Yes, Ethereum’s falling social volume is good news

According to data recently published by Santiment, the social volume of Ethereum is nearing six-month low levels across social discourse platforms. This would imply that traders are looking for volatility elsewhere to trade.

Ethereum Social Volume vs Price Chart

Source: Santiment

It would appear that ETH’s social volume has been declining since its 2020 peak in mid-August and a subsequently smaller spike in September. However, a closer look at the trend observed in these charts shows that while the observed spike in social volume resulted in a corresponding spike in price, the period just prior to the price rise involved a considerably low level of social mentions.

This confirms the hypothesis that the falling crowd interest is a positive sign for an asset to rebound back to previous highs, given enough time. The strength of this decrease is in fact a bullish sign, as it serves as a counter indicator.

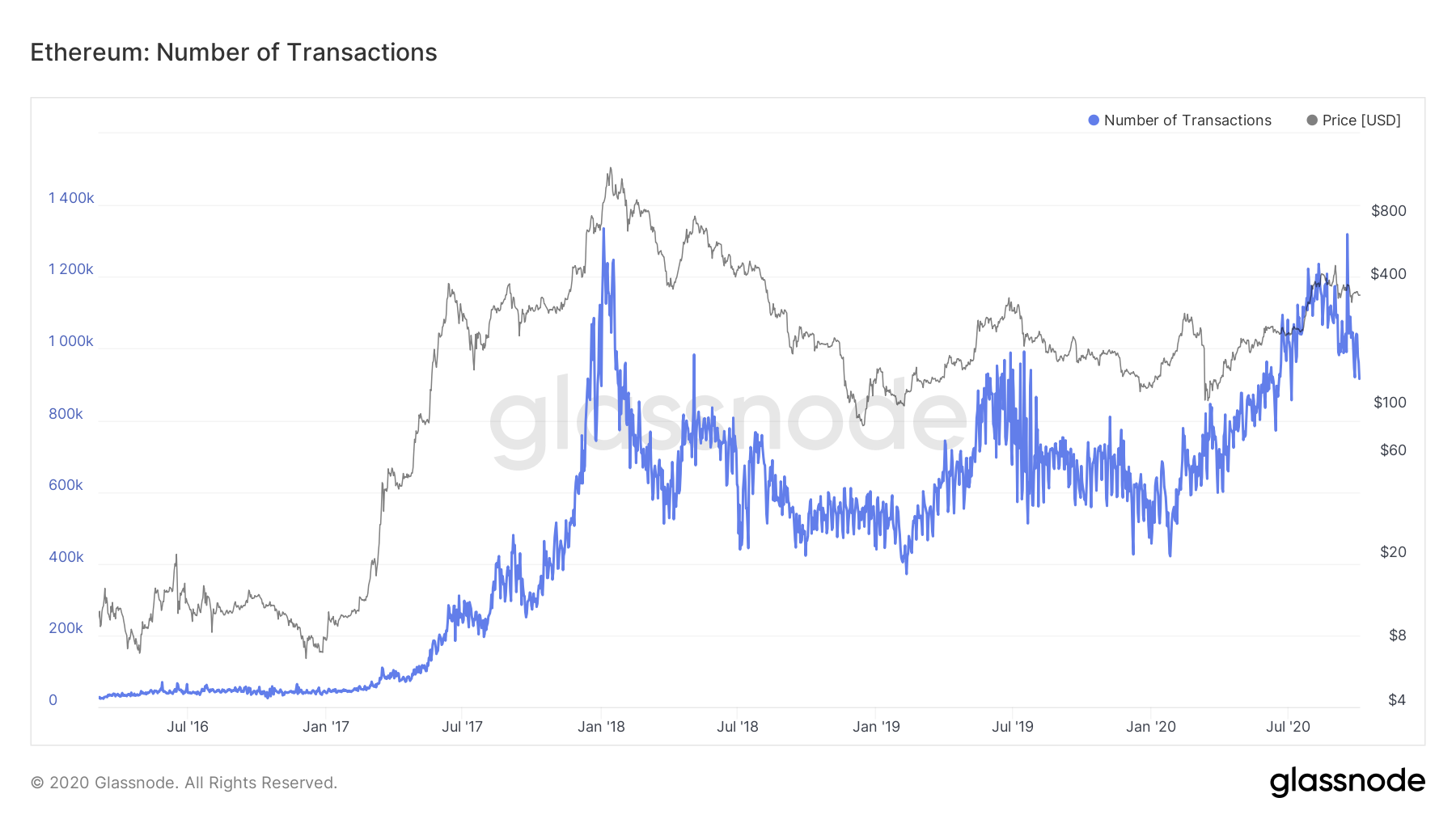

Ethereum Number of Transactions

Source: Glassnode

Additionally, the number of daily transactions seems to have continuously increased and is presently at levels close to its all-time high. In the wake of several important developments for Ethereum, with its record-high gas fees and announcements around ETH 2.0, this strong level of on-chain network activity is a positive indicator for the cryptocurrency.

As it trades around mid $350 levels, at the time of writing, ETH has demonstrated its ability to maintain its price in and around this level. While its short-term price may move in tandem with BTC, which is significantly correlated with it, the bullish indicator of lowered social volume may indicate that an uptrend in price is approaching.