Ethereum-Bitcoin realized volatility spread, catalyzed by fierce market trading, widens

Ethereum recorded an exponential rise in its price in early-2020. However, come mid-February, the bullish momentum stalled, with the world’s largest altcoin recording significant losses.

However, despite a brutal weekend which saw massive sell-offs, Ethereum’s price appeared to have held on to the bulls. The same cannot be said for Bitcoin. The king coin, on the other hand, is building bearish momentum.

Ethereum had posted YTD gains of 55.9%, at press time, while Bitcoin’s YTD gains were found to be at 10.44%. From the 2020 peak to date, Ethereum’s price had depreciated by 28.62% from trading at a high of $285.10 on 15 February to $203.50, at press time.

Source: Coinstats

From a whopping $10,431 on 13 February to trading at a low of $7,917, Bitcoin had registered a loss of 23%.

Despite major price corrections after the crypto-market’s rally in January, Ethereum was observed to be more volatile than the king coin. This is evident from noting the increase in ETH-BTC realized volatility spread for six months on the Skew charts. This gauge has been increasing for quite some time now.

Source: Skew

The ETH-BTC six-month realized volatility spread climbed to an all-new ATH of 21% on 9 March. Additionally, realized volatility spread for the three-month and one-month charts also spiked to 30% and 50%, respectively. This could potentially be attributed to growing activity in both derivatives, as well as the spot market.

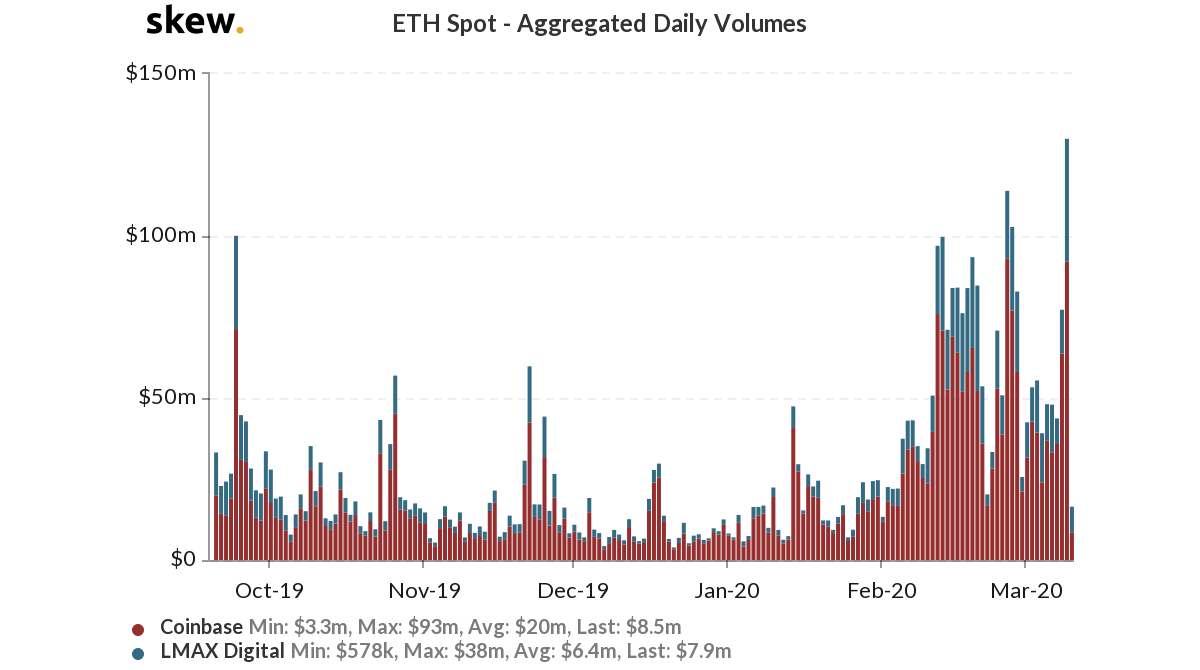

Interestingly, aggregated daily volume on ETH’s spot on two exchanges, Coinbase and LMAX Digital, collectively shot up to $130 million on 9 March, of which Coinbase contributed $91 million. This level of spot volume from these two exchanges was last seen on 27 June 2019 when the figures hovered close to $152 million.

Source: Skew | ETH Spot

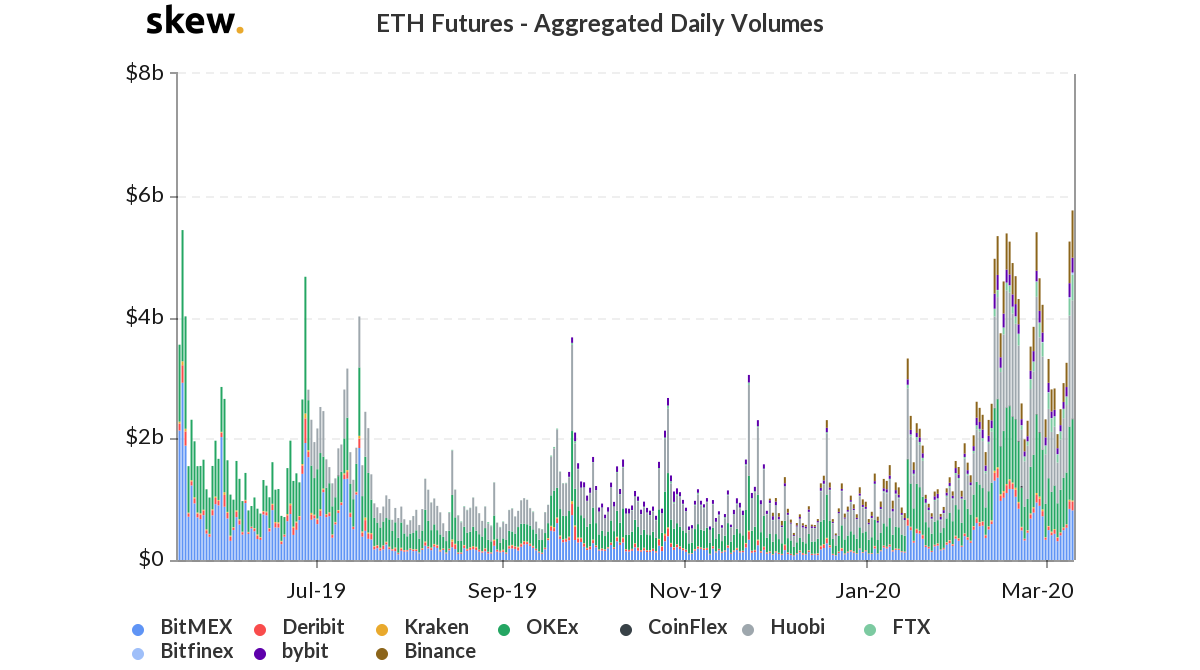

Ethereum’s Options, on the other hand, did not exhibit any impressive numbers, with Deribit posting only $4.6 million the 9 March; the Futures’ aggregated volume, however, registered an all-time high. The aggregated daily volume for Ethereum Futures touched $5.6 billion on 9 March. Huobi dominated the figures, contributing a massive $1.9 billion, with OKEx contributing $1.3 billion as well. BitMEX and Binance followed suit with $816 million and $778 million, respectively.

Source: Skew | ETH Futures Aggregated Daily Volumes

The upsurge in spot from the two exchanges, coupled with the rise in Futures volume, has catapulted Ethereum’s volatility. The narrative of the king coin being held while Ethereum is fiercely traded still seems to be holding true.