Cryptocurrencies’ ‘Boom and Bust bubble’ is now over: Chainalysis

For many, the cryptocurrency market is divided into two phases; pre-2017 and post-2017. This, of course, refers to the December 2017 bull run which saw Bitcoin and the rest of the market surge to unprecedented highs, with the king-coin inching close to $20,000 a pop. The bull-run saw a massive influx of retail investors. However, the winter of 2018 saw most of them wiped out.

This rapid rise to $20,000 and drop to $3,000 a year later caused many to term the market a “bubble,” but with a steady 2019, those accusations can be put to rest.

More than just the price movement, on-chain data has once again shown why the ‘Boom and Bust’ cycle of cryptocurrencies, not just Bitcoin, can be laid to rest, according to Philip Gradwell, Chief Economist at Chainalysis.

In an exclusive interview with AMBCrypto, Gradwell highlighted the total value transferred on-chain as a “core key indicator” to make the aforementioned conclusion. When analyzing this indicator, he stated that “cryptocurrencies are growing again,” which is resulting in the ‘playing out’ of bubbles that have been associated with the cryptocurrency community.

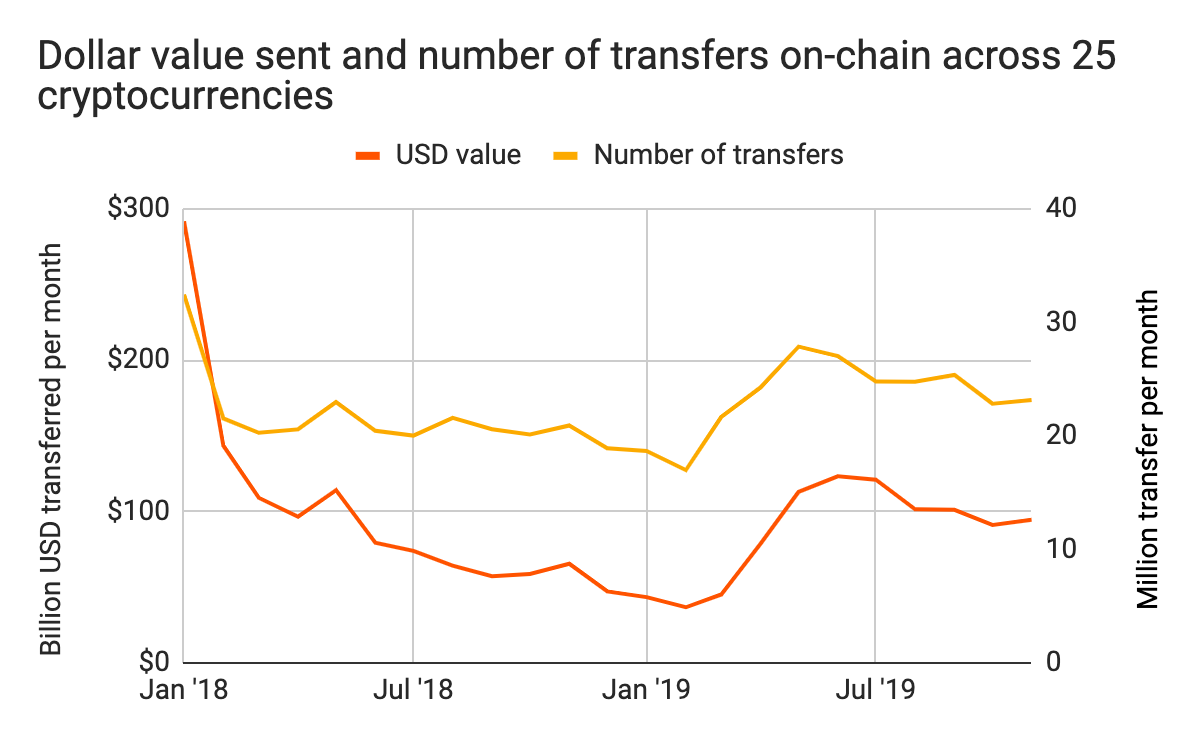

Chainalysis, in order to better understand the actual value moving on-chain and between market participants, removed value-transfers within a service.

Breaking the analysis into two parts, he stated that in February 2019, the dollar value sent on-chain reached its lowest point since before the 2017 bull run. At the time, it should be noted that Bitcoin was teetering at just $3,500, with exchange volume nearing monthly lows due to slumping volatility. With the price picking up at the close of March, the dollar value sent on-chain “nearly tripled” to $100 billion per month, which wasn’t seen since March 2018. This on-chain increase followed Bitcoin’s massive price-breakout in April, which continued through the quarter.

In terms of the sheer number of transfers, the metric has increased by 35 percent in the past six months,

“The number of transfers has increased from 17 million per month in February 2019 to 23 million in November 2019. This suggests that cryptocurrencies are growing again, and that the boom and bust cycle starting in 2017 has truly played itself out.”