When can we expect a Bitcoin correction?

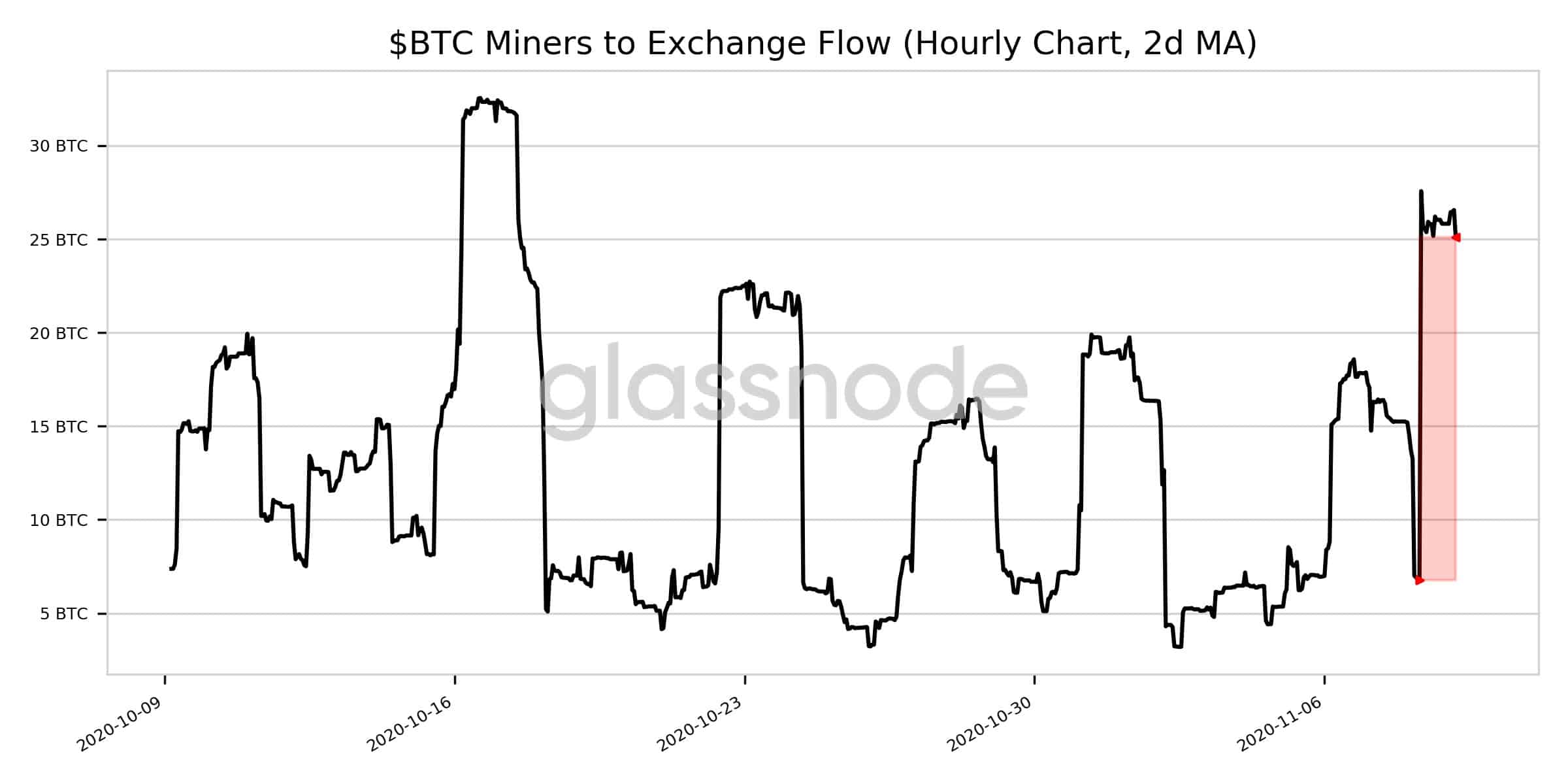

With recent announcements of the COVID-19 vaccine, new momentum was unleashed for Bitcoin on spot exchanges. Gold took a hit, and the increasing BTC-Gold correlation spread was a relief for most retail and institutional traders. New demand for BTC was generated, as the news spread and to meet this demand, miners flow to exchanges has increased. Currently, it is nearly 25 BTC an hour, up from 6 BTC a day ago. This is a four-fold increase and it has got retail traders worried that BTC may crash in the short-run.

BTC Miners to Exchange Flow || Source: Glassnode

Though supply from miners has increased, this may not be sufficient to increase sell-side pressure on spot exchanges. There is new demand being generated nearly every day and this demand may be absorbed by increasing supply from miners.

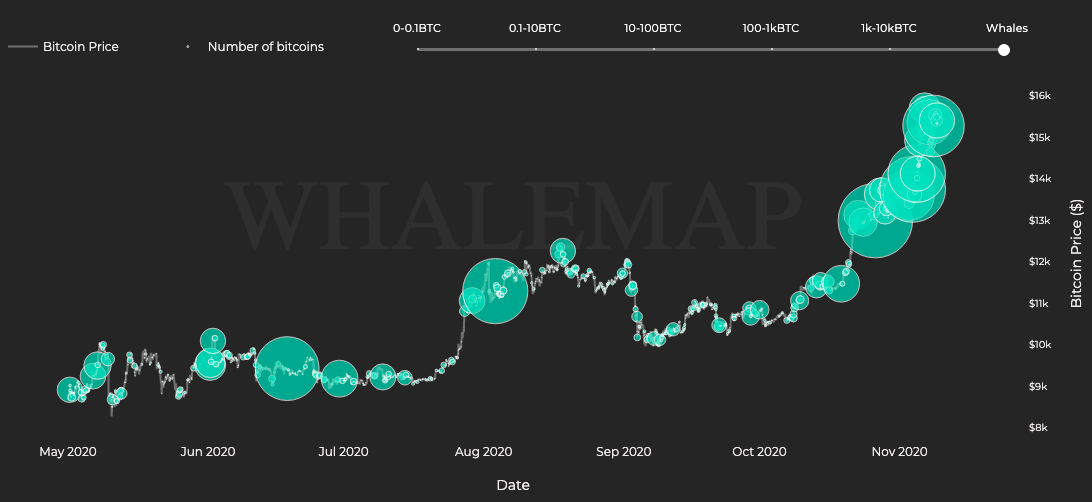

Besides that, in the current price rally, whales and institutions are playing a bigger role than retail traders and miners. This is why their movements in the market are significant. Whales started accumulating above $12900 and are still accumulating at $15300.

BTC Accumulation by Whales || Source: Whalemaps

The fact that institutions are buying right now, is possibly reassuring for the retail trader as this signals there is a low possibility of a price drop at the current level. Before accumulating at the current price level, institutional traders accumulated above $10000.

Though Bitcoin miners are arguably the most vital part of the entire BTC ecosystem, whales are playing an equally crucial role. Especially 6 months post halving, in the current phase the accumulation of Bitcoin in cold storage wallets, despite 97% wallets being profitable is critical to the price rally. The fear of a correction in the short run, may not be well-founded. To shed more light on this, consider the fact that in Q3 Square sold more Bitcoin (160,000), than what was mined. Square’s Bitcoin was nearly two times that of the mined Bitcoin.

This information is critical for retail traders, to get clarity on the who’s who of the bull run. Though an increase in selling pressure from miners signals that BTC’s price is inclined to suffer, there is no correction in sight due to accumulation by whales. A similar scenario, with a bigger impact, may occur when institutions empty their Bitcoin bags.