Here’s how Bitcoin spot, derivatives will do, following the expiry

Bitcoin Options are holding steady, despite Friday’s expiries that amounted to over $1B. As predicted a week ago, the expiry event was a smokescreen. In fact, the outcome was the opposite of the anticipated crash on the CME, with Open Interest and Volumes remaining consistent.

According to data from Skew, $7B worth of contracts expired last month on 28 August 2020, with the Open Interest dropping by 32% in less than a week. Recovery wasn’t complete yet, however, and the price on spot exchanges soon dropped 10% within a week of expiration.

This time around, there has been no drop in price on spot exchanges so far. In fact, Bitcoin’s price has gained by $400 since 24 September. This expiry in question had no negative impact on the price, despite the fact that on-chain metrics continue to project the present Bitcoin market as a bearish one.

Open Interest and trading volume on derivatives exchanges have not recovered yet, and the bearish sentiment is evident. Since there is no drop in price on spot exchanges, will there be a complete recovery to the mid-August level?

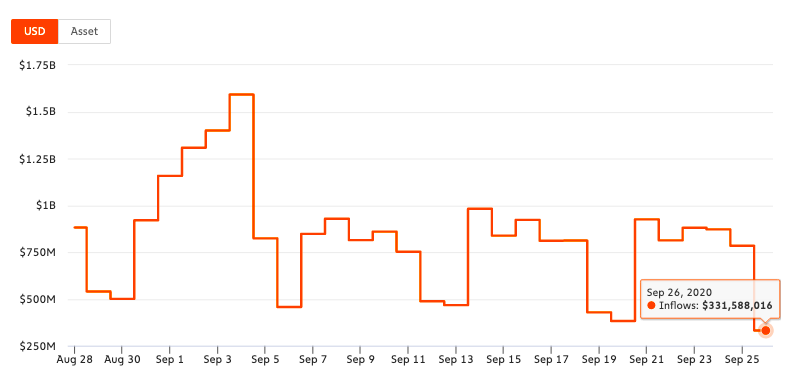

While this may seem unlikely, it may transpire if Bitcoin’s supply to spot exchanges recovers. At the time of writing, the inflows were at its lowest in a month. In fact, 26 September witnessed a huge drop in inflows, a drop of 59% – the biggest drop in 99 days.

Source: Chainalysis

The drop in inflows will keep the supply in check, but demand needs to increase on spot exchanges. Bitcoin is being pulled out of exchange wallets, and demand is getting choked further. However, the price is not very responsive as the volatility and volume being traded is low, compared to other assets in the market like DeFi projects and Ethereum.

Over 5000 BTC was transferred outside exchanges to unknown wallets post the expiry event in three transactions, based on Whale Alert’s updates. While 82% HODLers continue to remain profitable, they have not booked unrealized profits on exchanges. Instead, whales are moving funds outside of exchanges.

Institutional investors’ holdings have dropped by 7-8% in overall value, since their last purchase, and there seems to be a missing piece of the jigsaw here.

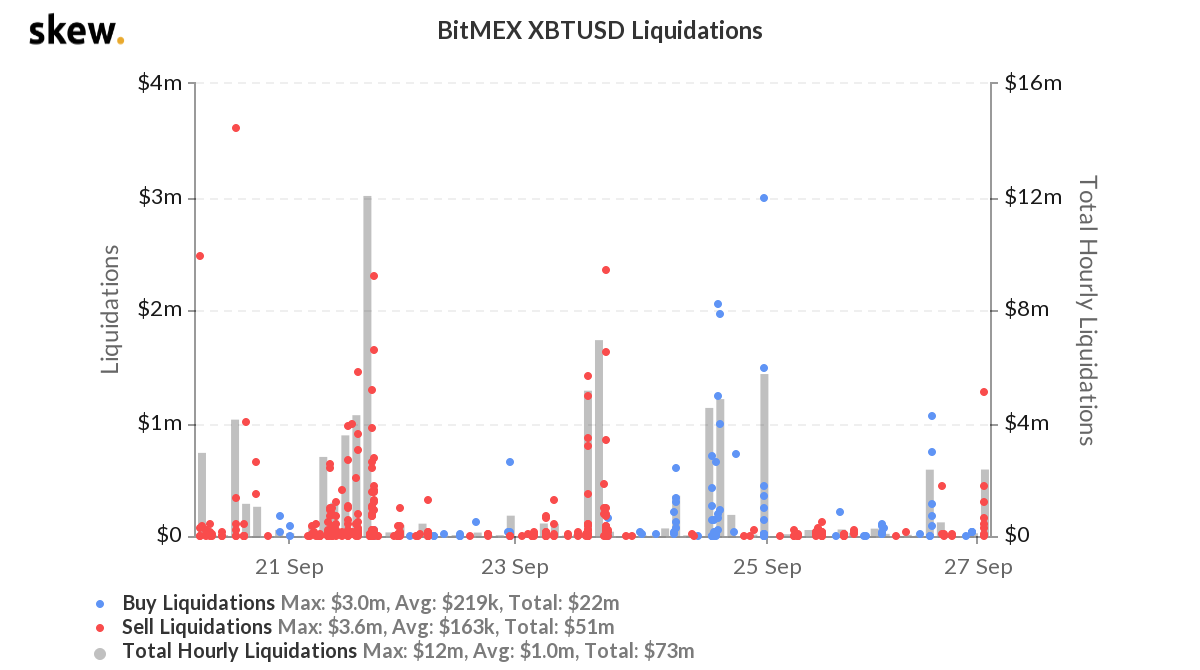

Despite the bearish sentiment, shorts on BitMEX are fueling long contracts and the difference is nearly 2.5x.

Source: Skew

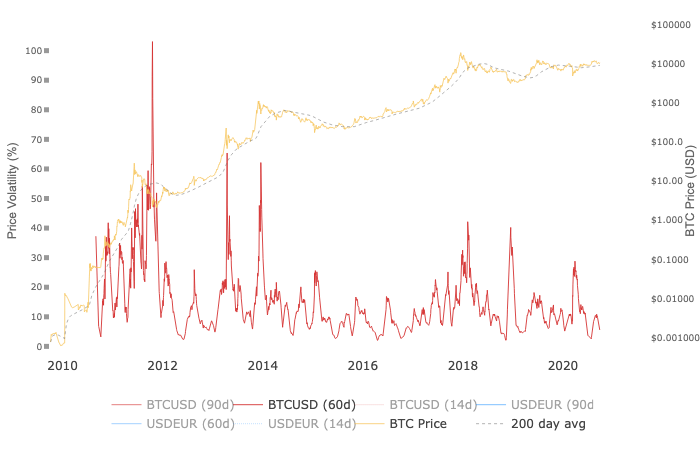

While these inconsistencies in bearish sentiment across spot and derivatives exchanges may point to a rally back to mid-August levels, other factors like low trading volume on both spot and derivatives exchanges indicate the opposite. In fact, according to Willy Woo’s Bitcoin Volatility Chart, 60-day volatility is at 5.55, with the same dropping by over 50% since mid-August.

Source: Woobull Charts

The network volatility is low, and unless it recovers by upwards of 50% in the next few weeks, attaining mid-August levels on Bitcoin spot and derivatives exchanges seems very unlikely.