Will Bitcoin be the go-to asset during the incoming stagflation?

Bitcoin has been termed as many things, an uncorrelated asset, diversification for portfolios, a bubble, etc. However, with the Coronavirus pandemic still affecting world markets, the narrative has evolved yet again. The sudden halt of supply chains and industries has caused irreparable damage to the economy of most countries. In India, Reserve Bank of India reiterated that the GDP is expected to be in the negative.

As this continues, the fear of stagflation is growing; stagflation is when the economic output is decreasing while there is an increase in inflation.

With bitcoin hitting $12,000 recently, the hype around the bull run is building up. Hence, it is appropriate to discuss if bitcoin will be able to handle the stagflation needs for institutional investors looking to diversify their portfolios.

As mentioned in the previous article, VacnEck’s experiments with diversification showed that small addition of bitcoin to the 60% equity, 40% bond portfolio yielded in reduction of volatility. This is important as combining bitcoin’s low correlation with traditional markets shows that during the times of sell-off, bitcoin will help reduce losses.

During recession or inflation, gold has always been the go-to and the oldest asset with a steady return. However, considering bitcoin’s relatively higher correlation with it shows that bitcoin and gold can both be used to help against the incoming stagflation.

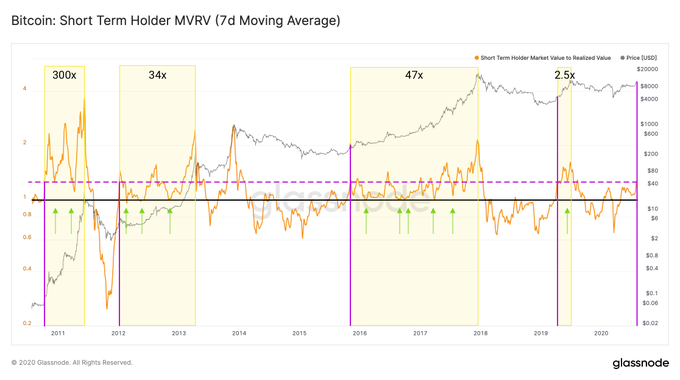

Additionally, Glassnode’s Reserve Risk indicator showed bitcoin in the green zone [a zone of low risk and high reward]. The low correlation with the traditional market and the Glassnode indicator showed that it is the best time to invest in bitcoin.

Source: Glassnode

Bitcoin has been hinting toward the start of a new bull run, especially with MVRV indicator hitting 1.25 level. Breaching the $12,000 level would set the price up to hit $15,000 and perhaps soon the $20,000 level, the ATH, which will kick start the bull run.