Litecoin exhibits trend reversal with possible breach of $66

Litecoin’s valuation faced the brunt of the bearish sentiment over the past two weeks as its price dropped below $60. With the collective market trying to recover, LTC registered a hike of 3.01 percent of the past 24-hours. The market cap remained under $3.89 billion but LTC continued to exhibit higher trading volume with over $5.04 billion over the past day.

Litecoin 1-hour

LTC/USD on Trading View

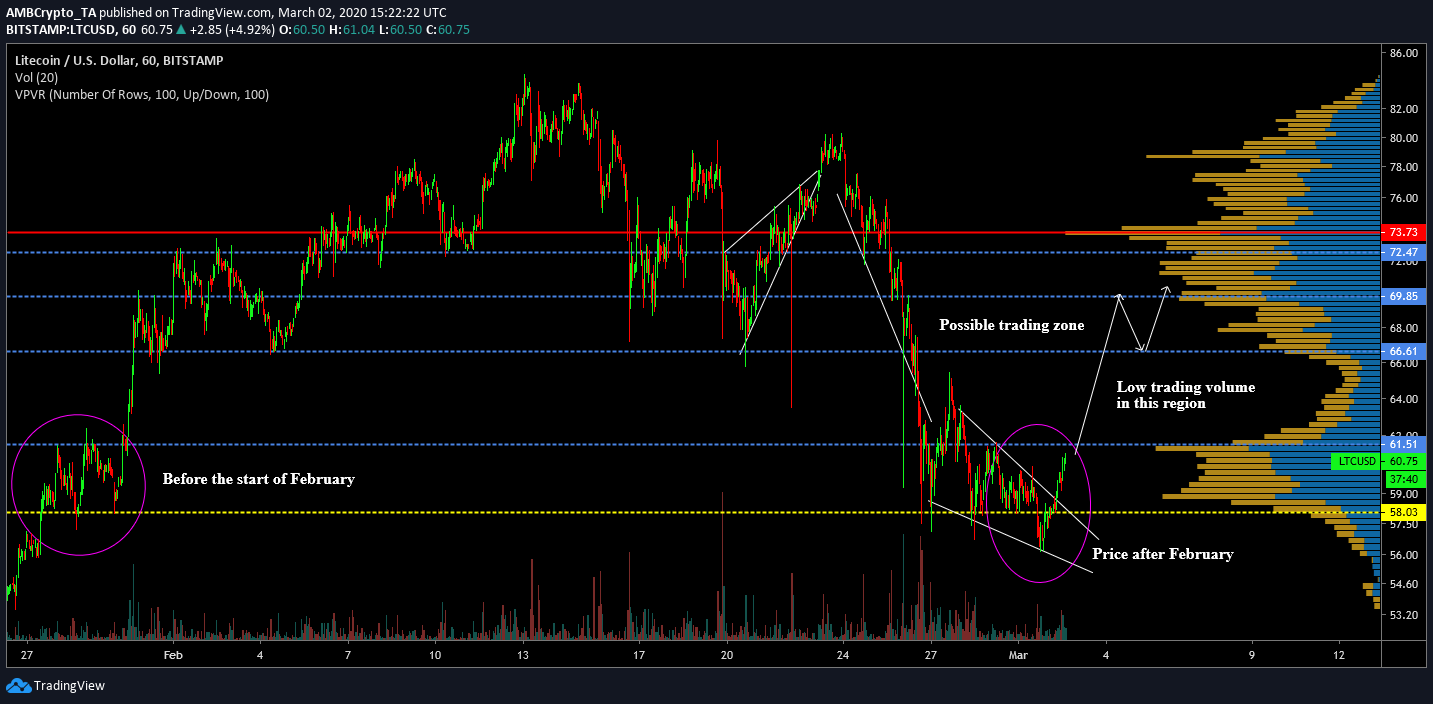

On analyzing Litecoin’s short-term chart, it can be identified that the asset lost all its positive gains that were accumulated during the first two weeks of the month. Although Litecoin indicated a surge between 20th and 22nd February, the price broke out from a rising wedge on 24th and another bearish rally continued till 27th February.

On 1st March at 18:00 UTC, Litecoin witnessed a low price point at $56.35. Since then, the asset has moved above immediate resistance at $58.03.

At press time, Litecoin’s price exhibited the formation of a falling wedge from which a bullish breakout had already panned out. Significant momentum should allow the price to move above the resistance at $61.51.

A breach above the $61.51 may directly allow Litecoin to attain consolidation above $66.61. According to VPVR indicator, the trading volume between $61 and $66.61 has been extremely low over the past 1 month. The indicator also suggested that trading activity at resistance $69.35 was substantial which validated its strength.

Assuming Litecoin is able to breach past the aforementioned resistances, the coin should consolidate between $66 and $69 for a couple of days before scaling above $70.

LTC/USD on Trading View

The momentum remained bullish according to the MACD indicator where the MACD line hovered over the signal line. However, the Relative Strength Index or RSI approached the over-bought section at press time, and historically the indicator has retraced its steps after testing the 70-mark line.

Conclusion

Litecoin’s recovery over the short-term seems likely as indicators reciprocate bullish traits at the moment. Over the next week, the asset should be able to facilitate consolidation above $70, considering bullish momentum is carried forward without unexpected hiccups.