Ethereum, DAI reach ATH in terms of total locked value [TVL] in DeFi

The sub-industry of Decentralized Finance or DeFi is showing no signs of stopping at the moment.

Over the past few months, DeFi’s stock has risen leaps and bounds and has managed to grow into a $600 million ecosystem. Now, according to recent statistics, the total number of DAI and ETH locked in DeFi has reached an all-time high.

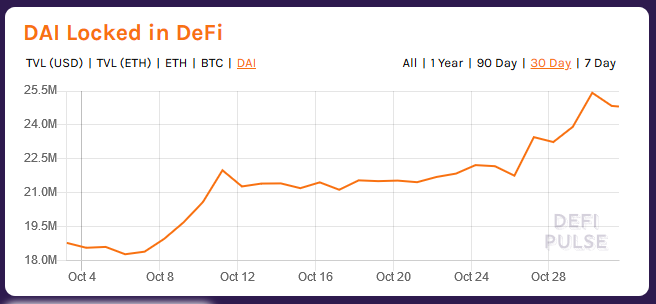

Source: defipulse

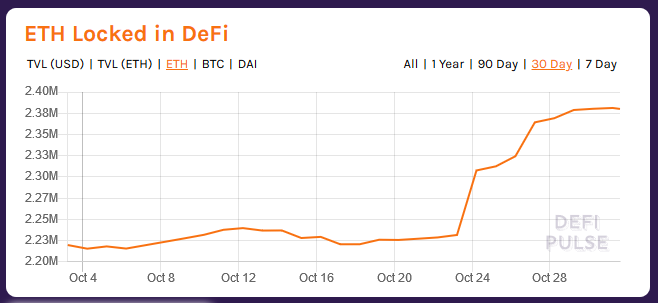

Source: defipulse

According to defipulse, the amount of DAI locked in DeFi on 30 October has reached a total of 25.42 million, after gradually witnessing growth throughout the month. At press time, the number had dropped down to 24.81 million.

With respect to ETH, a total of 2.381 million tokens were locked in DeFi, recording the ATH. However, the value locked has been constant over the past three days. The total value locked [TVL] in DeFi at press time was around $616 million. Maker held the highest TVL in terms of USD, with a market dominance of 50.88 percent, which was equivalent to $309.3 million.

Total Valued Locked or TVL explains the total capital that is currently affiliated or committed to a specific app via its smart contracts. Therefore, DeFi’s valuation as a decentralized loan service is usually assessed in terms of TVL.

At present day, protocols under Ethereum’s DeFi apps cover a wide range of services that expand from payments to custodial services.

However, according to the aforementioned stats, the fastest growing aspect of DeFi is clearly the borrowing and lending platforms. The importance of stablecoins, especially DAI, has increased substantially due to DeFi and the rest of the community is starting to take notice.

As previously reported, Coinbase CEO Brian Armstrong had stated that DeFi graphs exhibited an “exponential curve” in terms of growth in 2019. The exchange had also announced a USDC bootstrap fund for DeFi support protocols in order to supplement the growth of the DeFi space.