FTT surges nearly 400% within a week – Should you buy it now?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- The future of FTT and its price action would be massively dependent on the FTX exchange being reopened.

- Technical and on-chain metrics were persuasive of the bullish case but investors should exercise caution.

FTX Token [FTT] saw massive gains in the past week. On the 6th of November, FTT was trading at $1.1195. News that Gary Gensler, the US Securities and Exchange Commission Chair, was open to the idea of a rebooted FTX exchange saw the token surge higher.

On 10th November, FTT spiked to $5.53, a 394% move within a week. In the past four days, the price has slipped toward $3. Was this a temporary move or has the long-term downtrend been broken?

The lack of resistance overhead could see FTT take off

The FTX exchange implosion was accompanied by a freefall in FTT prices. In the past year, the price has stayed around $1 as the company has been in bankruptcy all this time, but recent events saw a jump to $5.

While we can argue that the market structure was bullish, a critical level of resistance at $4.41 was not yet breached.

A set of Fibonacci retracement and extension levels (pale yellow) were plotted based on the recent move upward. Apart from that, resistance levels from December 2020 and February 2021 were plotted as well.

To the north, these levels were the ones to watch out for. In particular, the $8.2, $9.86, $10.84, and $15.54 levels could stall a rally in the coming months.

Such a strong move would require vast demand, and that would come in the event of more positive news developments. As things stand, from a technical perspective, a retest of the $2.13-$2.86 region presented a buying opportunity.

Gauging how risky this buying opportunity could be

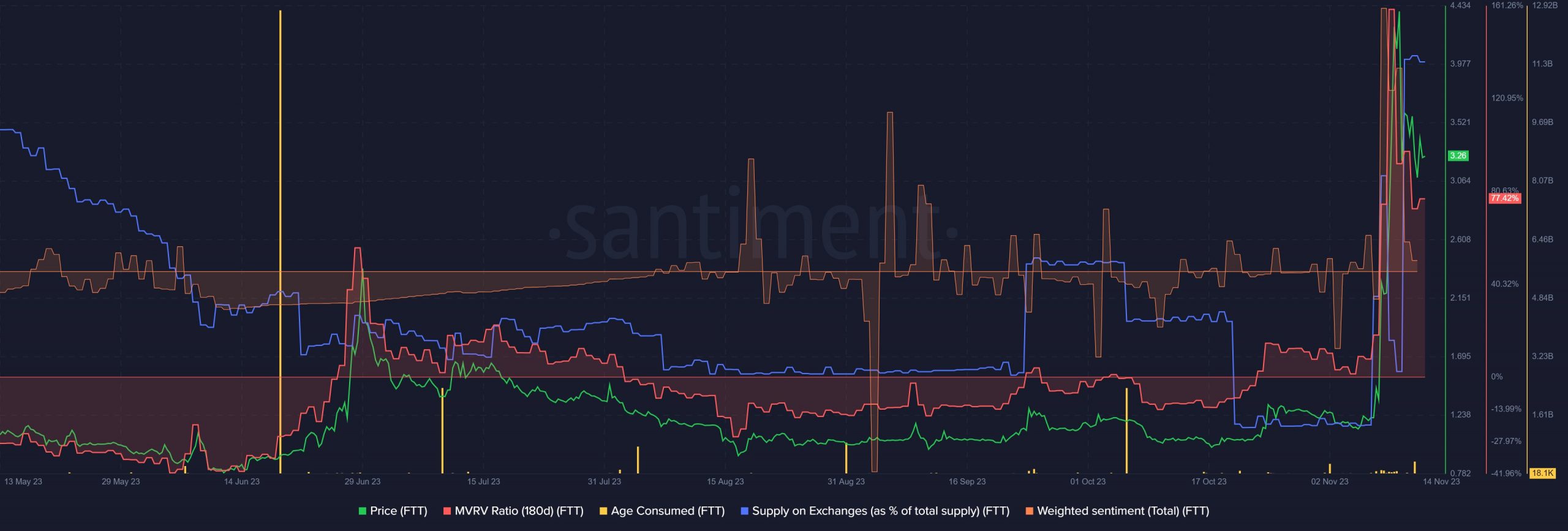

Source: Santiment

The weighted sentiment shot to a high not seen in over a year, as did the MVRV ratio. This meant that long-term holders would likely be pleased to liquidate a part of their possessions to book profits.

In turn, this could force a deeper pullback or even a downtrend.

Read FTX Token’s [FTT] Price Prediction 2023-24

The supply on exchanges metric also jumped to a high not seen since March, which pointed toward imminent selling pressure.

Therefore, buyers must bet only on what they can afford to lose. A drop below $2.13 would invalidate the idea that the rally could extend higher.