Grayscale’s Bitcoin Investment Trust records a total cumulative return of over 2000%

Bitcoin recorded a mediocre run over the last two months, a period during which the coin’s price plummeted from its yearly high of $13,800 to below $9500. The initial bullish momentum subsided, with stagnation and sideways movement soon taking over the market. Despite this prolonged misery, the largest virtual asset was still enjoying a lucrative year, when compared to the beginning of 2019.

Alongside Bitcoin, Grayscale’s Bitcoin Trust [GBTC], which acts as a Bitcoin fund exclusively investing in BTC, has also surged significantly since its inception in 2013.

Source: Grayscale

According to Grayscale’s Performance and Risk Monitor report, GBTC boasted a total annualized return of about 84.4 percent, after accounting for the annualized Risk percentage over the same period of time [Inception to March 2019]. Besides Bitcoin, only Grayscale’s ETC trust reported a positive total return of 7 percent, while all other virtual assets reported a negative return percentage.

Source: Grayscale

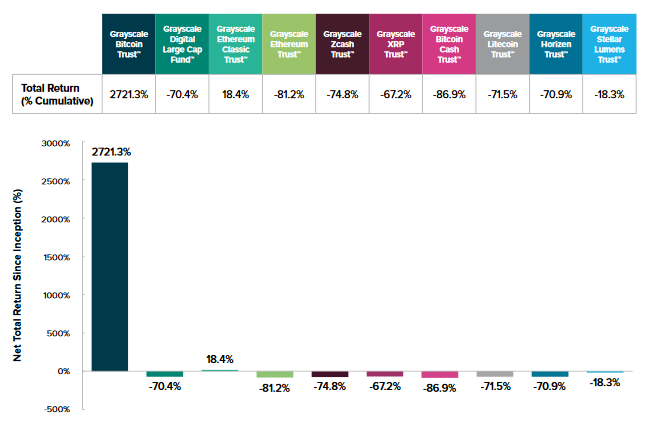

However, GBTC’s impressive numbers are more comprehensive when the total cumulative return percentage is taken into consideration. GBTC has yielded a growth of 2721.3 percent since its introduction, massively outperforming a majority of the virtual asset funds backed by Grayscale.

In similar fashion to Bitcoin, GBTC also outclassed the traditional asset index in 2019, including the likes of S&P 500 and Global Dow. At the start of July, GBTC had recorded a yield of 296 percent to year-to-date appreciation, whereas the aforementioned could only garner 18.7 percent and 12.9 percent, respectively.

The growth of GBTC in 2019 can be attributed to the effective #DropGold campaign led by Barry Silbert, an initiative that promoted the idea of opting for Bitcoin rather than Gold as a long-term investment. Silbert believes that despite having immense history and “cultural significance,” gold does not have the same utility and productiveness as Bitcoin. Bitcoin has the “potential to be incredibly valuable,” he said.