Three reasons why DeFi’s performance will overshadow Bitcoin’s soon

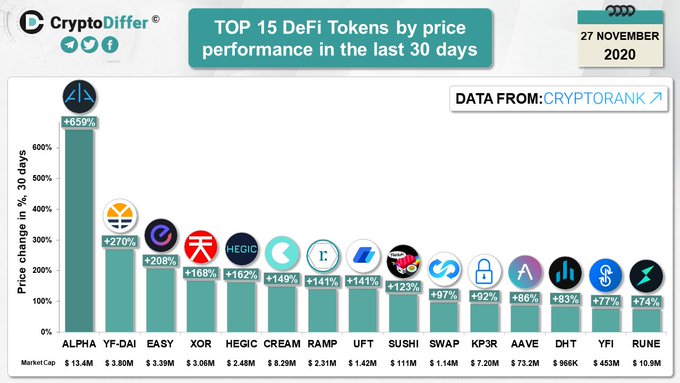

While Bitcoin’s price was rallying on the price charts, DeFi tokens were adding TVL in both BTC and ETH. However, after the price dropped by 8.64%, DeFi’s TVL soon plummeted from $14.35B on 23 November to $12.7B in less than a week. This didn’t mean that DeFi’s rally was over though. In fact, while the top 15 DeFi tokens based on performance included Alpha, Yield Farming DAI, EASY, XOR, and HEGIC, tokens like SUSHI, AAVE, and YFI have offered double-digit returns of over 70%.

Source: Twitter

Apart from double-digit returns, there have been several recent developments in DeFi over the past week, with each of these developments suggesting that the price rally may have just started. Here are some facts,

- Saffron Finance and Barnbirdge are leading the charge in a risk tranch-based category of DeFi investment

- Yearn has announced a merger that takes it a step closer to being a DeFi mega-bank

- Also, DeFi liquidations soared to a record $92M on 27 November 2020 and Compound was the hardest hit

DeFi’s rally has also been supported by its inverse correlation with Bitcoin. Further, despite its high correlation with BTC, ETH’s price has sustained itself above the $500-level, something that could be bullish for DeFi going forward. In fact. Anton Chashchin, Commercial Director at CEX.IO Loan, told AMBCrypto,

“The traditional markets have been considered a safe harbor for investors to build their portfolios and reach their financial goals. But after the COVID-19 outbreak, institutional as well as retail investors have been looking for new solutions to protect their wealth from inflation and decentralized finance (DeFi) has been one of them.”

He added,

“Data from Dune Analytics reveals that since the beginning of October the total value locked in decentralized applications rose nearly 28% to hit a record high of over $14.4 billion. Meanwhile, the number of users shot up by 62% since then to reach nearly 1 million and requests from institutional investors are increasing by roughly $30 million per week.”

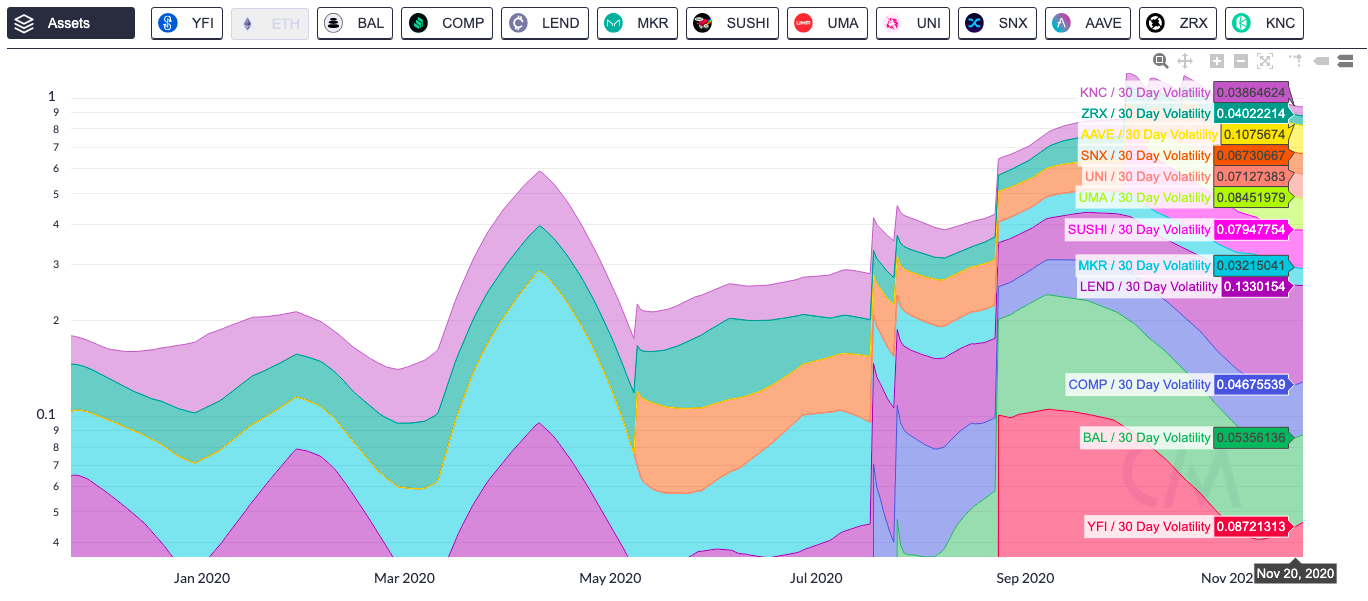

The aforementioned increase in demand and trader interest in DeFi may be another driver behind its double-digit gains. Additionally, it can also be argued that volatility and network momentum drops in Bitcoin’s market may turn heads towards the DeFi space.

The supply shortage narrative may not be enough for Bitcoin’s price rally. Price volatility and network momentum is key to driving the cryptocurrency’s price to its ATH. However, both metrics have dropped of late, based on data from Woobull charts. On the contrary, DeFi may be shifting gears to replace BTC as the top-performing asset in December 2020 in light of all the aforementioned developments, the rapidly increasing volatility, and demand.