Everything you need to know about these DeFi projects with superior returns

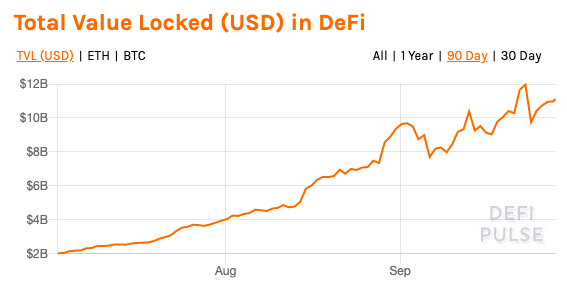

DeFi protocols have seen rapid adoption, growth, and an exponential rise in TVL in 2020. The latter is an especially good metric since while a high number of daily/monthly active users is not a direct indicator of a project’s growth, Total Value Locked is, when gauging how well a DeFi project is doing.

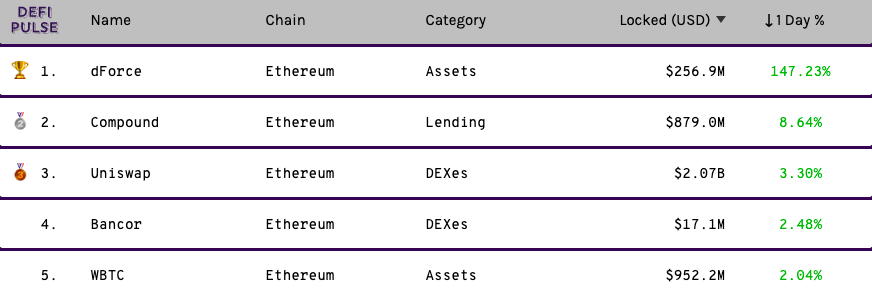

Source: DefiPulse

The DeFi space has created value for the ecosystem with projects like Maker and Aave and with activities like Yield Farming. In fact, DeFi’s lending or collateralized projects have outperformed the top 25 altcoins based on market capitalization.

Does this warrant DeFi projects having a classification of their own? Altcoins are popular for their high volatility, trade volume, and returns. Since most of the popular DeFi projects have all these attributes already, and are in fact innovating with practices such as yield farming that have produced RoIs of over 9000%, is such an argument justified? At the very least, these DeFi projects should be Altcoins 2.0, right?

Altcoins have been around as alternatives for payment for the longest time. However, for the first time in a decade, projects powered by the world’s top altcoin, Ethereum, are outperforming by such an extent that there’s practically a hysteria around it.

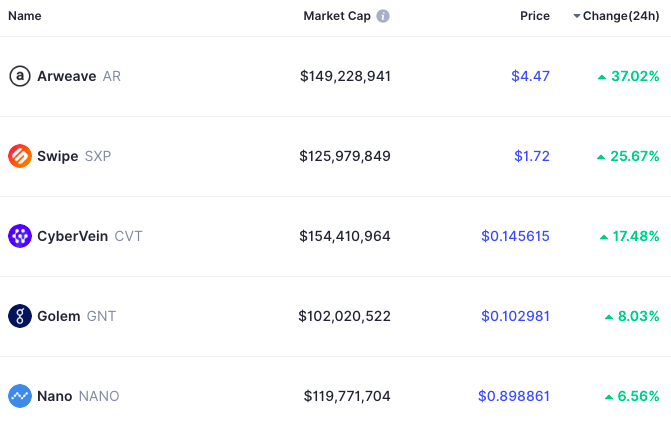

Consider this – Here are the best-perming altcoins in the market over the past 24-hours.

Source: Coinmarketcap

Now, typically, a 37% return for an altcoin in 24 hours is great. However, for DeFi projects, the same may go up to 147%. In fact, returns in DeFi are nearly 5 times that of altcoins over a 24-hour period. And, these comparisons get even more skewed when checking returns for over a week or a month.

Source: DefiPulse

While the RoI is the primary motivator for the trading community, over the past 6 months, the dominance of Bitcoins and altcoins has dropped as well. Bitcoin’s dominance, at the time of writing, stood at 57.8%, and it may continue to drop as the dominance of stablecoins and DeFi projects rises. This is another top reason why DeFi projects may offer better insights to new buyers or traders, when categorized as DeFi Projects, and not Altcoins.

On-chain analysts have argued that the SushiSwap incident and unsustainable returns of 9000% through practices like Yield Farming are akin to the ICO bubble and craze; thus implying that the bubble may burst soon. In that case, it may not be ideal to say that DeFi projects are Altcoins 2.0 since many of the original altcoins continue to survive, even if a majority haven’t.

Before 2020, the TVL in DeFi projects was below $600M, and it took the market 8 months to hit this mark. The growth was slow and there wasn’t much interest or trading activity from traders. The Bitcoin rally of 2020 and launch timeline of ETH 2.0, however, motivated traders to lend/lock value in DeFi projects, pushing the TVL to $11B.

DeFi projects may offer better returns to traders, at least in 2020. Whether that is sustainable and whether it deserves to be called as a different asset class, however, is a conversation to be had later.