UAE bank to use RippleNet to enhance remittance footprint throughout the Philippines

RAKBANK, a retail and business bank in the UAE, has partnered with BDO Unibank, a full-service universal bank in the Philippines, with a plan to enhance its current remittance footprint in the Philippines, according to a report. RAKBANK had previously joined RippleNet to power instant cross-border payments to India’s Axis Bank beneficiaries, way back in 2017.

This partnership will enable customers to transfer money instantly, and in a secure manner, to any bank within the country, via RippleNet using RAKBANK’s transfer services [RMT].

Commenting on the move, Peter England, RAKBANK’s CEO stated,

“We, at RAKBANK are committed to increasing our international remittance footprint and are delighted to enhance our RMT services into the Philippines, thanks to our partnership with BDO. This partnership aims to offer the Filipino expat community here in the UAE the ability to safely and instantly remit money back home at competitive rates with zero back-end charges and no hidden fees.”

Through RippleNet, BDO Unibank has now become the Philippines’ bridge between the island country and the Gulf, offering banking and financial services to the Filipino expatriate community in the UAE.

Additionally, Ripple’s report on 16 January titled ‘The Growing Remittance Market in Asia-Pacific: 2020 Global Payment Opportunities,’ had noted that the Asia-Pacific (APAC) market is ahead in digitalization as it has improved the process of sending global payments for consumers. It also noted that remittance flows to low and middle-income countries such as the Philippines and Thailand had achieved a record high of $529 billion in 2018 and were expected to reach $550 billion in 2019.

The report further revealed that the Philippines, specifically, is the third-largest remittance-receiving country in the world and with more than 10 million Filipinos working abroad, “there is a massive inflow of remittances from workers sending their earnings home.”

Ripple also released its Q4 2019 XRP Markets report on 22 January, one that spoke about its On-Demand Liquidity (ODL), among other things.

The report noted how over two dozen companies had become customers of ODL since 2019 and hinted about Ripple’s plans for additional corridors across APAC, EMEA, and LATAM for 2020.

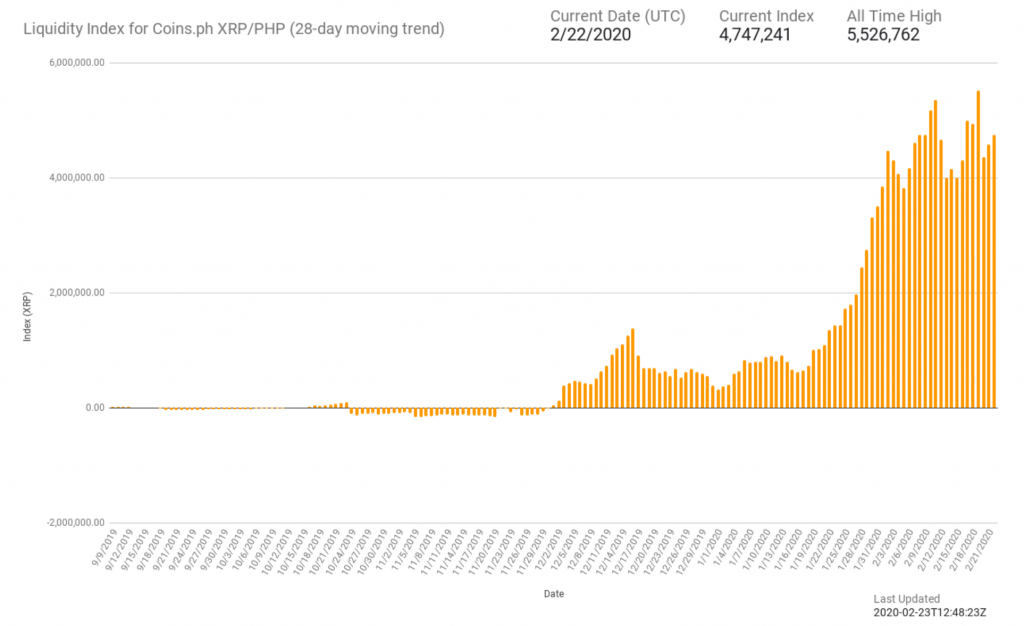

Interestingly, the Liquidity Index on Philippines-based Coin.ph for XRP/PHP has also been on a rise over the past few weeks.

The attached chart released by Liquidity Index Bot shows how the Liquidity Index for Coins.ph XRP/PHP increased over time. The liquidity, which was below 2,000,000 at the start of January, increased drastically and hit an all-time high of 5,526,762 sometime around 18 February. However, it soon fell again and had an index of 4,747,241 on 22 February.