FATF’s Travel Rule may need to address the ‘sunrise problem’

While most crypto-users have welcomed regulations that are now being developed for the digital assets market, it hasn’t always been smooth sailing when governments and regulatory bodies have confronted compliance-related challenges. While more regulations have helped the industry grow and even improve user and investor confidence, there are questions of data privacy that have arisen over the past few years. While regulating cryptocurrencies are needed, are the trade-offs too steep?

In a recent episode of the Unchained podcast, Dave Jevans, CEO of CipherTrace, elaborated on how more regulations may also have unintentional consequences for the digital assets market. Jevans argued that in the case of the FATF’s Travel rule and other AML-related regulations, one of the biggest challenges is with regard to user data privacy. Jevans also noted that another major concern is with regard to private wallets. He said,

“I think the second one is going to be that everyone will just move everything to private wallets. Why would you do [virtual assets service provider] VASP to VASP transactions? Your transaction fee will be doubled, but you know, move everything to a private wallet and then send it. And then none of this makes any sense.”

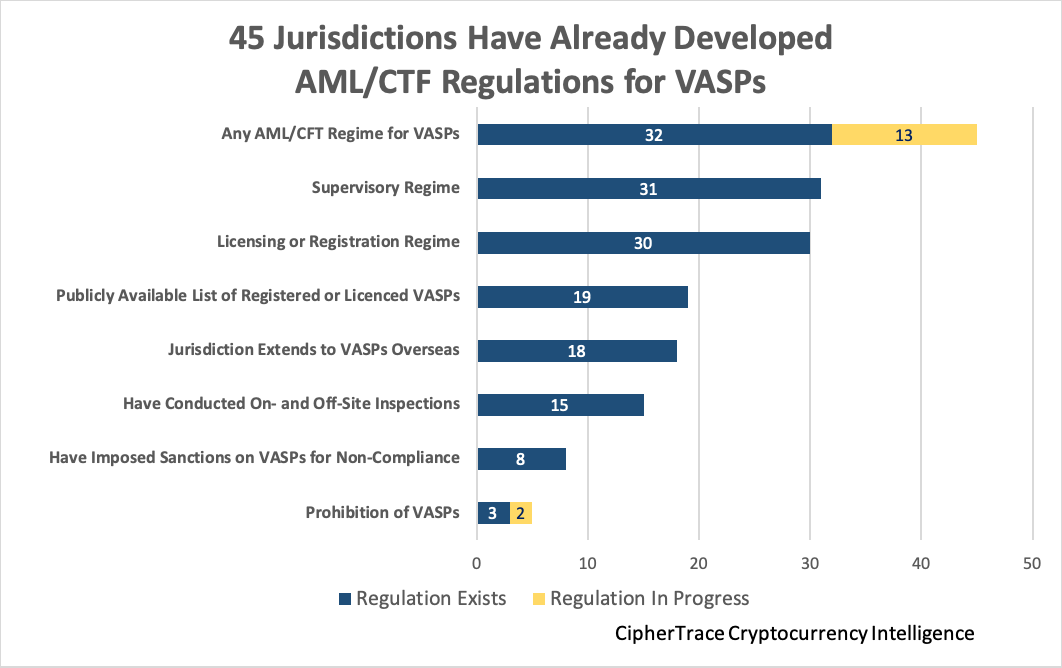

A recent report by CipherTrace had highlighted how the industry is moving towards adopting and implementing FATF’s revised standards with regard to virtual assets service providers. It had noted,

“Within jurisdictions that have begun licensing and registration procedures for VASPs, most reported less than ten registered VASPs, while a small minority of jurisdictions reporting over 100 VASPs. Over 1000 registered or licensed VASPs were reported from 20 jurisdictions alone.”

However, a key concern is that the implementation of such regulations is extremely region-specific. Certain countries and regulators may have varying standards on compliance and how the Travel Rule needs to be enforced with regard to the digital assets market. According to Jevans, this would lead to the “sunrise problem” in which different countries implement their compliance systems differently. He said,

“If there’s enforcement in one country, let’s say Singapore or the United States decides to enforce strictly. Does that mean that France hasn’t implemented it you can’t send money there. So does that create a restriction in the, in the market and you no longer have global liquidity? So none of these in my view are positive.”