ICON, Digibyte, Monero Price: Altcoins to tumble after exhaustion of buyers

The 80-day relative performances of privacy coin Monero, Icon, and Digitbyte showed that ICON aka ICX dominated with a 99% relative surge, while both XMR and DGB were down 11% and 14%, respectively.

Source: TradingView

Monero

Source: XMRUSD on TradingView

Monero, a widely known privacy coin has always been in the news, either for it being mined via malware or for regulation-related problems. In fact, a recent report by Guardicore had revealed that a long-running attack campaign aimed at infecting Windows machines was running MS-SQL servers to mine Monero, among other cryptos.

Monero was once one of the top-ranked cryptocurrencies on CoinMarketCap. However, at press time, XMR was ranked 12th with a market cap of $892 million, while recording a 5.75% price surge over the last 24 hours.

As seen in the chart above, the coin was noting a rising wedge pattern with an equally rising OBV indicator, indicating an influx of rising capital in the market. Due to a looming death cross, the price seemed bearish with the target set at $36.66.

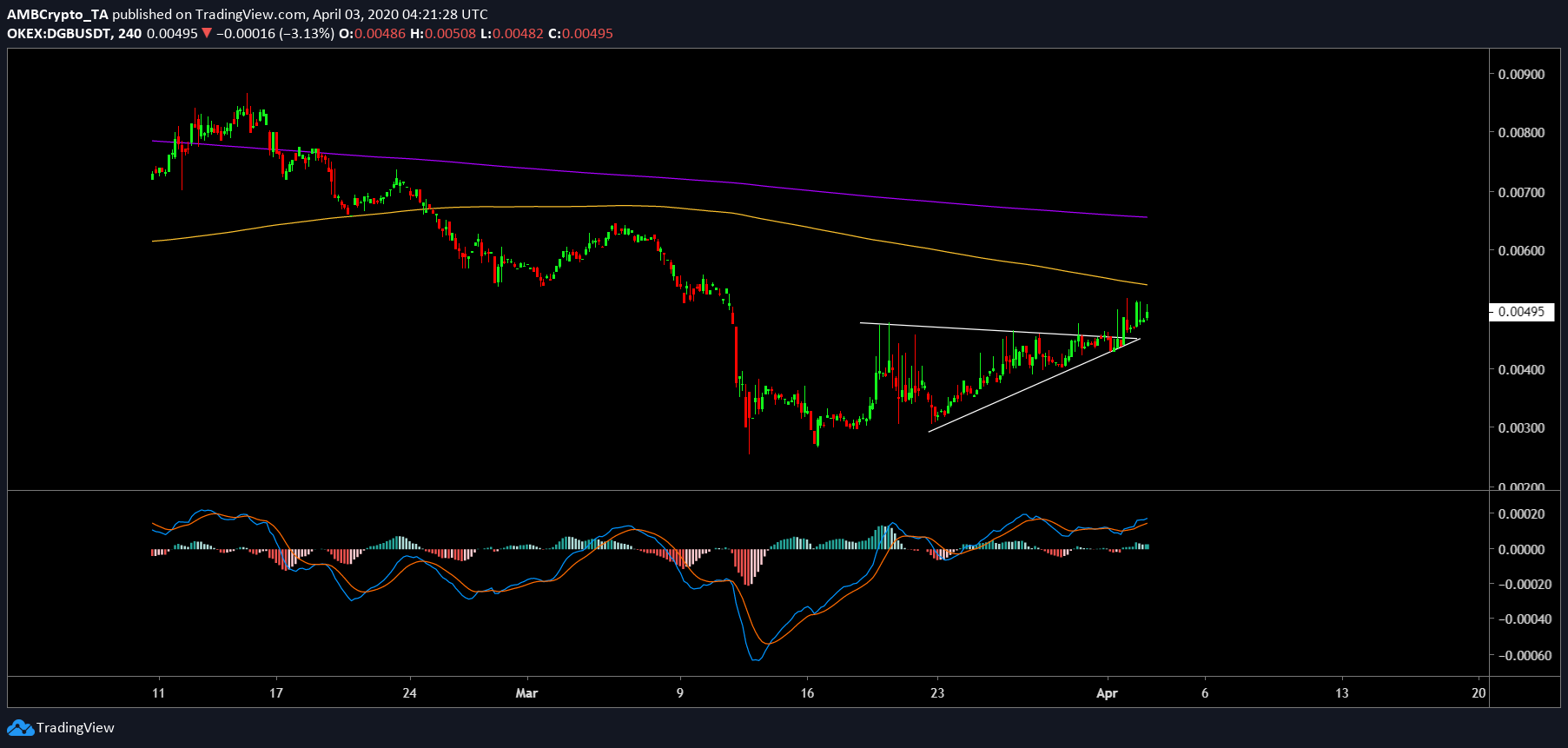

Digitbyte

Source: DGBUSDT TradingView

At the time of writing, Digibyte had broken out of its ascending triangle in a bullish surge. The bullishness of the coin might soon come to an end with the price coming close to the 50-DMA [yellow]. As the 67th largest cryptocurrency with only $56 million in market cap, there is a chance for its price to dip even lower after the breakout from the ascending triangle.

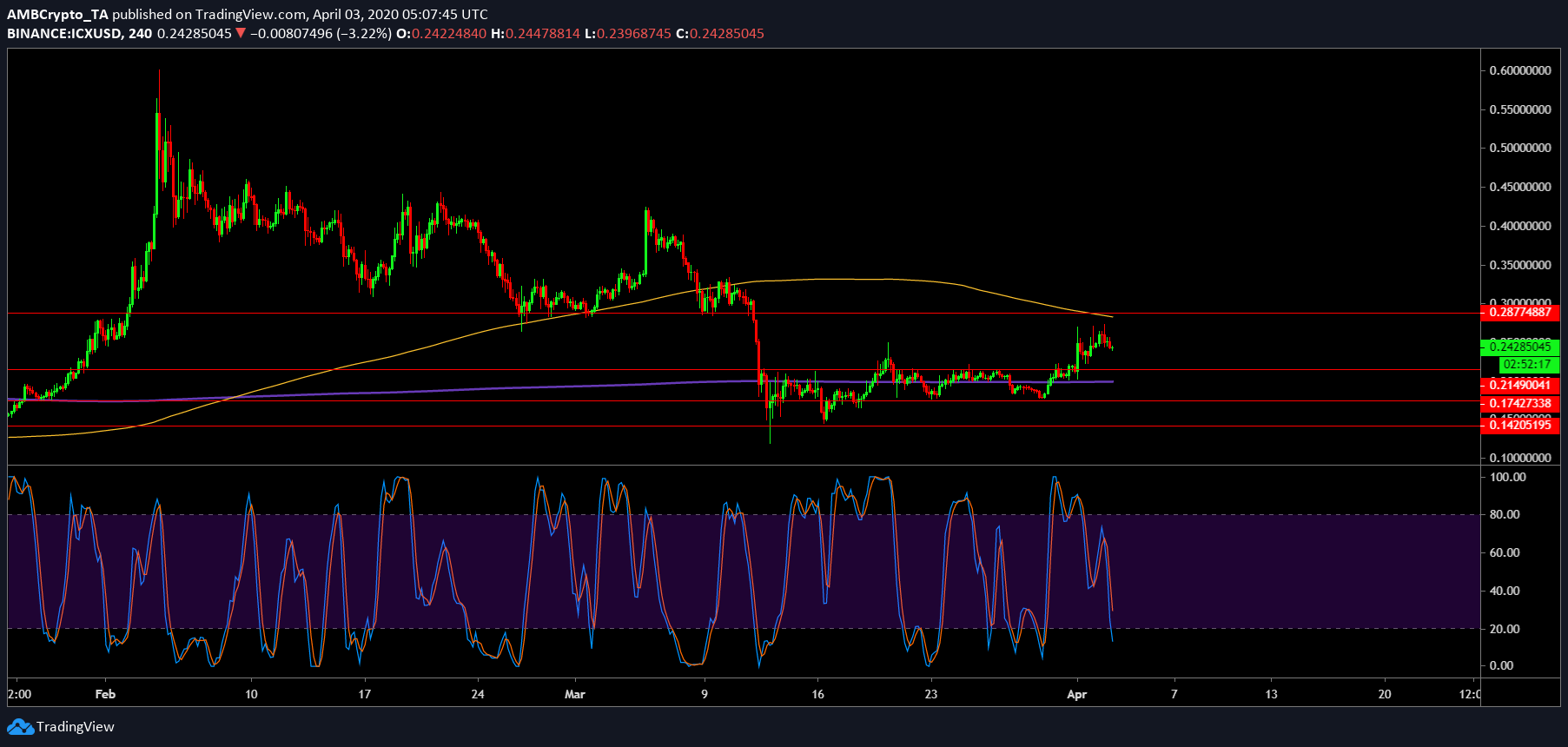

ICON

Source: ICXUSD TradingView

ICX had breached the 200 DMA [purple] successfully on 01 April after playing coy with it since 13 March. However, after a recent surge above it, the price was recorded to be at $0.2431, with the token having a market cap of $101 million and a 24-hour trading volume of $11 million. The recent surge below the 200 DMA could face a retracement [of 9%] as the Stochastic RSI had also performed a bearish cross, indicating re-entry into the oversold zone.