Ethereum poised for 200% pump; just ask the options traders

It’s no surprise Ethereum traders are high on optimism, but looking at the derivatives market for the altcoin, their heads are certainly in the clouds.

Since the beginning of the year, the price of Ether has skyrocketed by over 100 percent, surpassing even the likes of Bitcoin. No other altcoin can compare to Ethereum’s bullish run and if the expectations of traders turn to market-reality, the most valuable altcoin will become even more valuable.

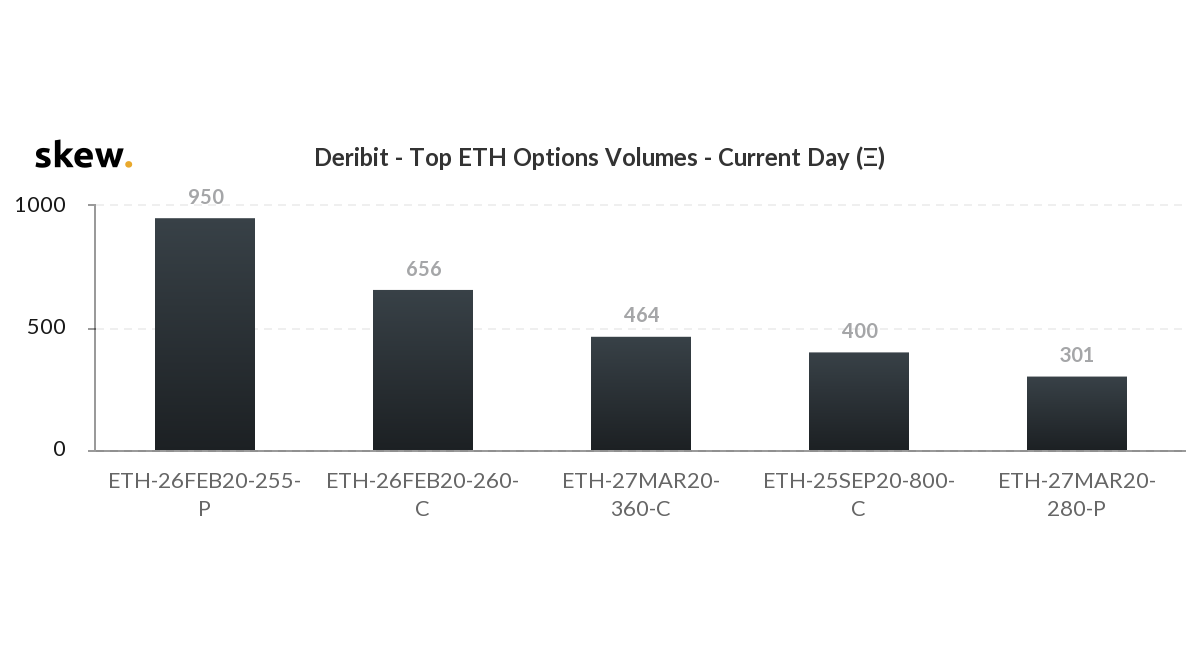

With Ether priced at just under $280 at press time, its Options market pegs its price at a whopping $800 in the next 7 months, a 200 percent-plus increase. The option contract with a strike price of $800 and an expiry of 25 September 2020 was trading with a volume of 400 ETH, prior to the price drop.

Deribit- ETH Options Volume | Source: skew

Other ETH Options contracts traded on Deribit have a far more measured but bearish outlook, given the immediate price drop. As the ETH price dropped by over 2.5 percent in the past 4 hours, taking the price to $256, the option contract with a strike of $255 saw over 950 ETH in volume, with an expiry date of 26 February.

The ETH at the money volatility structure shows an increase in the skew to June, rising as high as 87 percent, followed by a drop to 84 percent as September comes around.

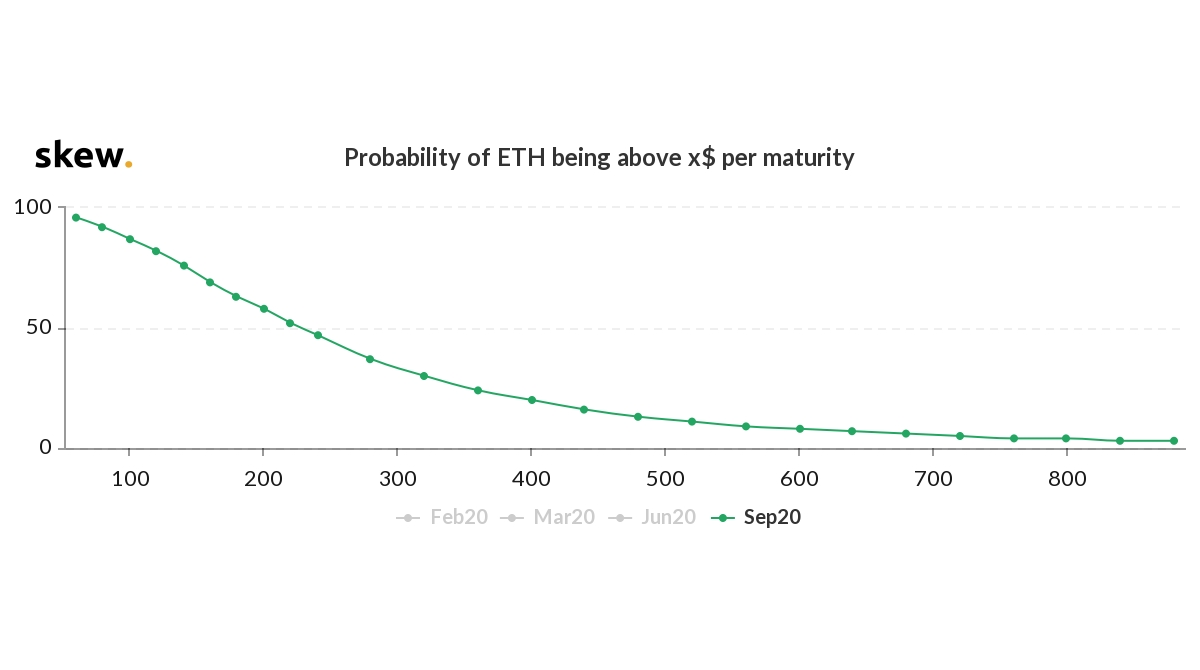

For the people that hold the $800 ETH Options contracts, the odds are not looking too good, however, from the current market perspective. The probability of the spot price rallying alongside such optimism, to put it mildly, and touching the price of $800 in September, is a measly 4 percent.

Probability of ETH above maturity | Source: skew

Owing to the price rebounding from the high of $288 to a low of $255, this price breakout has been tested for the past two weeks. Based on this retreat, the implied volatility for Ether, in the short 1-month time frame which was above its 3-month and 6-month equivalents, fell on 24 February, owing to low volatility.