Ethereum’s distribution suggests this about its place in the coming months

Knocking on the doors of the elusive $600-mark, Ethereum was observed to have risen by 25% on the charts since 20 November, at press time. After failing to breach the $500-mark on a couple of occasions in the past, its conclusive breach of the aforementioned level soon triggered an enormous rally. However, while at press time Ethereum was valued at $583, developments with respect to its on-chain metrics are what is catching the eye right now.

Ethereum: Smaller Addresses>Whale Addresses

Source: Twitter

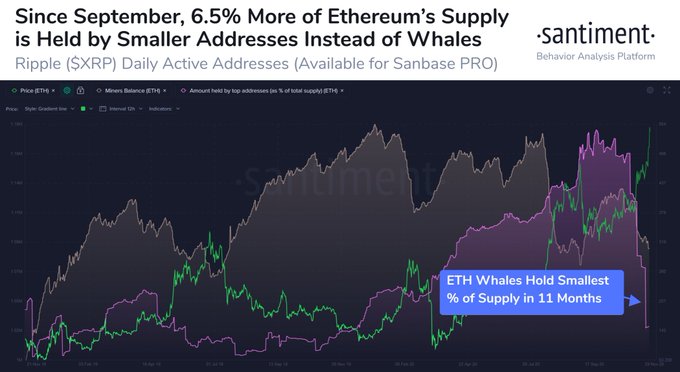

According to Santiment, while Ethereum climbed to a 29-month price high (31 months actually, at press time), the ETH supply held by the top 10 whale addresses also went down. In fact, it was reportedly at an 11-month low, as illustrated by the attached chart, with only 12.1% of the total tokens now held by these major accumulators. Interestingly, the share controlled by whale traders was 18.6% only a couple of months back.

A fall in whale accumulation means that smaller traders are picking up more ETH, a development that points to a more even distribution.

Growth and transition hand-in-hand?

ETH/USD on Trading View

The attached chart pictures the price action of Ethereum over the past couple of months. Coincidentally, Ethereum’s steady bullish run began exactly 60 days back after its price registered a local bottom at $313.

Ergo, it can be speculated that this entire rally, one which is turning out to be the largest in 2020, was based on the foundation of small trader distribution. The fact that whale accumulation was depleted during this rally is extremely ideal and indicative of a different path in Ethereum’s future.

Source: Twitter

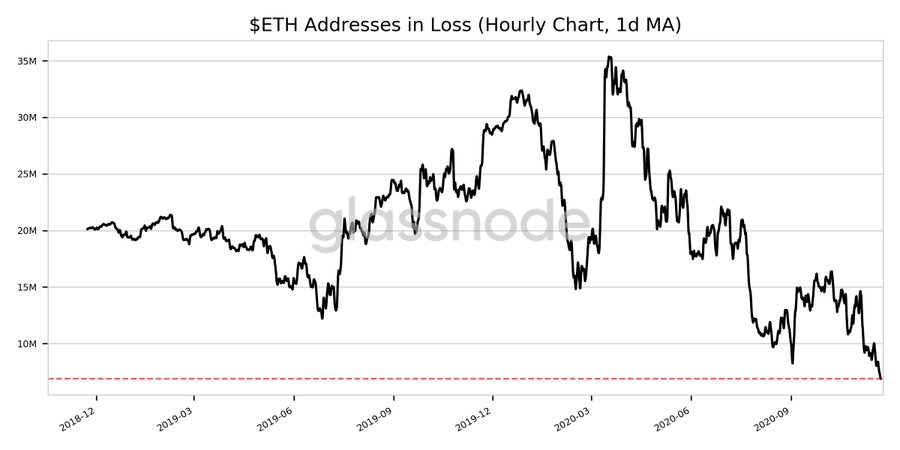

It is also worth noting that the number of Ethereum addresses registering losses right now had reached a 2-year low, at press time. With new addresses, other active addresses are growing in stature as well.

Ethereum 2.0: Is it finally becoming more relevant?

Until a month ago, uncertainty was still the norm with ETH’s eventual PoS shift and 2.0 only valid in words. The landscape has changed quite a bit over the past few weeks, however.

Its organic growth has been significant over the past few weeks, and it will only get extended due to the recent rejuvenation of the Ethereum 2.0 narrative.

At press time, 292,320 ETH had already been staked in the ETH2 deposit contract, leaving 231,968 ETH needed to launch ETH 2.0. The completion index was at 55.8%. Even though the progression still appeared to be miles away from completion, the momentum picked up over the past week has been massive.

With distribution becoming more widespread and ETH 2.0 optimism ringing louder, the world’s largest altcoin might soon be witnessing a transition towards a different, more important landscape in the future.