How has Bitcoin investors’ ‘ideology’ evolved since 2016?

Bitcoin’s future is a topic of discussion that has gained relevance and steam over the year. Whether the crypto-asset is undergoing a bullish rally or a bearish correction, based on metrics, fundamentals, or sentiment, speculations predicting the asset’s future have always kept the community on its toes.

One of the key trends that fueled various debates over BTC’s future in the year 2020 is the Hodling activity of users. In fact, previously, it had been reported that certain groups of Hodlers remained extremely optimistic, despite the recent sell-off which resulted in Bitcoin dropping down to $9,150.

Source: Twitter

However, certain crypto-analysts in the space remain certain that present-day investor confidence and hodling behavior in the Bitcoin market will reap benefits for the world’s largest digital asset in the long run.

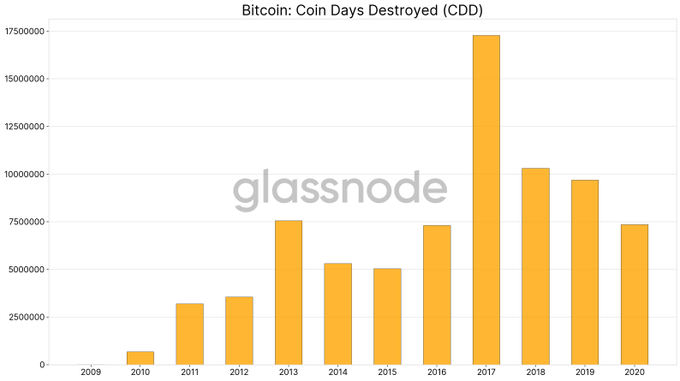

A recent Twitter thread by Rafael Schultze-Kraft, CTO at Glassnode, explained a few of the metrics which expanded on this narrative. Speaking about the hodling activity in the market, Kraft revealed that the average Coin Days Destroyed had fallen over the past 5 years, dating back to 2016.

Coin Days Destroyed or CDD is defined as the transacted Bitcoin volume times the number of days since the coin was last moved. Lower CDD usually is a sign of the presence of long-term hodlers.

Kraft added,

“Similarly, Bitcoin Binary Coin Days Destroyed (= number of days per year in which more coins were destroyed compared to the historic average) has never been as low as in 2020.”

Source: Twitter

Bitcoin’s Reserve Risk levels, at the time of writing, also suggested that the Bitcoin market had an attractive risk/reward ratio for its investors, with a low ratio indicative of higher market confidence.

Long-term hodling; just a change in the type of users?

Now, before we conclude that Bitcoin users have evolved over time, we need to understand the initial functionality of the crypto-asset. Bitcoin had a higher on-chain velocity initially, which meant that the asset was moving off-exchange, as well as being used for acquiring goods and services.

However, with time, the off-chain velocity has taken precedence as the intra-exchange movement became more relevant and people would only transact BTC to either acquire other coins or convert to USDT when the market was down.

In fact, recent research reports clearly indicated that this was a sign of Bitcoin being viewed more from a point of speculation, meaning users were drawn more towards the narrative of improved valuation in the future, rather than its utility aspect at present.

Therefore, rather than users becoming more evolved, it can also be speculated that new users entering the space came from the idea that hodling BTC is more lucrative than spending it on services or goods.

Whether Bitcoin is profitable based on these metrics in the future is yet to be seen, but it is quite possible that the current crop of Bitcoin investors does not share the same ideology as the investors of yesteryears.