ecosystem, the congressman questioned Zuckerberg on the topic of the Libra Reserve.

According to the whitepaper, Libra would be backed by fiat currencies and short-term government deposits. However, this proportion would be changed subject to the Libra Association. Reports later emerged that the fiat currencies considered would be the US dollar, the Euro, the Great British pound, the Japanese yen and the Singapore dollar.

Facebook, in response to a letter by Fabio De Masi, a German legislator, stated that the reserve would hold 50 percent USD, 18 percent EUR, 14 percent JPY, 11 percent GBP, and 7 percent USDSGD. Now, it appears, these figures are incorrect.

On asked how it could impact the USD as the reserve currency of the world, Zuckerberg responded that Libra could not stifle the US dollar, but strengthen it globally.

“Because the [Libra] Reserve will be primarily US dollars, I actually think that a project like could be important for extending America’s financial leadership, to the contrary of the risks that are being pointed out.”

Zuckerberg went on the clarify that the Libra Reserve will be “primarily US dollars,” and that previous reports from Facebook that the USD will hold 50 percent weightage are not “fully finalized.”

A major economic concern for regulators worldwide is the ability of the Libra Association to willingly decide the Reserve composition. Meant to create stability and avoid fiat-like value fluctuation, the Association can increase or decrease the fiat currencies and government deposits by the processes of “minting” and “burning.”

This ease of Reserve manipulation, coupled with the widespread retail use of Libra could cause ripple effects on a country’s monetary policy, with Libra essentially dictating the demand for sovereign currencies.

Based on existing economic conditions, Libra has chosen the aforementioned five currencies. However, this could change in the future as global stability shifts. In light of this imminent effect, Luetkemeyer questioned whether the Libra Association would include the Chinese yuan [RMB] in a world where it stays firm, while other currencies weaken. He stated,

“The [Libra] Association could set this and we [the United States] would have nothing about it, and it would be a negative effect on our position.”

Zuckerberg, in response, stated that this proportion change should be something that is looked at “up-front.” Picking at his words and his position very carefully, Zuckerberg speaking as the CEO of Facebook, a mere member of the Libra Association and not the leader, advised regulators to place a restriction on the dollars in the Reserve. His advice read,

“I think, it would be completely reasonable for our regulators to try to impose a restriction that says that it [the Libra Reserve] has to be primarily US dollars.”

While the Facebook CEO has intentionally avoided the attention when it comes to Libra, pushing Calibra’s David Marcus to take the flak, this comment on the Reserve is noteworthy. Zuckerberg’s association with Libra no doubt hurts the latter’s image, but his positioning Libra as an American tool emphasizes the importance the United States and the US dollar will have on the overall functioning of Libra.

Many believed that Libra could even launch outside the perimeter of the United States owing to criticism from Washington, but Zuckerberg reaffirmed the need for US approval, without which Libra would not see the light of day.

The more you peel back the layers, the more you realise that the US dollar is intrinsic to Libra, either by error or by design.