Bitcoin

Can Bitcoin reduce ‘bureaucratic friction’ for businesses in emerging economies?

Recent steps taken across the globe with regard to regulating cryptocurrencies like Bitcoin has paved the way for greater adoption from various quarters of the financial world. While many view Bitcoin as an investment vehicle, the king coin is gaining a lot of traction in developing economies across the globe. Latin America, parts of Africa and Asia seem to be at the center of this new wave of adoption for the world’s largest and oldest cryptocurrency.

Speaking on the Tales from the crypt podcast, Matt Ahlborg, Founder of UsefulTulips.org discussed how Bitcoin is enabling users and businesses in places like Kenya to connect to a global economy and the current set of challenges faced in such regions when it comes to furthering Bitcoin use. Ahlborg highlighted that in such economies local laws aren’t adequate to facilitate financial communication with the international market, in such scenarios Bitcoin’s self-sovereign nature and its borderless philosophy are of an advantage. Ahlborg noted,

“Bitcoin market right now in emerging economies, it’s that people are turning to Bitcoin because they, have a ton of bureaucratic friction and they don’t want to deal with it.”

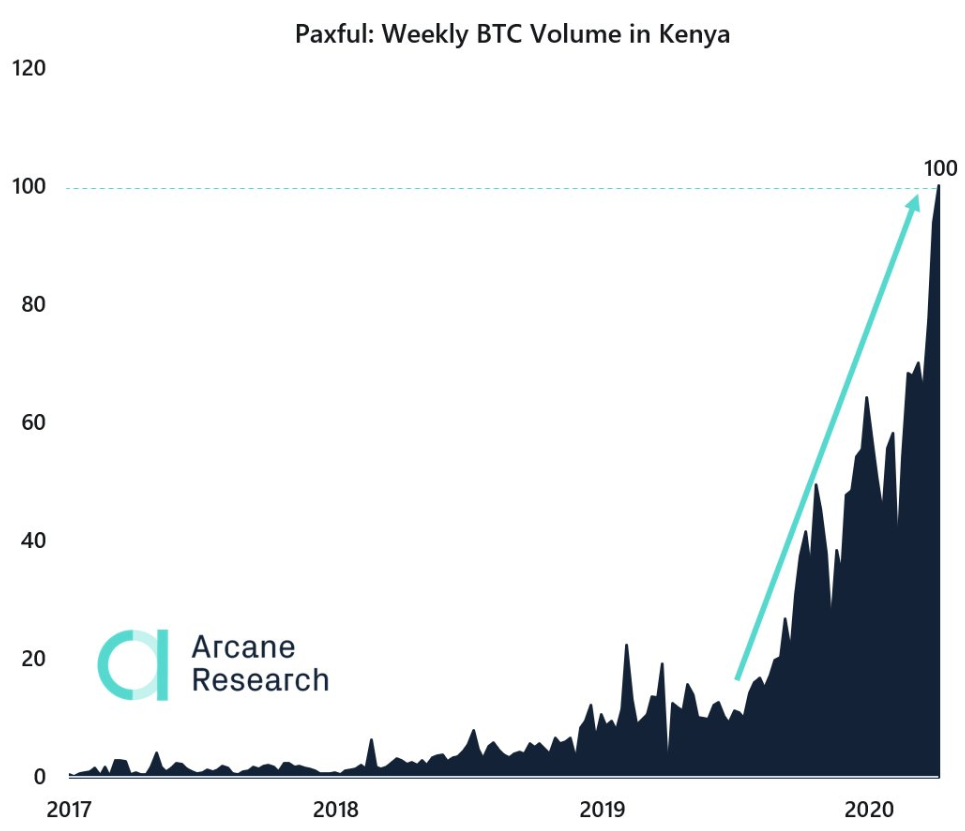

Source: Arcane Research

A recent report published by Arcane Research highlighted the recent growth of Bitcoin volume that seems to have surged especially during the current period of global economic crisis. It showed how weekly Bitcoin volume in the country had been on a steady rise since late-2019 but has drastically risen in the past few months of 2020.

However, Ahlborg added that while the adoption rates for Bitcoin seems promising and the fact that people view it as a way to circumnavigate corruption and red-tape, Ponzi schemes and scams continue to deter many, he said, “There are all sorts of these Bitcoin-related Ponzi schemes that people get tricked into investing and that I cannot deny as probably also a pretty large component of the volume in Kenya as well.” he added,

“That type of stuff [Ponzi schemes] also strengthens during bull markets as well, and a lot of people get swindled, and so there’s definitely a downside to a lot of this stuff to do. “