Multiple Bitcoin theories arrive at the same conclusion

Bitcoin sliding under $12,000 wasn’t surprising considering the number of failed taps at it. While this retracement is a healthy correction, it is uncertain to accurately predict what might happen in the future. However, there are theories and models that try to do exactly that.

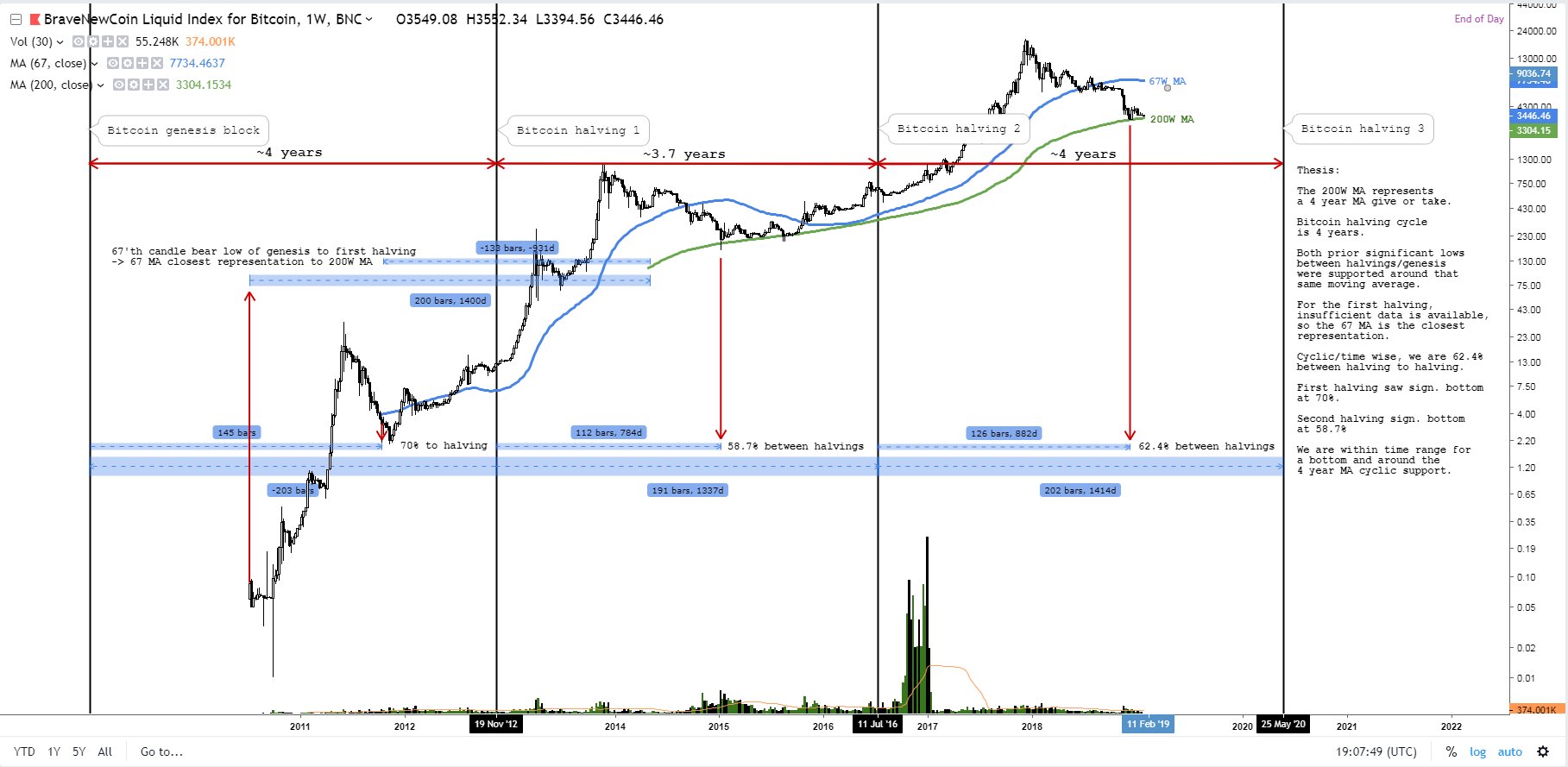

Bitcoin Four-Year Cycle

Source: Twitter

For instance, the “four-year cycle theory” states that bitcoin moves in 4-year cycles with 200 weekly moving average acting as a support. The fact that halving occurs once every four years also fuels this theory. It seemed true for a while, however, the bear markets since 2017 seem to prove otherwise

The reason why the four-year cycle theory fails is due to the lengthening bitcoin cycles. The first bitcoin cycle lasted for 400 days, within which, the bull market lasted for 250 days. The second cycle lasted for 1150 days and the third for is on its way and already 623 days have passed.

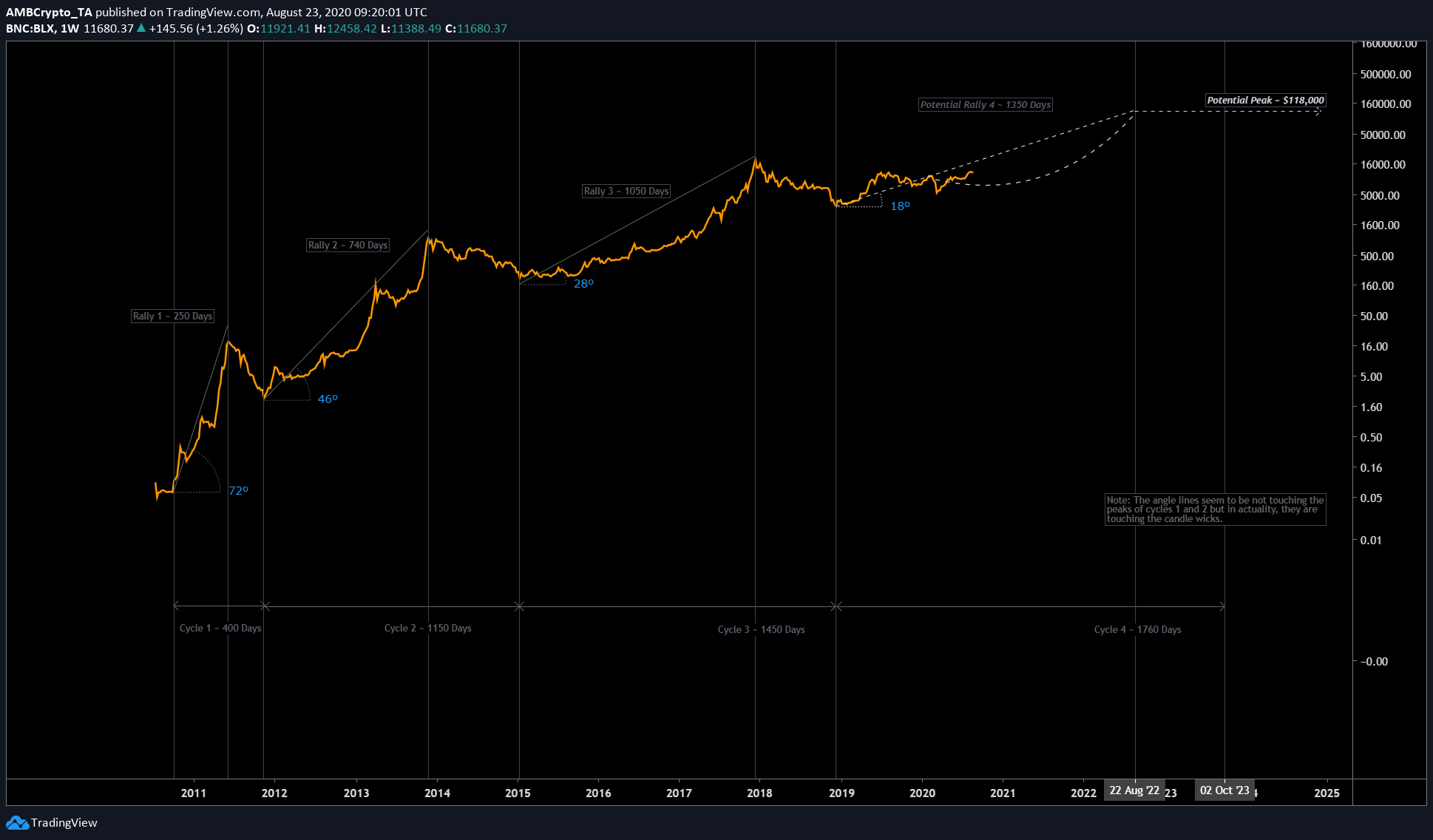

Bitcoin ROI Cycles

BLX TradingView

Based on ROI Cycles the price of bitcoin will hit peak somewhere in late 2022 and estimates the cycle to last 1760 days. That leaves ~730 days for bitcoin to hit its peak.

Coincidentally, this also falls in line with the popular yet controversial PlanB’s S2F ratio model. Both models come to a similar conclusion regarding bitcoin’s top – that 1 bitcoin will be equal to $100,000 by 2022.

A new narrative emerges?

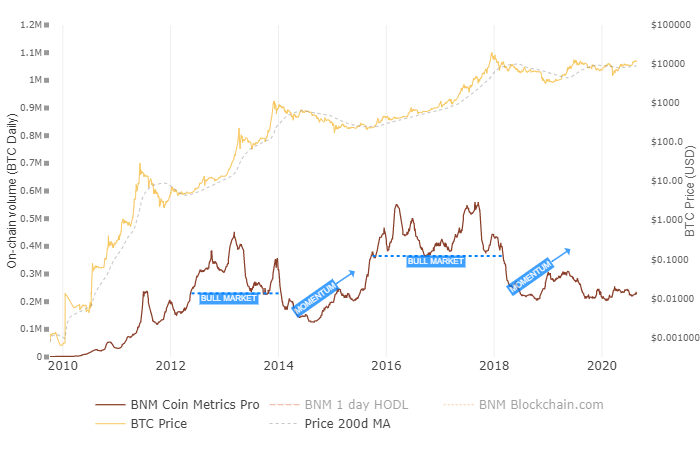

Source: Woobull

Although the four-year cycle can be discredited, ROI cycle theory still needs to be disproved and this will happen only when bitcoin reaches its new peak.

So far, bitcoin has not only held up its narrative for being an uncorrelated asset but also has had a higher ROI than most. In fact, using bitcoin’s network momentum chart, it can be seen that bitcoin is going through an extended momentum phase.

The “extended” bit is understandable considering the extended bear market, which aligns with ROI Cycle theory’s lengthening cycles. However, ‘what will bitcoin do’ is still the question. A fascinating observation is that most of the models and predictions point toward the price of bitcoin in six figures.