Why most traders are Hodling Bitcoin at this price

The common notion among traders is to buy the dip, however, even at the current price, retail traders are HODLing. Based on on-chain analysis from CoinMarketCap, currently 95% HODLers are profitable and despite this Bitcoin accumulation is ongoing.

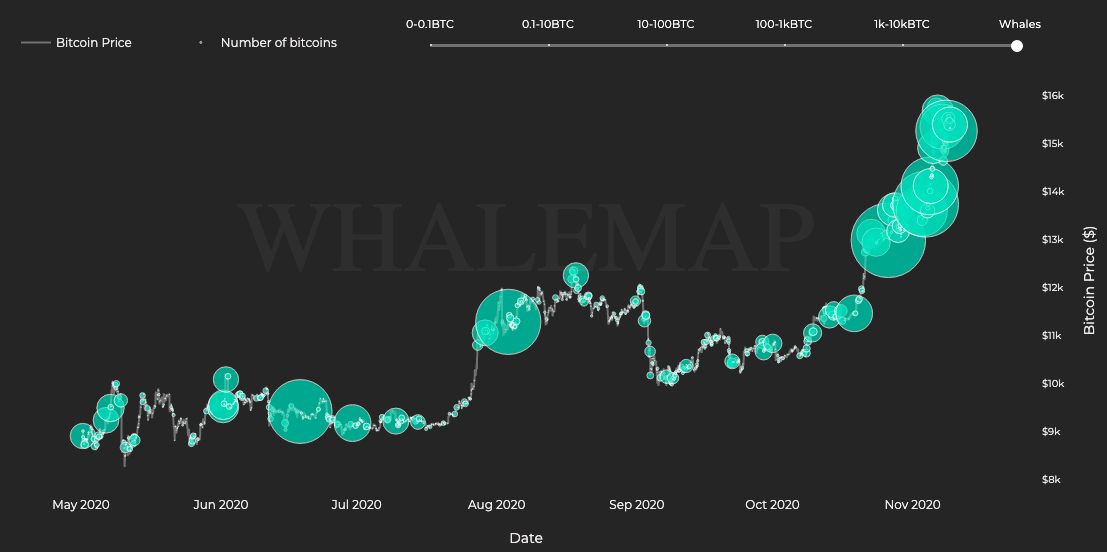

Map of unspent BTC || Source: Whalemaps

The above data from Whalemaps suggests that the Bitcoins accumulated above $12000 are still unspent. HODLers are waiting for the price to hit a new ATH before they increase selling pressure on spot exchanges.

Currently, the market is experiencing a supply shortage. It is driving demand and prices upwards. The virtual buy wall that was created in the order books of spot exchanges, is appealing to the retail investor, as that drives prices up faster. HODLing Bitcoin that was purchased above $12000 would mean, selling at a higher price could result in a higher profit margin. Besides, the shortage is key to the mass HODLing phenomenon that is taking place.

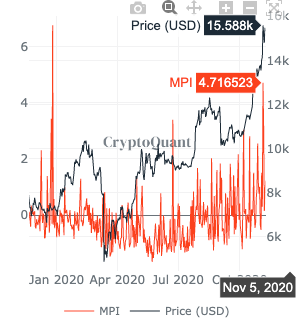

Miner’s Position Index || Source: Cryptoquant

Retail HODLers are accompanied by miners, until recently. MPI has consistently stayed below 2 for most of October 2020, however on November 5, 2020 it hit 4.71. When MPI is above 2, it is considered that there is selling pressure and 4.71 is nearly twice that number. Miner inflow to exchanges nearly doubled in a single day, however, there was enough new demand generated on these exchanges to absorb the supply.

This demand and increase in the number of active Bitcoin wallet addresses may possibly be supporting the supply shortage narrative.

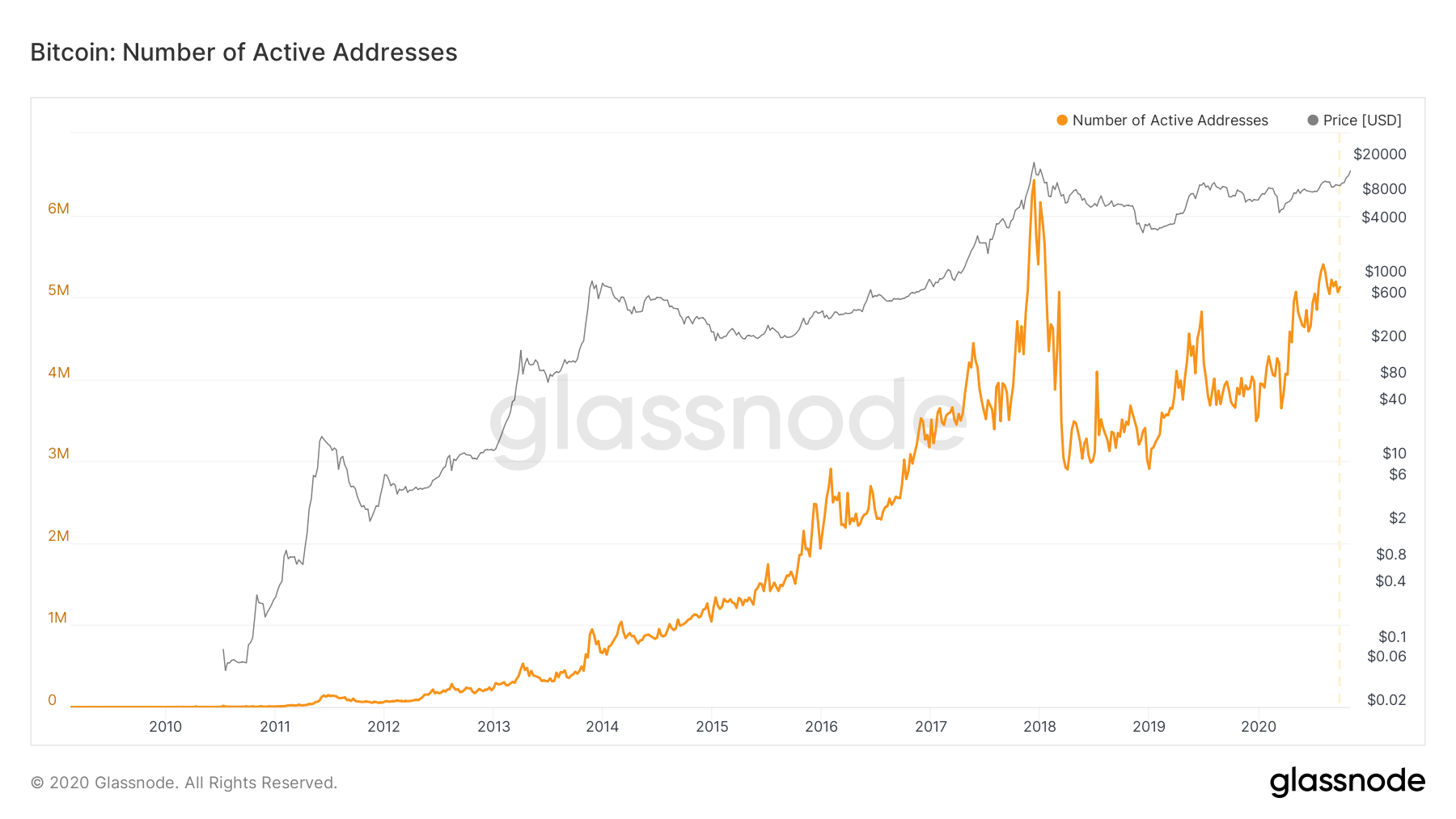

Bitcoin active addresses || Source: Glassnode

Retail traders need to keep an eye on the active addresses as of late, MPI this has emerged as a reliable indicator of market events. In the past 24 hours, active addresses went up by over 5%. New demand being generated at this pace may be able to tackle the supply from Miners and continue fueling the supply shortage narrative.

With increasing institutional interest and key influencers like Nouriel Roubini’s recognition of Bitcoin as a probable store of value, and Bitcoin’s response to the vaccine against Gold has reinstated faith from institutions. Despite corrections in the price rally, the QoQ returns have not failed to impress those skeptical of adding Bitcoin to their portfolio.

For retail traders, HODLing at $15.2k may drive prices higher, however, booking unrealized profits in steps would ensure that they are profitable and don’t lose out on rewarding altcoin and DeFi projects along the way.