Here’s how many Bitcoin is left for retailers to buy

Let’s pick up where MicroStrategy left off – their additional purchase of bitcoin, which leaves them with a total of 40,824 BTC. While this may be bullish for bitcoin and everyone in the ecosystem, we don’t realize what this implies, so, let’s take a look at what this means.

Grayscale

Grayscale Investments has been at the forefront of bringing bitcoin to institutions and retail alike. However, what goes unnoticed by most is the rate at which they are buying BTC.

Jan 2017 – Jan 2018, their BTC holdings increased by 9.87%. The same trend was observed from Jan 2018 to Jan 2019 with a 15.73% growth in holdings. From Jan 2020 to June 2020, the holdings increased by a whopping 89.39% to 536.86K BTC that they hold [not accounting for the first week of December].

Grayscale is gobbling up bitcoin at an unprecedented rate as more institutions realize what the future for the dollar holds.

MicroStrategy

In an interview with CNBC Michael Saylor casually mentioned that it would produce profits in excess of $500 million next year and it would debase by 15-20% if held as cash, which is why he invests it in bitcoin, which provides 100% yearly return. Just from August 2020 to December 2020, Michale Saylor has scooped up a whopping 40,824 BTC, which is approximately 7% of what Grayscale holds.

These two companies are just the ones that are in the news or being talked about widely in the crypto space.

Let’s take a look at the ones that aren’t.

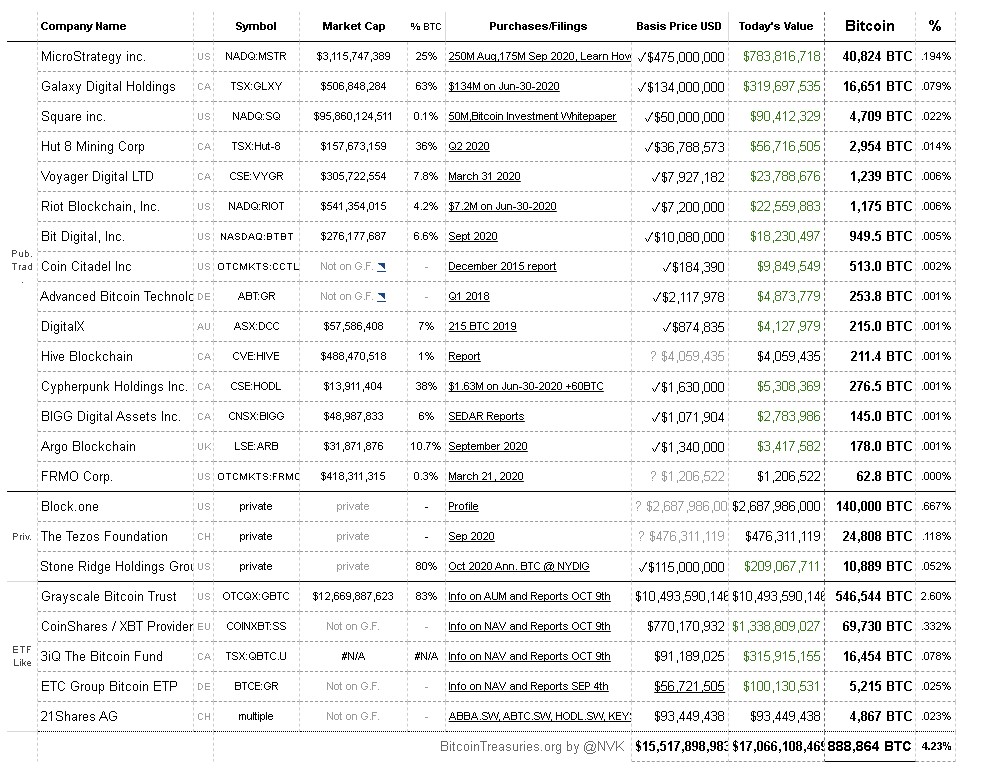

Source: BitcoinTreasuries

As one can see, these companies together hold about 0.888 million BTC or 888K BTC. This number is only going to go up.

The question that should, at this point, come up in is – “Will there be any BTC left for people like you and me, the retail side of the market?”

Let’s take a look at that.

Total BTC supply – 21M

To be mined – 2.434M

Circ. supply – 18.565M

Lost BTC – ~4M

Free float – 14.565M

So, we have approximately 14.565 million BTC circulating in the free market. 6.09% of this is already owned by these institutions, which leaves a total of 13.667M BTC to us retail folk, right?

Well, no!

Let’s try to approximate the bitcoins being held by whales or owned/held solely by exchanges.

There are a total of 15.866M BTC held in wallets containing more than 10 BTC, which are whales [very losely]. However, this includes the lost bitcoins [of 4M]. deducting that, we have 11.866M BTC held by whales/exchanges.

So, 11.866M BTC out of 13.667M BTC is held by either whales or exchanges or both, which leaves about 1.801M BTC readily available and for the taking of retail, institutions, and whales alike.

Although the above is a very vague approximation of numbers by loosely defining whales, exchange supply, etc., this does bring out a portion of the truth if not the whole truth itself, which is bitcoin is scarce.