Ethereum is succeeding, but can we say the same for Ether?

The development of a ‘hype circle’ is infectious in the digital asset industry and most of the time, a majority of the users tend to join the bandwagon. A similar situation is presently transpiring with respect to Ethereum and its ETH 2.0 plans, with many people now flocking towards the ecosystem with genuine optimism.

Although there are legit reasons behind such cases of optimism (ETH 2.0 being one of them), certain bullish narratives attached to Ethereum, especially those based on metrics, can be a little skewed at times.

The Head of DTC Capital, Spencer Noon, had recently claimed that Ethereum is the only network after Bitcoin that levies meaningful transaction fees in security. He considered the aforementioned fact as a bullish sign. However, a recent Glassnode report shed further light on the same and clarified how these fees are distributed across distinct transactions.

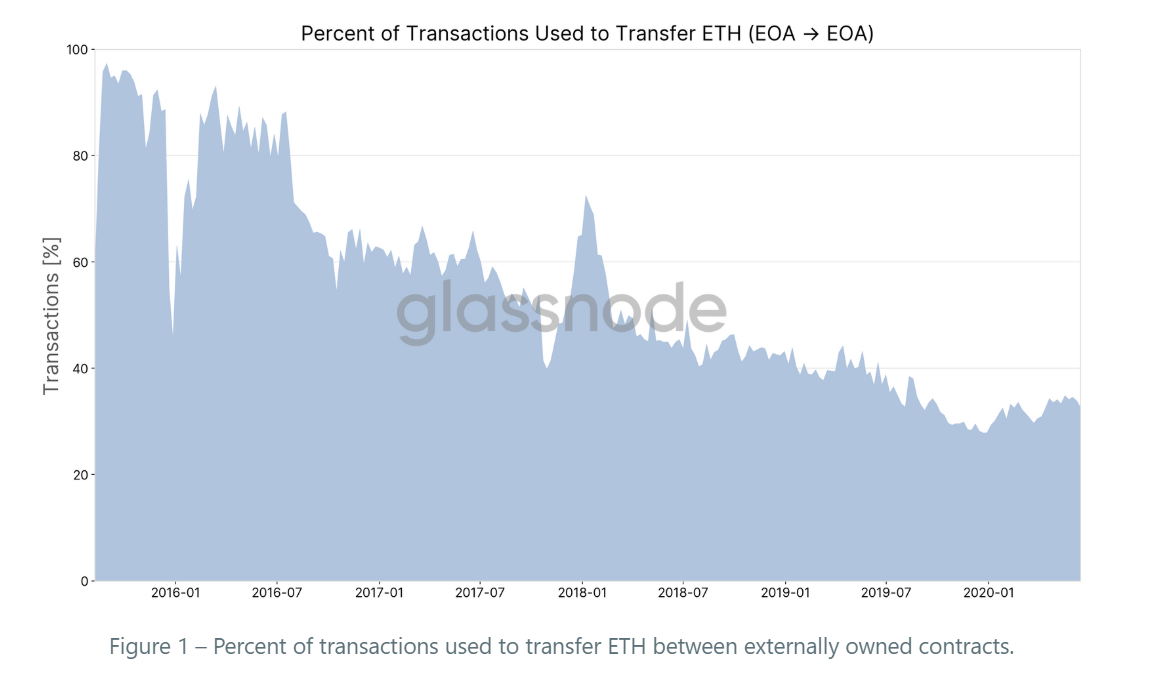

According to the aforementioned analysis, the Ethereum network has processed fewer transactions over time to transfer ETH between Externally Owned Accounts (EOAs).

EOAs are defined as accounts that are controlled by private keys and do not have associated code with the blockchain. A higher percentage of users are usually EOA accounts.

Source: Glassnode

The attached chart suggests that only 34.2% of the network transactions were used to transfer ETH between EOAs, while a mere 10.7% of the total fees were spent on transactions in 2020. These statistics are clearly an indication that ether transfers between users haven’t been the main use-case for Ethereum.

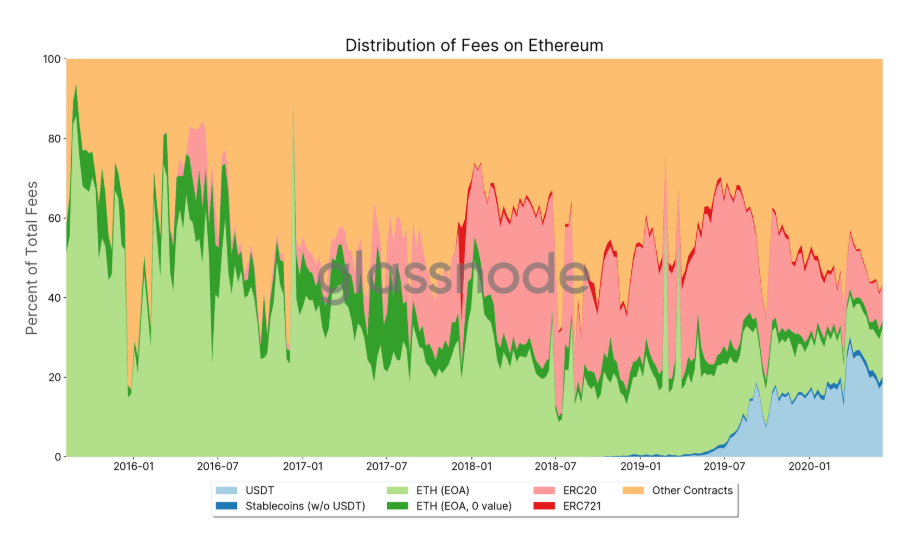

So, what about 89.3% of the transaction fees on Ethereum?

Source: Glassnode

The chart herein illustrates the entire distribution of fees across Etheruem since 2016.

Source: Glassnode

As identified, in 2020, around 52.4 percent of the fees are being used in “other contracts.” These “other contracts” do not utilize ERC20 or ERC721 standards, meaning that ether is barely used here for any use case. The report further added,

“USDT which has increased from virtually zero at the beginning of 2019 to currently almost 20%. Other ERC20 contracts amount to 12.6%, and ETH transfers between EOAs 11.5%. Zero-value ETH transfers to EOAs (1.9%), other stablecoin transactions (1.4%), and ERC721 contracts (0.8%) take a back seat.”

Source: Glassnode

These other contracts in the discussion that accrued the highest chunk of transaction fees included DeFi, games, tokens, and surprisingly, a Ponzi scheme company named MMM. The scam company also happened to lead the list for total fees in 2020 among the “other contracts” transactions, which, to be fair, is not a good color on Ethereum.

Stablecoin issuance has also dominated Ethereum’s blockchain over the past few months, a subject intensely discussed in previous reports.

Are higher transaction fees still bullish for Ethereum?

Yes, higher transaction fees are still a positive scenario for Ethereum, but not Ether.

We tend to forget that the development of Ethereum’s blockchain has not manifested in a valuation growth for Ether over the past few months. If stablecoin issuance directly translated into the actual crypto’s growth, the bullish narrative would have been justifiable.

However, it can be speculated that at this point in time, the utility of the cryptocurrency Ether will be further down as many issuers on the Ethereum blockchain, those holding the asset, are blatantly dumping these tokens in order to free up cash for their operations. Hence, it is possible that the valuation of Ether will face further depreciation, even if its functionality importance on Ethereum remains high.