Here’s the price impact of regulatory news on bitcoin

Cryptocurrencies, unlike the conventional currencies issued by a monetary authority, are not controlled or regulated by any single jurisdiction. However, national regulations do have a substantial impact on crypto assets. A recent report released by the Federal Reserve Bank of Dallas looked into this.

The report confirmed that cryptocurrencies, especially Bitcoin, have seen significant corrections in price over the years whenever there were new changes in the following categories – anti-money laundering, exchange controls, issuance (securities) regulations, and CBDCs previously.

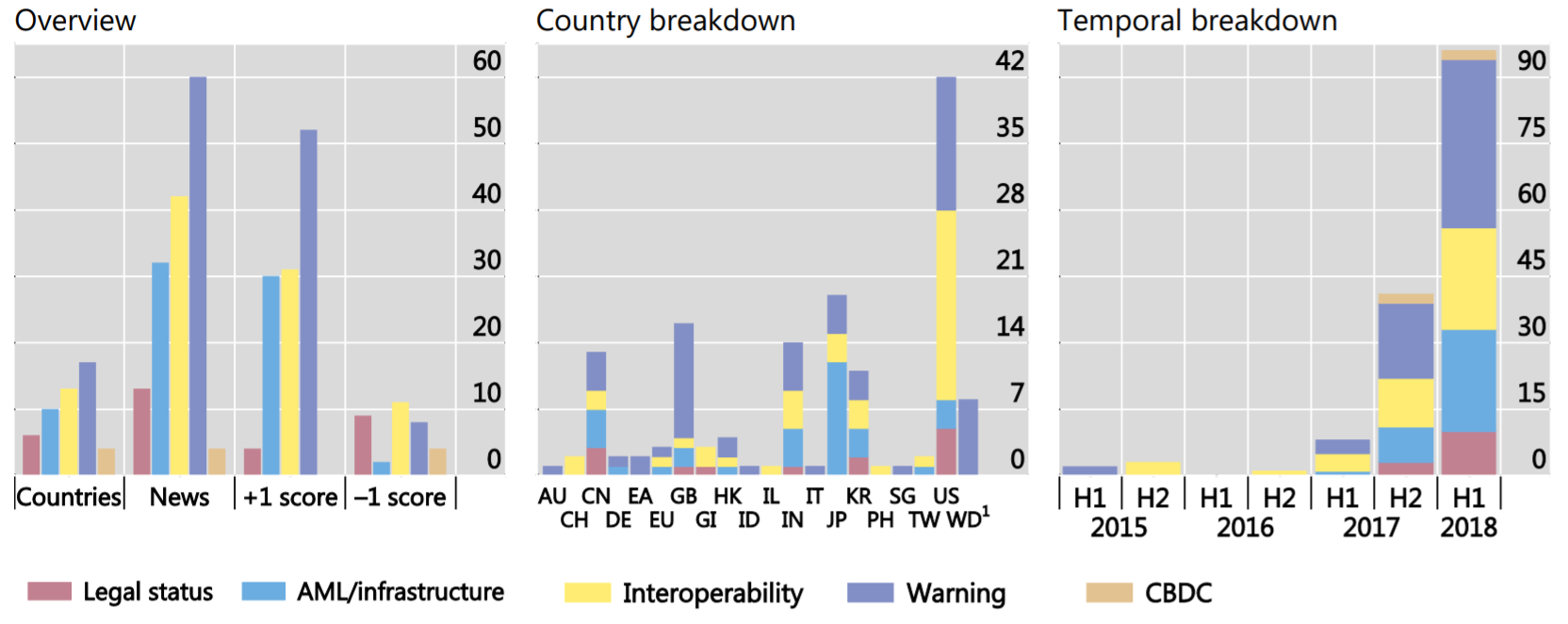

Source: News database on cryptocurrency-related policies, dallasfed

Similarly, another recent study had also echoed a similar opinion. The study analyzed 120 regulation-related news between 2017 and 2018 in the categories mentioned above and estimated the direct effect of each regulatory event on the price of 300 cryptocurrencies.

Interestingly, it was also revealed that news regarding issuance of CBDC resulted in Bitcoin’s price dropping by value by 1.82%. Following the news regarding China’s Digital Yuan being in its final phase, BTC’s price recorded a drop of 6% on April 16.

Source: BTC/USD, TradingView

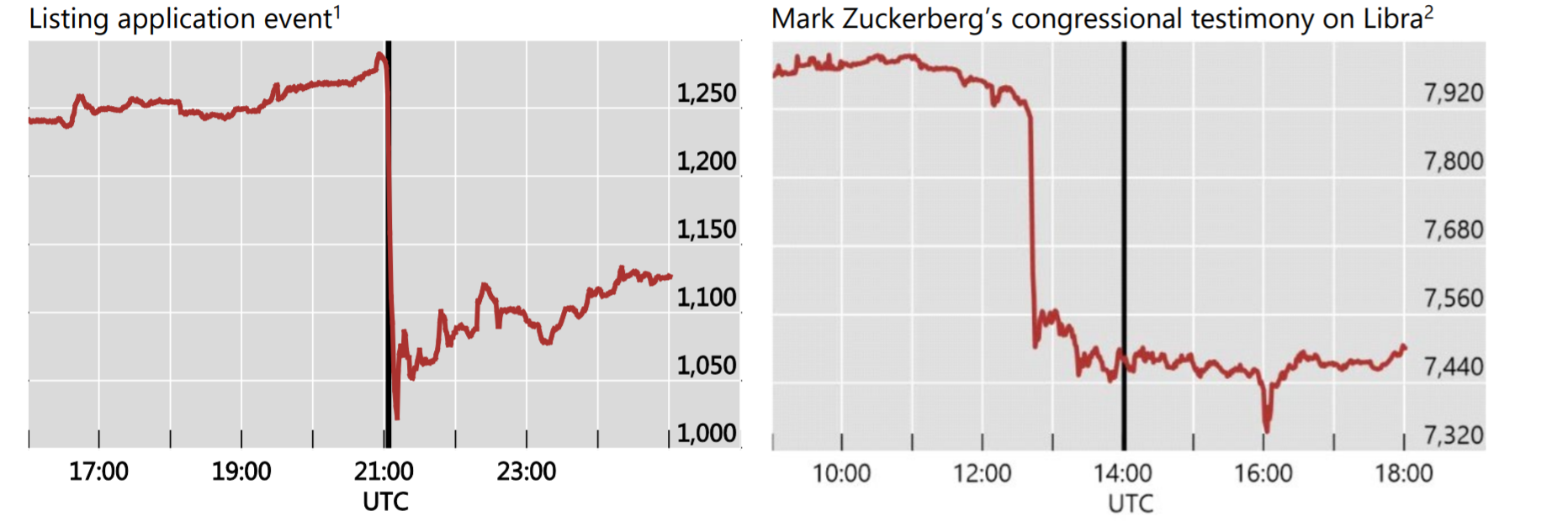

Furthermore, United States Securities and Exchange Commission (SEC) in March 2017 had turned down an ETF for bitcoin. The price of bitcoin dropped by 16%, following the development. Bitcoin saw a considerable price impact post the hearing on Facebook Libra in October 2019. Similarly, the Japanese Financial Services Agency (FSA) had ordered six cryptocurrency exchanges to improve their money laundering procedures. This also resulted in prices tanking significantly in a couple of hours.

Source: Bitcoin intraday price reaction to two news events, dallasfed

The first vertical line indicates the US listing event on 10 March 2017 [left] and the second vertical line indicates the Libra hearing on 23 October 2019[right].

However, the report also found out that the risk concerns and broad value judgments regarding cryptocurrencies publicly expressed by government officials had zero effect on the coins.