Despite dip to $3.4, FTT signals bullishness

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

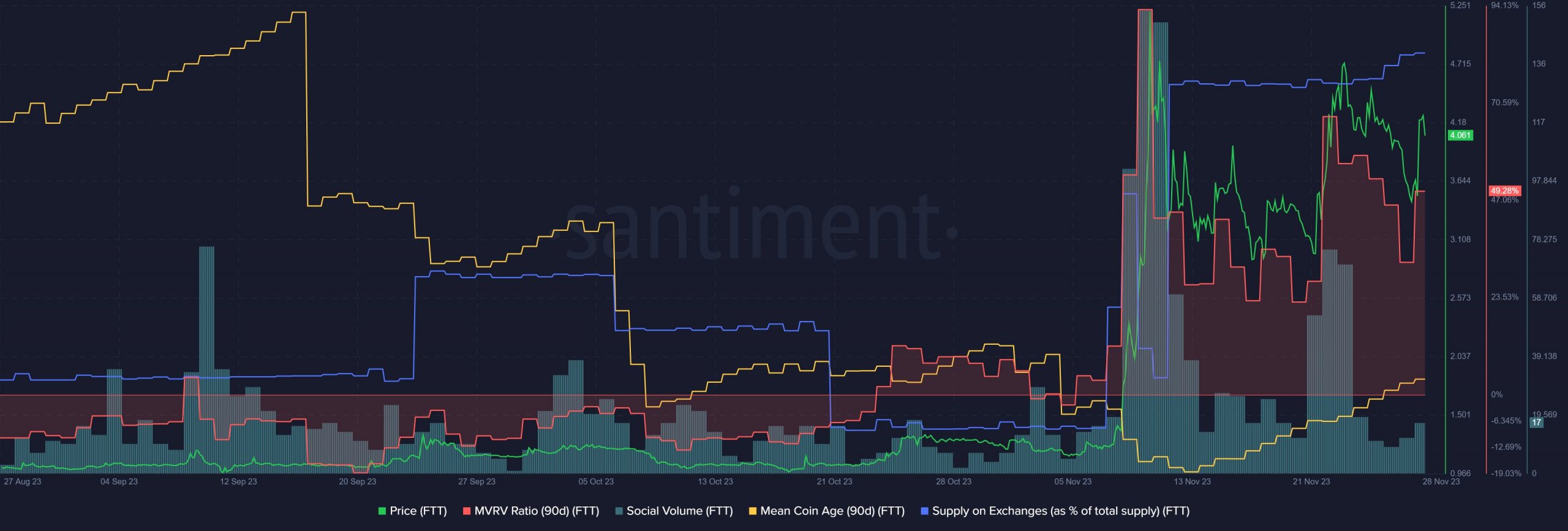

- FTT boasted a high Supply on Exchanges as it neared range highs.

- The technical findings supported the bulls, but the overhead resistance shouldn’t be underestimated.

FTX [FTT] has traded below the $1.3 mark since September. However, it was only on the 9th of November that the token managed to break past the resistance at $1.65 that had been in place since November 2022.

This significant move was followed up by the bulls, and they managed to push prices to $5.53. Since then, however, FTT has settled into a range. Should investors expect a breakout soon?

The range formation posed a large obstacle to the early November rally

FTT pumped at a time when another prominent exchange token, Binance Coin [BNB], suffered. At press time, FTX’s native token showcased a bullish structure.

It would thus need to fall below $2.9 in order to shift the market structure bearishly.

The RSI agreed with this idea as it saw a bounce from neutral 50 a couple of days ago. This signaled weakening upward momentum, but overall, the buyers were in control.

The On-Balance Volume (OBV) was also in an uptrend.

Moreover, the Directional Movement Index (DMI) showed a strong uptrend in progress on the one-day chart. However, FTT traded within a range that extended from $2.81 to $4.84.

Therefore, another revisit to the $4.8-$5 region would likely result in bulls facing rejection.

The rise in social volume was overwhelming, but can it be sustained?

Source: Santiment

When any asset records triple-digit percentage gains within a matter of days, it is bound to make waves on social media. FTT was no different, especially since the U.S. SEC Chair Gary Gensler speculated about rebooting the FTX exchange.

However, the social volume has since fallen, meaning that participants were talking about the token less. This could continue so long as the token trades within the aforementioned range.

Is your portfolio green? Check out the FTT Profit Calculator

At press time, the token’s MVRV ratio was at a high seen in June and on the 10th of November. Hence, holders could seek to secure some profits and could add to the selling pressure.

The Supply on Exchanges metric also rose swiftly after the rally, which meant holders could be readying to sell these assets on CEXes soon.