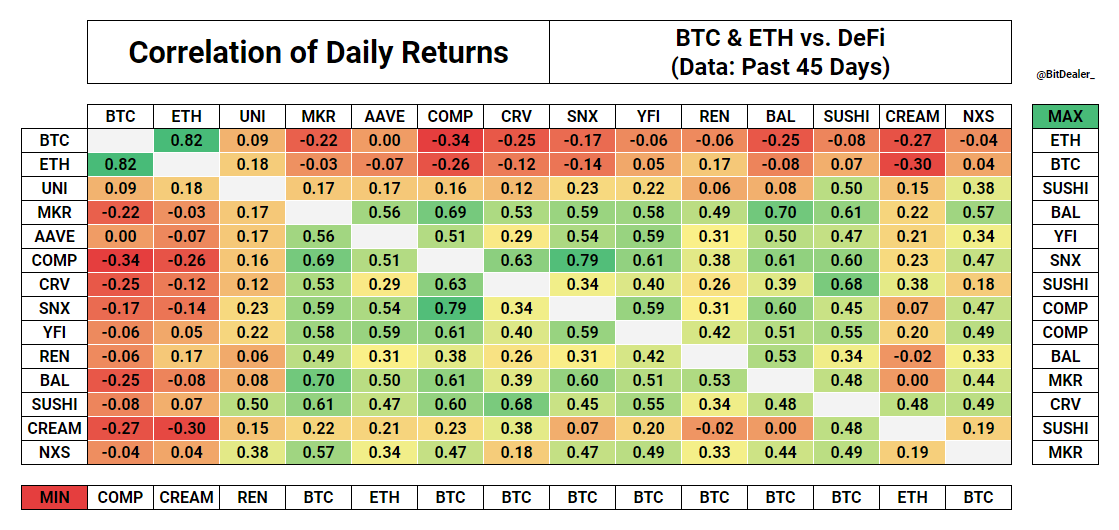

BTC-Defi Correlation in the past 45 days, as negative as it gets?

In the past 45 days, Bitcoin’s price has crossed $13700, currently trading above $13400. The price has sustained above the $11000 level and recorded the highest monthly close since 2018. In this duration, Bitcoin’s correlation with DeFi has become largely negative. Though that is the same case as with Ethereum, the ETH-DeFi correlation is expected to improve, and the negative correlation is likely to be temporary. DeFi drives volume and transactions on the Ethereum Network so the negative correlation may be fixed soon.

BTC-DeFi and ETH-DeFi correlation || Source: Twitter

The correlation among DeFi tokens continues to remain positive and BTC-DeFi correlation largely negative based on the above chart. The BTC-DeFi correlation is significant for DeFi as the TVL in Defi significantly dropped to $8.48 Billion and recovered overnight on November 2, 2020. TVL throughout the month of October remained largely the same, at $11.12 Billion.

TVL for top DeFi projects like UNI, MKR, AAVE, and COMP is the same as it was at the beginning of October. The negative correlation may be due to the correction in these top tokens. For instance, Uniswap’s price dropped nearly 40 percent in October 2020, one of the reasons for this could be that traders invested in Defi may have diversified from Bitcoin, back when volatility in Bitcoin was low. However, since Bitcoin’s price and volatility increased, funds were injected back in Bitcoin and pulled out of these projects.

Defi may be losing market capitalization to Bitcoin as DeFi is inversely correlated with Bitcoin since it exploded first in 2020. Post halving when Bitcoin’s price was at the $8500 level, near its fair price. A negative BTC-DeFi correlation has had an impact on ETH’s price as well. Since ETH-BTC’s implied correlation spread is dropping, the dropping BTC-Defi correlation means ETH’s correlation with Defi may drop as well, largely this may happen for prolonged periods, over 45 days. The negative impact of the negative correlation may materialize in the portfolio of several retail traders who parked funds in DeFi due to promising and highly rewarding incentives.

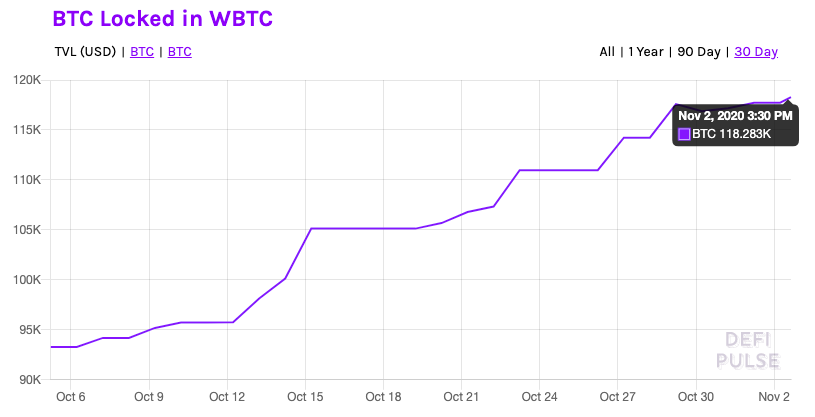

The result of negative correlation will amplify when BTC and ETH parked in Defi flood spot exchanges. If BTC-DeFi correlation hits a new all-time low, then increasing reserves on spot exchanges may impact the price and volatility of both BTC and ETH. Nearly $8.26 Billion worth of ETH and over 118.3k BTC are parked in DeFi.

Locked BTC in DeFi || Source: DeFi Pulse

Adding even 50% of the parked funds on spot exchanges would cause a surge in exchange reserves and correspondingly add to the selling pressure. The dropping correlation might have a negative impact on BTC’s price in the long run.